According to JP Morgan, Vietnam’s GDP per capita has grown at an average rate of 7.1% annually between 2017 and 2022, surpassing the $4,000 mark and is on track to reach $7,500 by 2030. The urbanization rate continues to rise, coupled with an upward trend in the lifestyle and consumption demands of the middle class.

With a young demographic structure, Vietnam is in its “golden population” phase, a period of rapid consumption growth similar to that of China and Thailand before 2010. The modern retail penetration rate in Vietnam currently stands at only 12%, significantly lower than the 20-45% range observed in other ASEAN countries. This presents a solid foundation for the explosion of modern retail and the consumer-retail sector in the stock market over the next few years.

A Leading Representative of Vietnamese Consumption

Masan Group has been recognized by JP Morgan as one of the prominent enterprises that epitomize the Vietnamese consumption story. For instance, Masan Consumer, the fast-moving consumer goods (FMCG) arm of Masan, boasts five powerhouse brands, each generating over $100 million in annual revenue. These include CHIN-SU, Nam Ngư, Omachi, Kokomi, and Wake-Up 247. Together, these brands account for 80% of MCH’s domestic revenue over the past seven years and enjoy exceptional market coverage, with over 98% of Vietnamese households using at least one of their products. Additionally, Masan Consumer operates one of the largest food and beverage distribution networks in Vietnam, encompassing 313,000 traditional and 8,500 modern retail outlets.

WinCommerce, a subsidiary of Masan and a leading retailer in Vietnam, operates a network of over 4,000 stores and supermarkets. Following a period of restructuring, the company has successfully developed distinct store models tailored to the needs of different areas. Specifically, WinMart+ Nông thôn focuses on offering reasonable prices to price-conscious consumers in rural areas, while WinMart+ in urban areas prioritizes convenience for busy city dwellers. Both models are committed to delivering superior customer experiences and providing high-quality fresh produce across their networks.

Since its launch, MEATDeli, a brand under Masan MEATLife, has made a strong impression in the Vietnamese food industry. With a mission to provide delicious and tender meat products using European-standard Air-Chilled technology, MEATDeli has become the go-to choice for millions of Vietnamese families. At the 2025 Annual General Meeting, Masan affirmed its long-term strategy for Masan MEATLife, aiming to transition into a branded meat processing company and expand its collaboration with WinCommerce. The company plans to leverage WinCommerce’s distribution network to tap into a $2 billion market opportunity.

With a diverse portfolio spanning condiments, convenience foods, energy drinks, and processed meat, alongside an extensive distribution network across Vietnam, the Masan Group is establishing a “Point of Life” ecosystem that touches every aspect of Vietnamese consumers’ daily spending.

Moreover, over the years, Masan has been gradually shifting its focus towards the consumer-retail segment, as evident in its revenue structure from 2015 onwards. Notably, the composition of Masan’s revenue portfolio has undergone a significant transformation, with nearly 93% of its revenue in the first quarter of 2025 derived from the consumer-retail segment, a substantial increase from 45% in 2015. The company is also working to simplify its corporate structure, divest non-core businesses, and pursue an IPO for Masan Consumer.

Attractive Valuation and Growth Potential

In their latest report, Bao Viet Securities Company (BVSC) expressed optimism about the Masan Group’s business prospects for 2025. The consumer-retail segment is expected to be a key growth driver, and strategic initiatives, along with the potential for Vietnam’s market upgrade, position MSN stock for significant upside in the 2025-2026 period.

In addition to impressive first-quarter financial results, the company possesses several attributes that appeal to foreign capital, including substantial room for foreign ownership in MSN, a valuation lower than its historical average, high liquidity, and a robust balance sheet. As of the first quarter of 2025, the company’s net debt/EBITDA ratio stood at a healthy 2.9x, and its free cash flow (FCF) surged by 81% year-over-year to VND 743 billion, demonstrating its ability to generate strong cash flows amid an investment pullback by many businesses.

Given the dynamic macroeconomic landscape, both domestic and foreign investors are seeking companies that can lead the “golden era” of consumption in Vietnam for long-term investment opportunities. In this regard, MSN is expected to shine with its best-in-class consumer-retail ecosystem, strategic investments, and a clear vision to serve over 100 million Vietnamese consumers.

The Rise of the New Market: Are Domestic Stocks Leading the Charge?

In the midst of global turmoil, international investors are shifting their focus towards emerging markets with promising potential. Among these, Asia, and particularly Vietnam, stands out as an alluring destination.

Masan Shares Soar on SK’s Latest News, Propping Up VN-Index

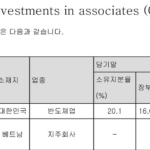

SK no longer holds any shares in Masan Group Corporation (coded MSN) by the end of 2024, compared to 9.2% at the end of 2023.