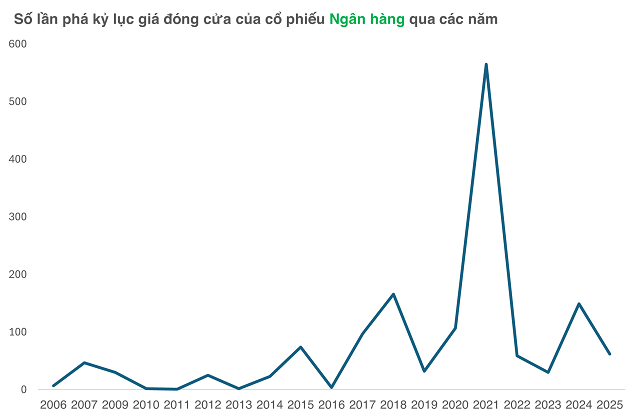

Undercurrents in Banking After the 2025 Tariff Shock

In Q2 2025, the Vietnamese stock market experienced a tariff shock, temporarily halting the upward momentum of banking stocks. However, since May, this sector has been heating up again.

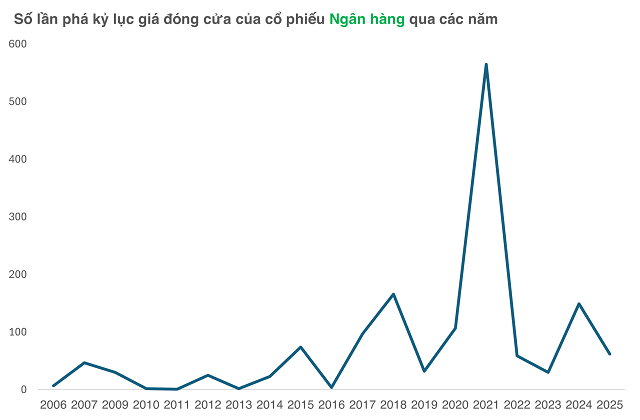

While there were only two instances of bank stocks breaking price records in April, May witnessed ten such occasions, reflecting an improvement in investor sentiment.

Compiled by the author

|

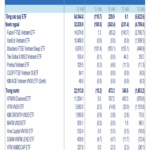

On May 23, STB shares broke their price record. Prior to that, on May 21, MBB and STB shares simultaneously reached new highs.

Thus far in 2025, STB and MBB have been the most prominent performers, with each stock breaking price records 14 times, resulting in price increases of 12.6% and 13.6%, respectively.

Compiled by the author

|

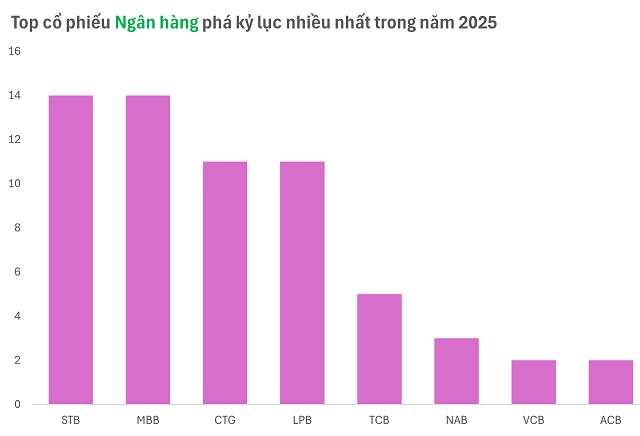

Nevertheless, this performance pales in comparison to TCB, whose share price has increased by 23.1% since the beginning of the year, despite only recording five record-breaking sessions.

Additionally, VAB (+50%), SHB (+47.3%), and KLB (+28.8%) have also made notable strides in terms of growth, with VAB currently in the process of executing its plan to switch to the HOSE by submitting its listing application.

The highlights of STB, TCB, MBB, VAB, and SHB’s performance do not yet confirm a resurgence of the banking wave following the 2025 tariff shock, as BID (-4.5%), VCB (-6.6%), VPB (-2.9%), and ACB (-0.3%) have yet to return to their 2025 starting points.

