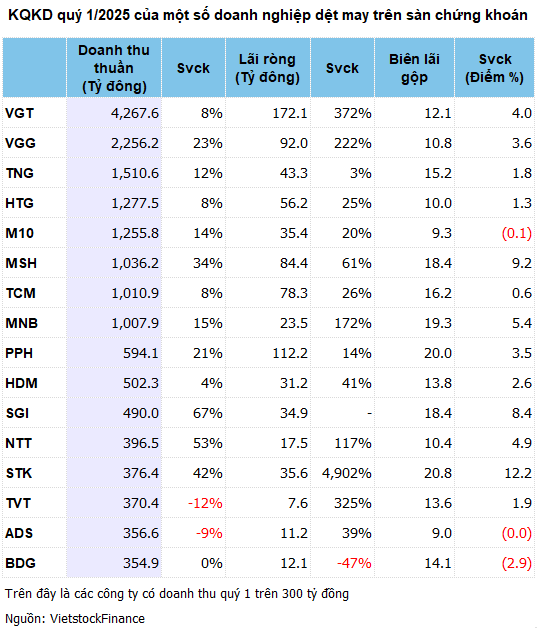

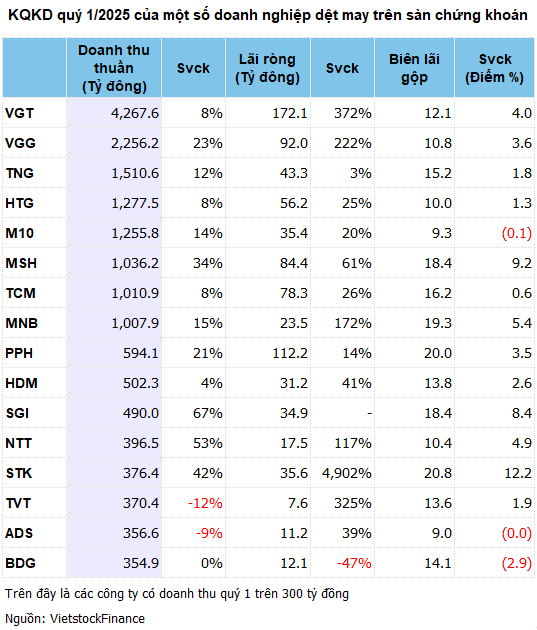

According to data from VietstockFinance, the combined revenue of 32 listed textile enterprises in Q1/2025 reached nearly VND 19,509 billion, up 11% over the same period last year. Eight enterprises recorded revenue above VND 1,000 billion.

|

Topping the list is Vinatex (VGT) with VND 4,268 billion, up 8% and accounting for 22% of the industry’s total revenue. Following closely is May Song Hong (MSH) with an impressive 23% growth rate, reaching VND 2,256 billion.

However, the bright spots are not evenly distributed. Garmex Saigon (GMC) continues to languish at the bottom with a meager revenue of VND 346 million in the quarter, mainly from pharmacy operations and joint ventures, while its core garment business has ceased production since May 2023 due to a lack of orders. By the end of March 2025, GMC had only 29 employees, a significant decrease from over 4,100 employees at the end of 2020.

Improved gross profit margin boosts profits for major players

Thanks to a slower increase in cost of goods sold compared to revenue, the industry’s average gross profit margin improved from 11.6% to 13.8%, driving a 32% rise in total gross profit to VND 2,686 billion.

Hanosimex (HSM) made a strong recovery, turning around from a gross loss of VND 13 billion in the same period last year to a gross profit of VND 38 billion in Q1/2025, with a gross profit margin of 13%. This improvement is attributed to better performance in their main business, higher selling prices for yarn, stable input costs, and full capacity utilization in the garment and towel segments with improved productivity and selling prices.

In contrast, Fortex (FTM) was the only company to report a gross loss of nearly VND 14 billion due to selling below cost, a reversal from a slight gross profit in the previous year.

The industry’s average net profit soared to VND 865.5 billion, 2.3 times higher than the same period last year. Among the 32 enterprises, 22 reported higher profits, 4 reported lower profits, 3 turned around from losses, and 3 remained unprofitable.

Soi The Ky (STK) achieved the most remarkable profit increase, 50 times higher than the previous year, reaching nearly VND 36 billion. This impressive performance is attributed to a 42% growth in revenue from adding 13 new customers and improved selling prices, resulting in a significant jump in gross profit margin from 8.6% to 20.8%. Additionally, favorable exchange rates boosted financial income by 77%, while a 61% reduction in selling expenses further contributed to the surge in profits.

