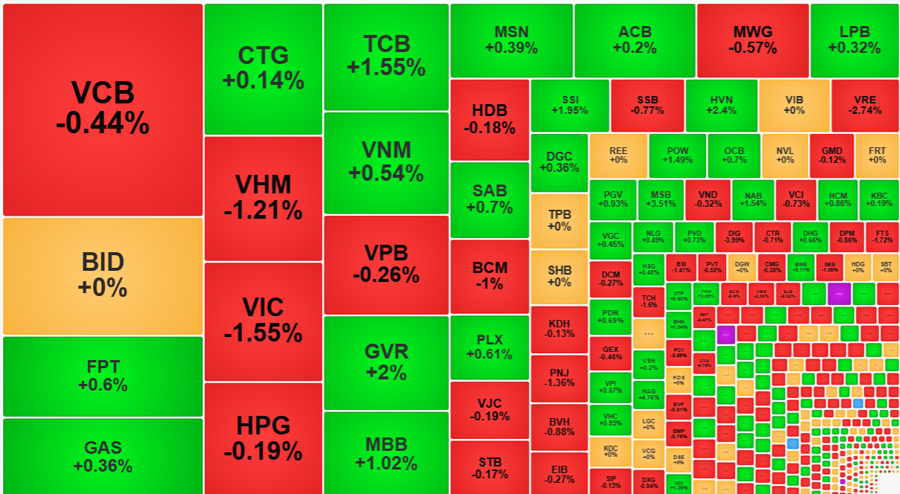

The domestic money flow’s robust resurgence continues to propel the VN-Index towards its previous peak. Despite intra-session fluctuations, the index closed just shy of the 1,340 mark, corresponding to a gain of 7.30 points, with a broad advance-decline ratio of 230 gainers over 88 losers. However, a pivotal shift occurred as large-cap stocks, notably the Vin group, faded in their leadership role, while funds flowed into mid and small-cap stocks.

Throughout most trading hours, the Vin group faced profit-taking pressure and declined, but VHM managed to close up 1.09% at the session’s end, while VIC remained unchanged. Meanwhile, mid and small-cap real estate stocks like DIG and CEO surged to their daily limit gains, with numerous others, including VPI, KDH, PDR, SSH, and NLG, witnessing substantial increases.

Similarly, the logistics sector continued its rally, with GMD and HAH plunging in the red, HVN climbing 4.15%, PHP advancing 6.78%, and SGP and rising 6.82%. The construction sector also broke out, led by CTD, CC1, DPG, FCN, and HBC. Information technology giants FPT and CMG rebounded, climbing 1.45% and 2.22%, respectively. The brokerage sector painted a bullish picture, bolstered by the market’s new liquidity peaks and expectations of an imminent upgrade by FTSE in September.

Overall, liquidity is concentrated in mid and small-cap stocks, with a particular focus on port, construction, and public investment sectors. These industries are anticipated to benefit from domestic growth stimulation and recovery following steep sell-offs triggered by US tariff-related news.

In contrast, the banking sector exhibits a divide, with BID, CTG, TCB, SHB, and VIB in the green, while heavyweights VCB, MBB, VPB, and LPB trend downward.

The VN-Index’s return to its previous high without triggering market concerns is noteworthy. Sentiment remains buoyant, fueled by robust liquidity in mid and small-cap stocks.

