Amid mounting pressure on Apple to move its iPhone production back to the US, veteran analyst Ming-Chi Kuo has weighed in, stating that it would be significantly cheaper for the tech giant to absorb a 25% import tax than to relocate its entire assembly chain from Asia.

Speaking on the X platform, Kuo asserted, “In terms of profits, it is obviously more advantageous for Apple to bear the 25% tariff for iPhones sold in the US rather than rebuilding the entire assembly chain domestically.” This statement comes on the heels of former President Donald Trump’s declaration to impose high tariffs on all iPhones not assembled in the US.

The challenge lies in the fact that Apple’s current production chain is not just massive but also intricately and efficiently designed. Much of iPhone assembly takes place in China and India, where partners like Foxconn and Pegatron operate gigantic factories, fine-tuning their processes over decades specifically for Apple. Replicating this system in the US is nearly impossible when considering the costs, time, and the lack of a ready workforce infrastructure.

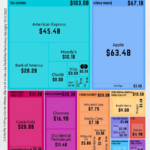

It is infeasible to move the entire iPhone supply chain to the US. Image: Forbes

While the US is a significant iPhone market, its role in the production chain is modest. Some components, such as Corning’s strengthened glass, originate from the US, but the final assembly—a crucial stage—takes place overseas. To bring this stage back to the US, Apple would have to invest tens of billions of dollars in building factories, training workers, and developing infrastructure, all to replicate a system that is already well-established in Asia.

Apple’s push to expand production in India is not coincidental. This strategic move is rumored to be aimed at diversifying its supply chain, reducing reliance on China, and mitigating policy risks. According to Bloomberg, by 2026, over 60 million iPhones per year will be manufactured at Indian factories, with Foxconn already investing $1.5 billion in infrastructure expansion in the country.

In addition to China, Apple has expanded its supply chain to neighboring countries. Image: Mechead

Financial experts predict that if the 25% tax were implemented, iPhone prices in the US could soar, hurting consumers. Wedbush Securities estimates that if the entire chain were moved to the US, the price of an iPhone could reach $3,500, more than triple the current price.

With over 120 million iPhone users in the US and annual consumption surpassing 60 million devices, Apple has clearly done its calculations. While tariffs present a burden, compared to dismantling the well-oiled Asian supply chain that has been running smoothly for decades, it is the less financially painful option.

References: WSJ, The New York Times

The American-Made iPhone: A Pricey Surprise

The iPhone is an iconic smartphone brand, but what would happen if its production moved back to the USA? The cost of manufacturing in the States is significantly higher than in other countries, and this would have a huge impact on the final price tag. A potential price of $3,500 per unit is not out of the question, a stark contrast to the current pricing strategy and a huge barrier for consumers.

Which ASEAN Country Fares Best Against US Tariffs?

The negotiations on tariffs with the US are ongoing, and Asian countries, particularly the ASEAN region, are in a hurry to conclude them. As a highly trade-dependent region, ASEAN has much at stake when it comes to US tariff policies. However, resilience lies not in the trade deficit figures but in the intrinsic structure and strategic response capabilities of the region.

“GHTK’s Participation at Viet Cargo Expo 2025”

From May 21 to 23, 2025, Giao Hàng Tiết Kiệm (GHTK) participated in the Viet Cargo Expo 2025 (VCE), Vietnam’s premier exhibition for logistics and cargo professionals. The event was held at the WTC Expo Convention and Exhibition Center in Binh Duong, bringing together industry leaders and experts to showcase the latest innovations and solutions in the logistics and cargo sector.

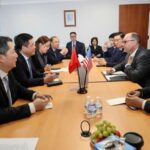

“Leading US Corporations Eye Investment in Vietnam”

On May 20, Vietnam’s Minister of Industry and Trade, Nguyen Hong Dien, who led the government negotiation delegation, met and worked with the leadership of four prominent American corporations: Excelerate, Lockheed Martin, Space X, and Google.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)