In absolute terms, Vinatex led in both revenue and profit. With a net profit of VND 172 billion, up 372%, Vinatex benefited from its fiber units turning around from losses and a full order book for the garment segment until Q2/2025.

May Viet Tien (VGG) also reported a 222% surge in profit to nearly VND 92 billion, thanks to securing multiple orders and cost-saving measures. Several other companies, including MSH, TCM, and M10, also witnessed improvements with profit increases of 61%, 26%, and 20%, respectively.

Small and medium-sized enterprises continue to face challenges

Not all enterprises fared well. TET, BDG, GIL, and EVE experienced profit declines ranging from 35% to 81%. For TET, a decrease in revenue and higher cost of goods sold caused a 26.2-percentage point drop in gross profit margin, resulting in a net profit of only VND 317 million.

GIL struggled to reach a profit of less than VND 3 billion due to a 99% drop in revenue from industrial real estate, coupled with a 13% decline in merchandise sales. The company is undergoing a business restructuring and expediting infrastructure construction to expedite land handover in the next quarter, leading to increased operating expenses.

The three loss-making enterprises were FTM (VND 39 billion loss), NDT (VND 10 billion loss), and GMC (VND 8 billion loss). As of March 2025, their accumulated losses amounted to VND 1,343 billion, VND 210 billion, and VND 111.5 billion, respectively. On a positive note, SVD, HSM, and SGI successfully turned around from losses to profits.

Export recovery amid lingering challenges

The positive Q1 performance reflects the recovery trend in Vietnam’s textile industry. According to the General Department of Customs, textile exports in Q1/2025 reached USD 8.6 billion, an 11% increase over the same period, driven by stable orders and product diversification. The US market contributed USD 3.8 billion, accounting for 44.2% of total exports and growing by 15%.

However, challenges remain as the US imposed a 46% import tariff on Vietnamese textiles from April 2025, although this policy has been temporarily postponed for 90 days. The tariff pressure compels enterprises to proactively restructure their strategies.

Mirae Asset Securities predicts textile exports to the US in 2025 to reach USD 18-20 billion, an increase of 8-10%, despite the tariff barrier. The main driver is US retailers’ preference for supply chain diversification after experiencing disruptions during the pandemic.

US tariff pressure remains an “unknown” – Illustrative image

|

Enterprises pivot and adapt to tariff challenges

At the 2025 Annual General Meeting of Shareholders, Vu Duc Giang, Chairman of VGG, warned: “If the 46% tariff is implemented, many enterprises may have to shut down.” TNG shared that they are reassessing their entire production plan, as the high tariff poses a significant risk even though US exports account for only 26% of their revenue. They consider this to be the most challenging period for the company.

TCM, with 30% of its revenue coming from the US, is actively exploring markets in Japan, South Korea, and other regions to diversify risks. They are also targeting the Middle East, South America, and African markets while investing in product design and development to enhance value addition.

Amid ongoing tariff negotiations between Vietnam and the US, Vinatex forecasts stable orders in Q3/2025 due to low inventory levels in the US. However, orders in Q4 may decrease by 10% due to weak buying power. Le Tien Truong, Chairman of Vinatex, emphasized: “The industry needs to utilize this period to adapt, just as it overcame tariff barriers before the WTO accession.”

Major textile enterprises respond to the 90-day “golden” period of postponed US tariff

“Tasco’s 2025 Shareholders’ Meeting: Integrating Vertically, Connecting the ‘One Tasco’ System and Partners to Serve Customers a Full Product and Service Lifecycle.”

On May 26, Tasco Joint Stock Company (coded HUT on HNX) successfully held its 2025 Annual General Meeting of Shareholders in Hanoi. The meeting acknowledged the company’s 2024 business results and agreed on development orientations for 2025, with automotive services remaining a key and strategic focus for the company’s ecosystem.

“Petrovietnam Targets ‘A New Facility Launch Every Month’ to Sustain Growth”

In April and the first four months of 2025, despite market challenges, the Vietnam National Oil and Gas Group (Petrovietnam) maintained stable production and business operations. The group ensured the progress of key projects, setting a monthly target to commission a new facility while expanding its market reach. This strategic approach aims to accomplish the mandate assigned by the Ministry of Finance.

“MWG’s Fearless Leader: Confident in Strategy Execution, Dishing Out Cash Dividends and Buying Back Shares”

Let me know if you would like me to continue crafting captivating content for your website or advertisement!

“The restructuring process has fortified our core strengths, making us more agile and resilient in the face of market fluctuations,” emphasized the CEO of MWG.