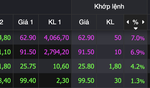

As of the close on May 26, the performance of several leading bank stocks lagged behind the VN-Index.

|

This differentiation makes it challenging for investors to bet on a synchronized surge in the banking sector, instead, they only perceive subdued effects in a few selective stocks.

Mr. Nguyen The Minh, Director of Research and Customer Development at Yuanta Vietnam Securities, commented: “Some bank codes like STB, TCB, and SHB have made impressive breakthroughs, but VCB and BID have been rather lackluster.” According to Mr. Minh, this differentiation stems from uneven business results. Many banks face challenges in expanding credit, handling bad debt, and recovering net interest margin (NIM). It is forecasted that by the end of 2025, when real estate credit improves, NIM may recover, helping to create a more uniform banking wave.

Foreign Room Expansion Presents Golden Opportunity for Growth

In addition to the expected improvement in business results by year-end, Mr. Minh also believes that the anticipated upgrade of the Vietnamese stock market in September 2025 will serve as an important catalyst.

The banking group is expected to benefit from this upgrade due to their large market capitalization. At present, many banks have not yet filled their rooms, but when foreign capital flows in following the upgrade story, these rooms may be filled.

Particularly, a few banks that took over weak credit institutions are presented with the opportunity to increase their foreign ownership limit (FOL) to up to 49% by law, thus enabling them to seek strategic partners.

According to VIS Rating, as of May 19, 2025, 3/4 of the banks involved in the restructuring of weak credit institutions (HDB, MBB, and VPB) have been applying new FOL limits, while VCB has remained unchanged.

Firstly, the 49% FOL allows banks like HDB, MBB, and VPB to raise new capital from foreign investors, supporting robust asset growth. According to the restructuring plan, these banks receive incentives from the SBV, including higher credit limits, lower reserve requirements, and liquidity support. If they maintain asset growth of over 25% or exceed the industry average in the next two years, VIS Rating believes that HDB, MBB, and VPB will need to supplement capital to maintain their capital adequacy ratio (CAR).

Secondly, the involvement of foreign strategic investors not only infuses capital but also enhances risk management and improves access to international capital.

For instance, VPB has tripled its lending to FDI enterprises to 3.7 trillion VND in 2024, thanks to support from Sumitomo Mitsui Banking Corporation (SMBC).

In early May 2025, VPB announced a syndicated loan of 1 billion USD, arranged by SMBC and other foreign banks, for sustainable finance.

However, it is important to note that negotiations with foreign investors can often be protracted. VPB took two years to sell a 15% stake to SMBC, while HDB spent five years searching for a partner. MBB has not yet announced plans to find a strategic investor and mainly relies on retained earnings and Tier 2 bonds.

Regarding VCB, the FOL remains at 30%, but the bank plans to offer a 6.5% stake in 2025-2026, including to its strategic partner, Mizuho. If successful, VCB’s CAR could increase by more than 200 basis points, solidifying its leading position.

Overall, in the long run, the participation of foreign investors will enhance risk absorption capacity, support growth strategies, and facilitate international integration.

Quan Mai

– 14:46 27/05/2025

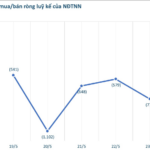

A Bluechip Stock Unexpectedly Sees Foreign Outflow of Nearly VND 700 Billion in the Week of May 19-23

The foreign sell-off was a major downside, with a significant net selling focus at the start of the week.

The Billionaire’s Assets Surge to Unprecedented Heights

“Vingroup’s stock surge: VHM and VIC soar to new heights. In a thrilling rally, Vingroup’s stocks witnessed a substantial surge with VHM and VIC reaching their peak. This exhilarating performance has propelled billionaire Pham Nhat Vuong’s net worth to a record-breaking $10.2 billion, according to the latest updates from Forbes.”

“Vietnamese Billionaire Pham Nhat Vuong Hits $10 Billion in Net Worth, Joining the World’s 300 Richest People.”

As of the latest Forbes update, billionaire Pham Nhat Vuong boasts a staggering net worth of $10.2 billion. He ranks 277th globally and firmly maintains his position as Vietnam’s richest person.