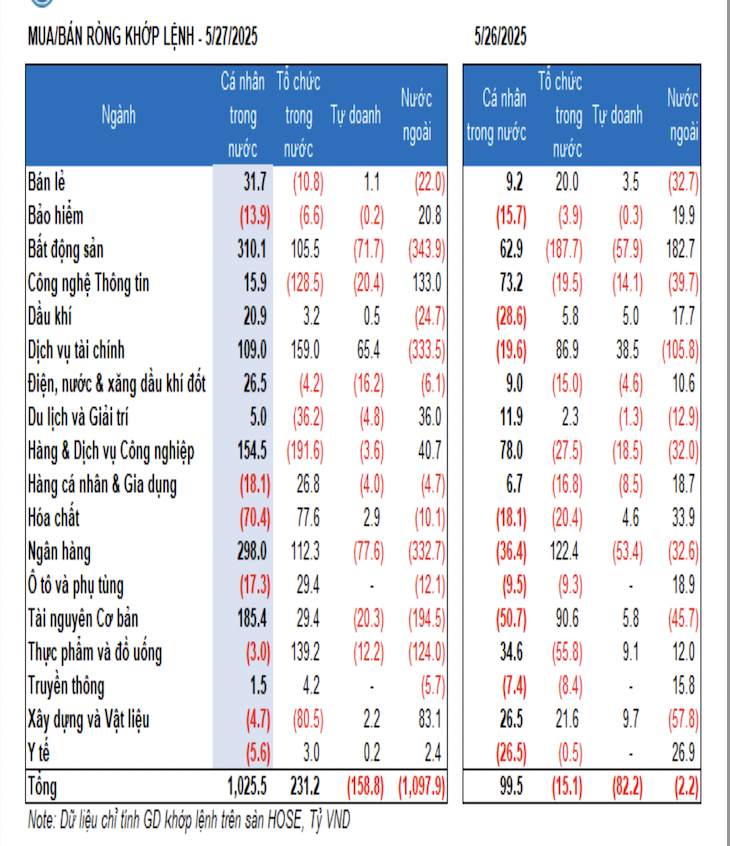

Market-wide liquidity surged to VND 29,000 billion in matched orders across the three exchanges. Foreign investors offloaded over VND 1,197.6 billion, net-selling VND 1,097.9 billion in matched orders. Their net-buying activities in matched orders focused on Information Technology, Construction, and Materials sectors. Top net-bought stocks by foreigners in matched orders included FPT, GMD, CTD, KBC, HVN, GVR, BVH, HHV, NLG, and FRT.

On the other side, foreigners net-sold real estate stocks in matched orders, with top net-sold stocks being HPG, VIX, VIC, VCB, NVL, VNM, DXG, STB, and GEX.

Individual investors net bought VND 1,026.2 billion, with VND 1,025.5 billion in net buying activities in matched orders. In matched orders, they net bought 11 out of 18 sectors, primarily focusing on the Real Estate sector. Their top net-bought stocks included HPG, GEX, VRE, SHB, VCB, MBB, DIG, HAH, VND, and PDR.

In terms of net-selling activities in matched orders, individuals offloaded 7 out of 18 sectors, mainly focusing on Chemicals and Personal & Household Goods. Their top net-sold stocks were VPB, GMD, VHM, KBC, GVR, EIB, DBC, TCM, and NLG.

Proprietary trading groups net sold VND 158.8 billion in matched orders, with the same amount in net selling activities in matched orders. In matched orders, they net bought 6 out of 18 sectors, with the most significant purchases in Financial Services and Chemicals sectors. Top net-bought stocks by proprietary groups in matched orders included FUEVFVND, E1VFVN30, SSI, VCI, VND, CTI, HDB, TCH, NLG, and DGC. Conversely, they net sold Banking stocks, with top net-sold stocks being VIC, FPT, HPG, VHM, NVL, REE, VCB, VPB, SHB, and LPB.

Local institutional investors net bought VND 257.7 billion, with VND 231.2 billion in net buying activities in matched orders. In matched orders, institutions net sold 7 out of 18 sectors, with the most significant net selling in Industrial Goods & Services. Their top net-sold stocks included FPT, GEX, DIG, VND, HAH, PDR, GMD, SHB, VPI, and HVN. The most significant net buying was in Financial Services, with top net-bought stocks being VIX, VIC, VPB, NVL, VHM, SSI, DXG, HPG, VNM, and EIB.

Today’s matched orders contributed VND 2,967.6 billion in negotiated transactions, a 55.9% increase from the previous session, accounting for 10.2% of the total trading value. Notable transactions included a transfer of over 12.4 million EIB shares (worth VND 281.8 billion) between individual investors. Additionally, local institutions sold over 13.1 million VSC shares (valued at VND 283.9 billion) to an individual investor.

Sector allocation of funds witnessed an increase in Real Estate, Securities, Food & Beverage, Retail, Software, Aviation, and Electricity Production & Distribution. In contrast, a decrease was observed in Banking, Chemicals, Agricultural & Seafood, Electrical Equipment, Rubber & Plastics, and Automotive Manufacturing.

Specifically, in matched orders, there was an increase in liquidity allocation towards mid-cap stocks (VNMID) and a decrease in large-cap (VN30) and small-cap (VNSML) stocks.

“Market Signals: A Tale of Contrasting Fortunes”

The VN-Index extended its positive streak, retesting the old peak from March 2025 (around 1,320-1,340 points). If this upward trajectory persists in upcoming sessions, the VN-Index could break free of this range. However, risks loom as this level presents a strong resistance, and the VN-Index may experience volatility. Currently, the Stochastic Oscillator is venturing deep into overbought territory. Investors are advised to exercise caution if the indicator retreats from these levels in the coming days.

Foreign Block Remains Net Sellers Despite Market’s Spectacular Recovery, Dumping Nearly $100 Million Worth of Stocks

“VHM witnessed a robust buying trend in the market, with a total net purchase value of VND 148 billion, standing out as the most actively traded stock for the day.”