Vietnamese Stock Market Extends Its Bull Run

The Vietnamese stock market is experiencing a remarkable rally, with the VN-Index climbing for the third consecutive session to reach 1,139.81 points, the highest level in over three years since April 2023. HoSE’s liquidity neared VND25 trillion, reflecting robust capital inflows as investors express optimism about the market’s prospects.

Taking a broader view, since the session on April 9, 2025, when news of President Donald Trump’s tariff measures caused turmoil in the Vietnamese stock market and pushed the VN-Index down to near 1,090 points, the benchmark index has swiftly recovered. In less than two months, the VN-Index surged by nearly 250 points. HoSE’s market capitalization also increased by over VND1,200 trillion (~$47 billion), reaching VND5,780 trillion.

Market Rally Fueled by Capital Inflows and Macroeconomic Factors

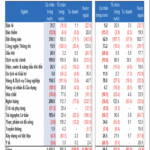

The main driver of the market’s upward trend has been large-cap stocks, particularly the Vingroup and banking sectors. Furthermore, capital inflows have spread to mid and small-cap stocks, with seafood, textile, logistics, and real estate sectors attracting strong buying interest in recent sessions, further bolstering the VN-Index’s performance.

Behind this impressive recovery are positive macroeconomic signals, both domestically and internationally. Firstly, Vietnam has swiftly reacted to mitigate the impact of the tariff measures. Initial concerns about high tariffs have been eased as negotiations proceed with a high level of agreement on principles, approaches, orientations, and plans, setting a positive tone for subsequent rounds of talks. The Trump administration’s new moves have reduced pressure on Vietnam’s key export sectors, such as textiles, while also creating opportunities for local businesses to leverage free trade agreements (FTAs) to expand their markets.

Notably, the VN-Index’s strong growth is not a coincidence but is backed by solid fundamentals and positive prospects for the Vietnamese economy. Domestic economic stimulus policies, including increased public spending and support for the private sector as outlined in Resolution 68-NQ/TW 2025, have provided a significant boost to the stock market. Additionally, Vietnam’s stock market valuations are considered attractive compared to regional peers. With the VN-Index’s P/E ratio hovering around 15-16 times, significantly lower than markets like India or South Korea, Vietnam remains an appealing destination for long-term investors.

