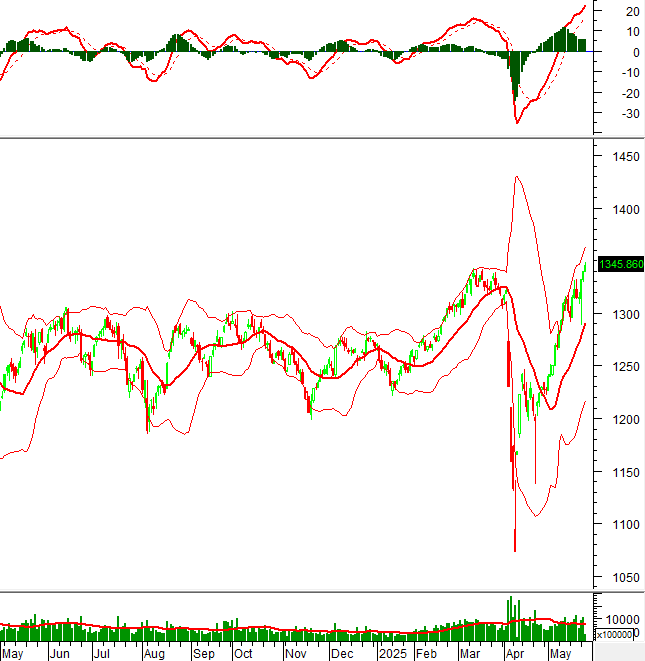

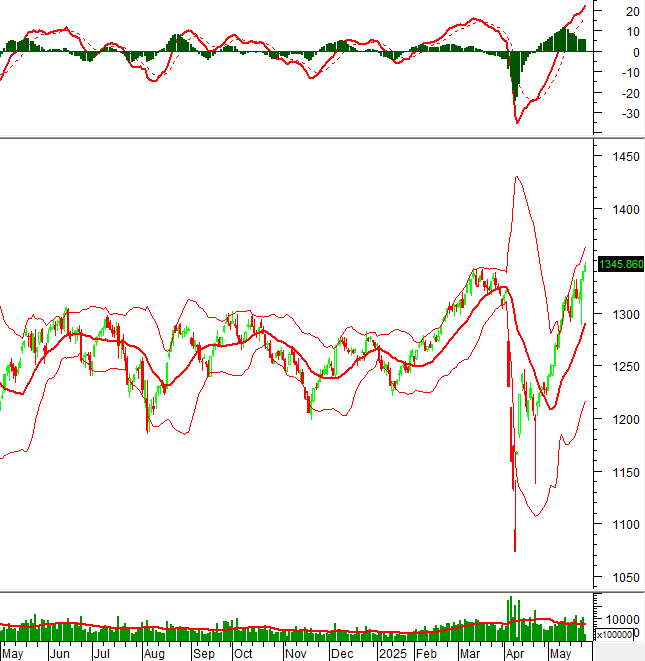

Technical Signals for VN-Index

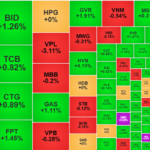

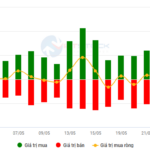

During the morning trading session of May 28, 2025, the VN-Index witnessed a rise in points and formed a Three White Candles pattern, remaining above the Middle line of the Bollinger Bands. This indicates a rather optimistic sentiment among investors.

Currently, the index has reached a new 52-week high, while the MACD indicator continues to ascend after providing a buy signal. This further reinforces the upward trajectory of the VN-Index.

Technical Signals for HNX-Index

On May 28, 2025, the HNX-Index witnessed an increase in points for the third consecutive session, with expected trading volume surpassing the 20-day average by the end of the session. This reflects a relatively optimistic investor sentiment.

Additionally, the HNX-Index successfully surpassed the SMA 50-day line and remains close to the upper band (Upper Band) of the Bollinger Bands, indicating continued support for the short-term recovery prospect.

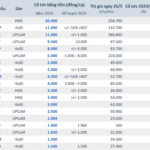

DXG – Real Estate Group Joint Stock Company

On May 28, 2025, DXG stock price continued its upward trend, completely breaking through the previous peaks of December 2024 and March 2025 (equivalent to the 17,000-17,500 range). The stock exhibited a Three White Candles pattern, accompanied by trading volume surpassing the 20-day average, reflecting the prevailing optimistic investor sentiment.

DXG’s new short-term target is the 19,000-20,000 region.

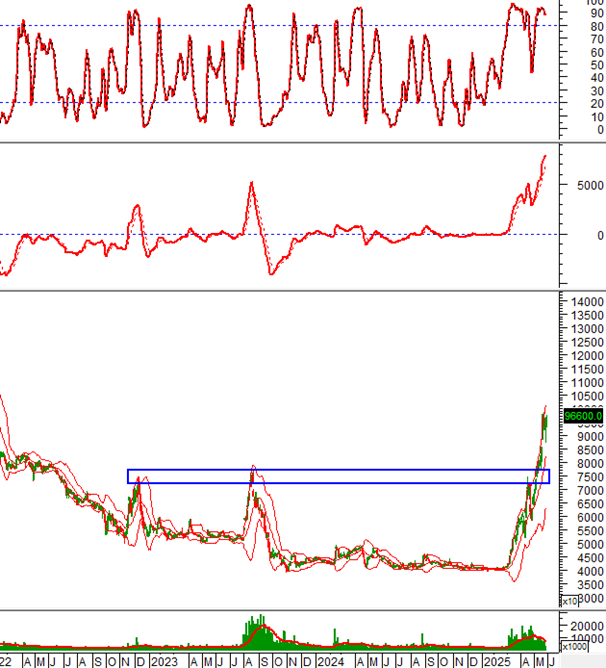

VIC – Vingroup Joint Stock Company

The stock price witnessed a significant surge, forming a White Marubozu pattern during the trading session on May 28, 2025. Out of the last 22 sessions, 20 displayed green candles, signifying the dominance of optimistic sentiment. The price is also hovering near the Upper Band of the Bollinger Bands, and this band is expanding, indicating a highly positive short-term outlook.

The stock price has completely breached the previous peaks of December 2022 and August 2023 (equivalent to the 72,000-77,000 range). The short-term target is set at the 105,000-110,000 zone.

Technical Analysis Department, Vietstock Consulting

– 12:05, May 28, 2025

“Market Signals: A Tale of Contrasting Fortunes”

The VN-Index extended its positive streak, retesting the old peak from March 2025 (around 1,320-1,340 points). If this upward trajectory persists in upcoming sessions, the VN-Index could break free of this range. However, risks loom as this level presents a strong resistance, and the VN-Index may experience volatility. Currently, the Stochastic Oscillator is venturing deep into overbought territory. Investors are advised to exercise caution if the indicator retreats from these levels in the coming days.

“Navigating the Market’s ‘Windy Heights’: Strategies for Avoiding Pitfalls as Stocks Soar”

The market has just taken an unexpected “U-turn”, reaching new peaks and bringing to light the old adage, “the higher you climb, the stronger the wind”.