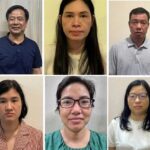

Law enforcement officials deliver decisions regarding Nguyen Thi Khuyen and Bui Thi Minh Nguyet

The Hanoi Police Investigation Agency is investigating a fraud case involving the appropriation of assets at Tam Loc Phat Group Joint Stock Company, as per the criminal prosecution decision dated April 19, 2024.

During the investigation, the Hanoi Economic Police identified that Nguyen Thi Khuyen (born in 1983, Chairman of the Board of Directors and General Director), together with Van Dinh Toan (born in 1982, Deputy General Director) and Bui Thi Minh Nguyet (born in 1968, Deputy General Director of Tam Loc Phat Company) have been providing false information to mobilize, receive, and appropriate a particularly large amount of money from numerous individuals for personal purposes.

According to the investigation, in June 2019, Nguyen Thi Khuyen (born in 1983, residing in Ha Cau Ward, Ha Dong District, Hanoi) along with Van Dinh Toan (born in 1982, residing in Dai Mo functional urban area, Dai Mo Ward, Nam Tu Liem District, Hanoi) and Bui Thi Minh Nguyet (born in 1968, residing in Thang Long residential area, Thanh Luong Ward, Hai Ba Trung District, Hanoi) conspired to establish Tam Loc Phat Media Company Limited, with Khuyen as the legal representative. The company was headquartered at 27 – V5A, Van Phu new urban area, Phu La Ward, Ha Dong District, Hanoi, with a chartered capital of VND 30 billion. On June 8, 2021, the subjects increased the company’s chartered capital to VND 100 billion, but none of them actually contributed any capital. On December 6, 2022, the suspects changed the company’s name to Tam Loc Phat Group Joint Stock Company.

Suspects Nguyen Thi Khuyen and Van Dinh Toan

In the initial phase of operations, Khuyen invited some acquaintances to join the company and agreed to utilize the legal entity of Tam Loc Phat Company to mobilize funds from investors. Khuyen developed a network of brokers to seek investors and falsely claimed that the invested funds would be used for production and business activities. The group offered high brokerage fees to those who introduced and invited new investors to the company. They also proposed interest rates significantly higher than bank rates (9.6% per month, including principal and interest; or 2.93% per month for interest alone) to attract investors interested in high returns.

Additionally, the group introduced a profit-sharing scheme for the brokerage network. Specifically, Grade F1 offices in the North (approximately 50 offices, with 5 people each) received 15% of the contract value immediately when investors signed the contract and made payments. If an office successfully helped establish a new office, the referring office would receive an additional 2% from the new office’s contracts. For secondary F2 cases, F1 would be responsible for distributing 10% of the contract value, while F3 and F4 would also receive a profit share of 15%. Grade F1 offices in the South benefited even more, receiving 25% of the contract value for clients they acquired.

Within the group, Khuyen was responsible for the overall management of the company’s operations, signing contracts, receiving funds from investors, and managing broker relations. She also directed the organization of events to falsely enhance the company’s reputation and image…

Van Dinh Toan was in charge of market development strategies and planned to organize promotional events for the company in various localities on a grand scale to attract more investors.

Bui Thi Minh Nguyet was tasked with purchasing certain products, such as clothing, cooking oil, and MSG, to demonstrate to investors that the company was engaged in trading activities. Nguyet also lectured at branch offices, attracted investors, and directly received funds from them. She benefited from a 20% profit share of the contracts she directly mobilized.

The funds obtained from investors were distributed as follows: 15% was allocated to the northern regional offices, while 25% was given to the southern offices. The remaining amount was transferred to Khuyen’s personal account and the Tam Loc Phat Company account, which Khuyen controlled. Khuyen used this money to make payments to previous investors in installments. Additionally, Khuyen utilized the funds for personal expenses, real estate purchases (currently under investigation by law enforcement), salary payments for herself, Toan, Nguyet, and other company employees, as well as the purchase of automobiles.

By September 2023, the funding source was disrupted, and the group could no longer attract new investors. As a result, Khuyen was unable to repay investors as promised, leading to complaints from several investors about the group’s fraudulent activities.

According to the investigation, from June 2019 to the present, the total amount of funds mobilized by the Khuyen group from investors exceeded VND 5,100 billion. Currently, the group is unable to repay more than VND 1,000 billion to investors.

Out of this, the Khuyen group and related individuals have embezzled funds from 18 victims who filed complaints with the investigative agency. These 18 victims represent over 160 investors, with 322 contracts totaling over VND 61 billion.

The Hanoi Police Investigation Agency requests that individuals who have signed business capital contribution agreements, shareholder capital contribution agreements, or made investment transfers to Tam Loc Phat Group Joint Stock Company submit their complaints and relevant documents to the Hanoi Police Investigation Agency (Economic Police Division), located at 382 Kham Thien Street, Tho Quan Ward, Dong Da District, Hanoi, for handling and resolution.

Denied Appeal, TOP Stock Suspended from Trading on UPCoM

“The company is yet to release its audited financial statements for the years 2022-2024, and no remedial measures have been implemented. This lack of transparency raises concerns among investors and stakeholders, casting doubt on the company’s credibility and financial health. The absence of audited reports prompts questions about the reliability of their financial data and the potential risks associated with their business operations.”

“Fraudster Tran Thi Huong Impersonates Law Firm Manager, Defrauds Victims of Over $10 Million with False Land Title Promises.”

Introducing the notorious con artist, Tran Thi Huong, who orchestrated a cunning scheme under the false pretense of being a reputable law firm director. With her deceptive charm, she lured unsuspecting victims with promises of delivering land ownership certificates, only to fraudulently seize their assets. Her elaborate charade exemplifies the dark underbelly of deception, leaving a trail of financial ruin and broken dreams in her wake.

The Rogue Banker: Embezzling Millions for a Gambling Spree

As the deputy director of the bank’s transaction office, Le Minh Luan abused his position by instructing his staff to falsify accounting records to the tune of nearly 14 billion VND. This illicit activity was undertaken to fund his online gambling habit and repay personal debts.