The Vietnamese stock market is recovering from its April 2025 lows and is trading at attractive valuations – lower than the 10-year average and corresponding to an expected profit growth of 14% in 2025. However, valuations across sectors are diverging, reflecting differences in profit outlook and risk levels, according to FiinGroup.

Amid prevailing uncertainties, profit growth trends are stabilizing, and capital flows are showing signs of becoming more selective. Here are some notable sectors and stock groups to watch in the coming period:

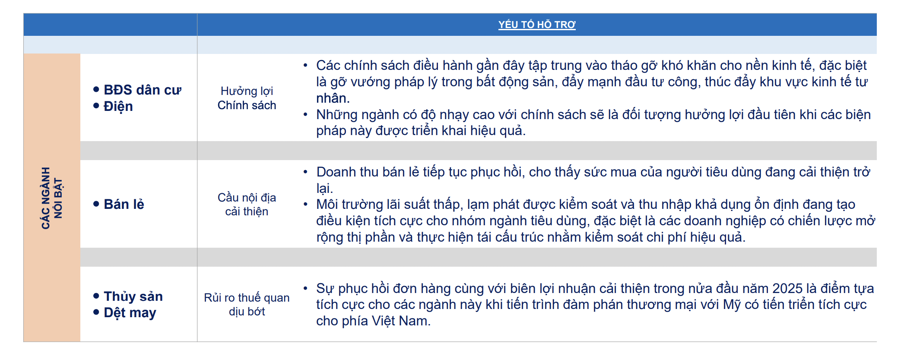

First, residential real estate: Profits surge due to project handovers, but opportunities will vary across companies.

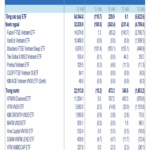

Residential real estate is one of the few sectors that experienced a remarkable profit surge in Q1 2025. The industry’s after-tax profit soared by 1083.6% year-over-year, mainly driven by VHM (+193.3%), VEF (+16344.6%), NLG (+269%), and KDH (+85.5%). It’s important to note that this growth primarily reflects the progress of project handovers rather than a sustainable improvement in the industry.

Nevertheless, the profit surge has also contributed to improved financial metrics, making it easier for companies to access various sources of funding, including bank loans and bond issuances.

The factors driving the upward trend in real estate stock prices (+27.5% since the beginning of 2025) are becoming more distinct: the Vingroup cluster is expected to benefit from supportive policies for the private economic sector, while the performance of other real estate stocks heavily relies on sales progress, project execution capabilities, and legal progress in key projects.

With interest rates remaining low, infrastructure development accelerating, and legal frameworks for the residential real estate market becoming clearer, real estate stocks are attracting capital inflows, particularly those of companies preparing to launch new projects (including VHM, DXG, NLG, KDH, TCH…) or making legal headway in existing projects (NVL, CII).

Second, the Power sector: Profits rebounded strongly in Q1 2025, and stock prices are supported by expectations of a new investment cycle backed by policies.

In Q1 2025, the Power sector recorded positive business results with a strong profit recovery, surging by 108.3% year-over-year, led by the Thermal Power group, particularly gas-fired power plants (POW, TV2), which achieved a remarkable after-tax profit growth of 113.9% due to stable gas supply. In contrast, coal-fired power plants witnessed a profit decline for the fourth consecutive quarter.

For renewable energy, the 85.3% growth in Q1 2025 was mainly attributed to hydropower plants benefiting from favorable hydrological conditions and GEG, which recognized retrospective revenues from the Tan Phu Dong 1 wind farm project after signing an appendix to the power purchase agreement under the transitional price mechanism (1.813 VND/kWh or 7.8 US cents/kWh)

With electricity consumption expected to continue its strong growth trajectory, the mid-to-long-term outlook for the Power sector is bolstered by Decree 72 and the adjusted Power Development Plan VIII. Specifically, EVN is now allowed to adjust the average electricity selling price more flexibly when input costs increase by ≥3%, enhancing cash flow and payment capabilities for power generation companies, thereby opening up new investment opportunities.

The adjusted Power Development Plan VIII strongly favors renewable energy, particularly wind, solar, and hydropower, while also significantly increasing investment in the power grid (+143%), creating opportunities for construction and EPC companies like TV2, PC1, and renewable energy developers such as REE, GEG, BGE, and TTA.

The 2025 ceiling electricity price has also been adjusted to support wind and LNG power generation, reducing profit margin risks for power plants using imported fuels (NT2, POW)

Third, retail: Retail revenues continue to recover, indicating improving consumer spending. The low-interest-rate environment, controlled inflation, and stable disposable income are fostering a positive landscape for consumer sectors, especially businesses with expansion strategies and effective cost-control measures through restructuring.

For Export sectors: The high growth in Q1 2025 does not reflect tariff risks. There is a clear divergence in profit growth within the Export sectors. Specifically, Wood and Tire industries witnessed sharp declines in profits, falling by 22.5% and 60.5% year-over-year, respectively.

In the case of the Tire industry (CSM, DRC), rising input costs, especially rubber, coupled with stagnant selling prices due to weak domestic demand and declining export prices, resulted in a sixth consecutive quarter of declining EBIT margins, reaching the lowest level in five years (2.1%). The outlook for 2025 in the Tire industry is less favorable as rubber prices gradually cool down but remain elevated compared to 2024 levels, and tire consumption is expected to remain subdued.

In contrast, Textiles, Seafood, Rubber, and Chemicals are industries with rebounding profits and positive growth quality (evidenced by profit growth driven by rising revenues and expanding EBIT margins)

Notably, all four industry groups are directly or indirectly dependent on the US market, and changes in US tariff policies are negatively impacting their profit outlooks.

Apart from the risk of facing higher tariffs when entering the US market, Vietnam’s export products (especially textiles) will be subject to increasingly stringent requirements for quality and traceability. This will favor companies that are not reliant on Chinese raw materials and can secure domestic supply sources, notably TCM (Textiles) and VHC (Tra fish)

However, the current size of tra fish does not meet the standards for export to the US, somewhat diminishing VHC’s competitive advantage. In the event of retaliatory tariffs by the US, the importing partner will bear the additional tax burden, as the contract stipulates that VHC is not responsible for any taxes in the US other than anti-dumping duties.

The Stealth Stock Market Wave: Selective Gains After the Tariff Shock

“Despite the tariff shock in early April 2025, Vietnamese bank stocks have witnessed a robust recovery since May. However, the large caps still have significant inertia, preventing a truly uniform upswing in the banking sector.”