These are the insights shared by Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association (HoREA), at a workshop on the theme “Bad Debt Treatment: What Are the Harmonious Solutions?” organized by Tien Phong Newspaper on May 27th in Ho Chi Minh City.

According to Mr. Chau, dealing with bad debts is not just about debt recovery but also about market revival. Hence, he proposed that the government consider issuing special mechanisms to tackle bad debts in a more aggressive and synchronized manner. “We need a new approach: recover debts, restore projects, save businesses, and preserve jobs,” emphasized the HoREA Chairman.

Mr. Le Hoang Chau, Chairman of HoREA. (Source: Tien Phong Newspaper)

Mr. Chau pointed out that one of the significant obstacles currently is the legal framework concerning secured assets. Many large-scale projects are stalled due to complicated procedures and prolonged legal disputes, preventing banks from auctioning off the assets and businesses from restructuring. Therefore, he suggested enhancing the legal framework to promote transparency and streamline the process of handling secured assets, including through public auctions or project transfers.

He also proposed forming a central-level inter-agency task force to review and classify stalled real estate projects to devise appropriate solutions for different categories of bad debts, rather than applying a rigid mechanism across the board.

Additionally, for viable projects, there should be more flexible conditions for businesses to access credit facilities, helping them recover financially and complete projects. This, in turn, would generate actual cash flow to repay debts.

“Once bad debts are addressed, new money will flow back into the market, rescuing businesses, strengthening banks, and enabling the government to collect taxes,” Mr. Chau emphasized. He further stressed that this is a comprehensive issue requiring the involvement of the entire political system, and it cannot be left solely to businesses to navigate through the crisis.

From a business perspective, Mr. Vo Hong Thang, Deputy General Director of DKRA Group, candidly shared that seizing secured assets is not always the optimal solution. In a volatile market, this could even become a burden for banks if not accompanied by efficient handling measures.

According to Mr. Thang, there needs to be close coordination between banks, businesses, and regulatory authorities to untangle bottlenecks, bring transparency to the process, and improve the efficiency of utilizing secured assets. Only then can bad debts be sustainably resolved.

Mr. Thang cited specific figures, stating that as of May, real estate credit outstanding in Vietnam exceeded VND 1,560 trillion, an increase of about VND 260 trillion compared to the end of 2024, equivalent to a 20% growth rate. If the credit growth target of 16% for the entire system is achieved this year, total real estate credit outstanding could reach VND 3.8-3.9 quadrillion. However, he emphasized that credit is still mainly focused on enterprises, while individuals are reluctant to take out loans to purchase homes due to high prices.

Another issue highlighted by Mr. Thang is the rapid increase in non-performing loans in the real estate sector. The total non-performing loans of 27 listed banks have surpassed VND 265 trillion, an 18.5% rise compared to the same period last year. Meanwhile, real estate enterprises continue to face risks due to stricter lending conditions, weakened financial statements, and complex and prolonged disbursement procedures.

Additionally, many banks only accept real estate as collateral, lacking flexibility in accepting other asset types like stocks or property rights. This further hinders businesses’ access to capital, especially amid escalating financial pressures.

Captivating Celebrity Clientele: The Fibonan’s Star Attraction

In a dynamic real estate market, where only the truly exceptional developments stand out, The Fibonan, an upscale apartment complex in East Hanoi, is shining bright. With its contemporary architecture, world-class amenities, and superior quality, The Fibonan appeals to discerning individuals seeking not just a home, but a lifestyle.

“Transforming Bad Debt into a Market Revival.”

The narrative around distressed debt needs to shift; it’s not just about debt collection, but an opportunity to revive the market. A robust and synchronized approach is required, and the government should consider introducing special measures to aggressively tackle bad debt.

Win a Mazda at the CentreVille Luong Son Grand Opening and Customer Appreciation Event

To express our heartfelt gratitude to our valued investors in the CentreVille Luong Son project, we are thrilled to announce that the project developer will be hosting a special event on May 31, 2025. This event will not only offer an exclusive opportunity to purchase units in the project but also present a chance to win exciting prizes, including a grand prize of a Mazda 6 Signature car. Join us at the CentreVille Luong Son urban area in Hoa Binh to be a part of this extraordinary occasion.

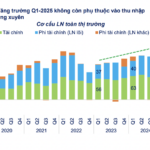

Enterprise Profits for Q1 2025: A Steady 12% Increase, Emphasizing Quality and Sustainability, Free from Reliance on Financial Income.

The net profit after tax for the whole market increased by 12% year-on-year, significantly lower than the average quarterly growth rate in 2024 (+20.5%/quarter). However, this growth reflects a more substantial and stable performance, as it is no longer heavily reliant on financial income contributions.