Market Upgrade Prospects and Foreign Capital Inflows

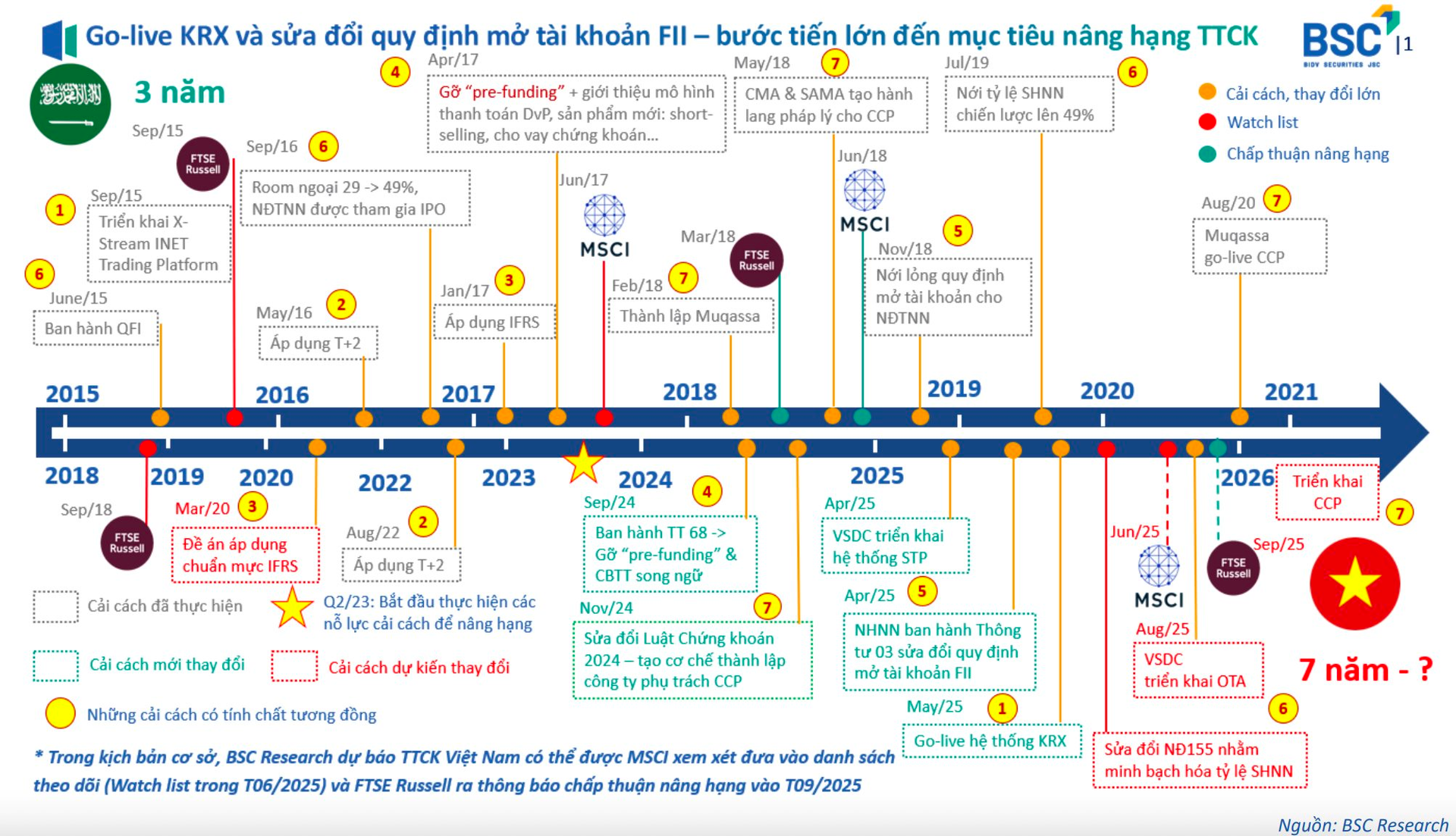

The KRX trading system, which began stable operations in May 2025, has significantly enhanced market transparency and efficiency. This system not only improves transaction processing capabilities but also facilitates Vietnam’s goal of upgrading its market status from frontier to emerging. Organizations such as MSCI and FTSE Russell have acknowledged Vietnam’s significant reforms in improving the investment environment, including easing foreign ownership limits and enhancing liquidity. According to BSC Research, Vietnam’s stock market could receive an upgrade announcement from FTSE Russell as early as September this year, while MSCI may include it in their Watch List in June 2025. A potential upgrade could attract billions of dollars from global ETF and active investment funds.

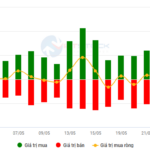

Notably, foreign investors’ net selling has shown signs of slowing in recent weeks. Data from the Ho Chi Minh City Stock Exchange (HOSE) indicates that foreign investors have started net buying again in some blue-chip stocks, particularly in sectors such as banking, real estate, and consumer goods. This signals a strengthening of foreign investors’ confidence in the Vietnamese market.

Petri Deryng, head of the Pyn Elite Fund, stated in a recent report that even before President Trump’s tariff decision, Vietnam had been increasing public spending and stimulating domestic private sector demand in various ways. With the new tariffs in place, domestic investment stimulus measures will undoubtedly intensify.

“If the tariff levels become reasonable, significant positive factors in the Vietnamese market could emerge to support the recovery of the country’s stock market. At the same time, investor capital may continue to shift from US tech stocks and MAGA stocks to other regions, including Vietnam,” emphasized Petri Deryng.

According to SHS Securities, the short-term trend of the VN-Index remains upward, with support at the nearest level of 1,320 points and stronger support around 1,300 points, corresponding to the highest price in 2024. The trading session on May 27 opens up the prospect of the index breaking through even further, especially in the context of positive trade negotiations, tariff developments, and the impetus from Resolution 68-NQ/TW 2025 on private economic development.

Currently, SHS points out that many stocks still have reasonable prices compared to their fundamentals. However, as the VN-Index has already risen significantly and is near the old peak of 1,340 points, investors should be cautious about new buying positions and carefully assess corporate growth prospects and second-quarter 2025 business results. SHS recommends that investors maintain a reasonable portfolio focusing on stocks with solid fundamentals, industry leaders in strategic sectors, and outstanding growth in the economy.

“Fisheries and Textile Stocks Soar Following Positive Signals from US President Donald Trump”

The seafood and textile industries have witnessed a remarkable double-digit growth in export turnover for the cumulative period of the first four months of this year.

“Market Signals: A Tale of Contrasting Fortunes”

The VN-Index extended its positive streak, retesting the old peak from March 2025 (around 1,320-1,340 points). If this upward trajectory persists in upcoming sessions, the VN-Index could break free of this range. However, risks loom as this level presents a strong resistance, and the VN-Index may experience volatility. Currently, the Stochastic Oscillator is venturing deep into overbought territory. Investors are advised to exercise caution if the indicator retreats from these levels in the coming days.