On June 6, 2025, FTSE will announce the constituent stocks of the FTSE Vietnam Index. On June 13, 2025, MarketVector will announce the MarketVector Vietnam Local Index.

June 20, 2025, is expected to be the completion date for the restructuring of the portfolios of ETFs referencing these indices.

In a recent report, Yuanta Securities predicted the constituent stocks and the number of stocks to be bought/sold for the ETFs tracking these indices.

For the

FTSE Vietnam Index (FTSE ETF reference),

Yuanta forecasts that FTSE will neither add nor remove any stocks.

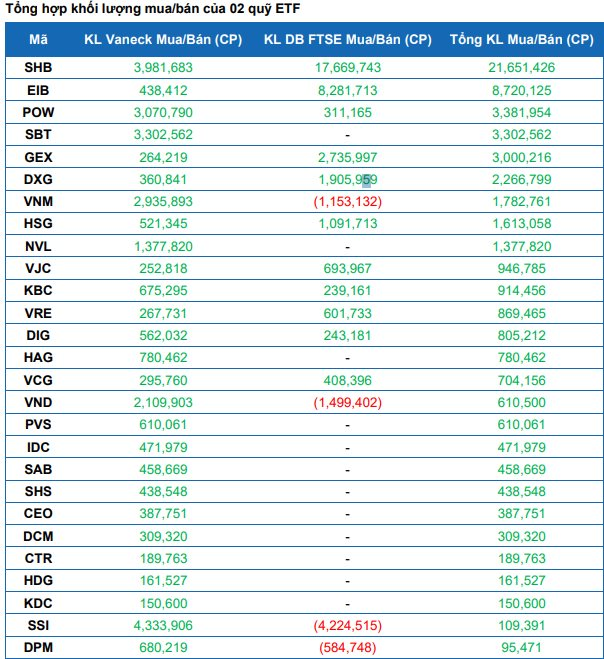

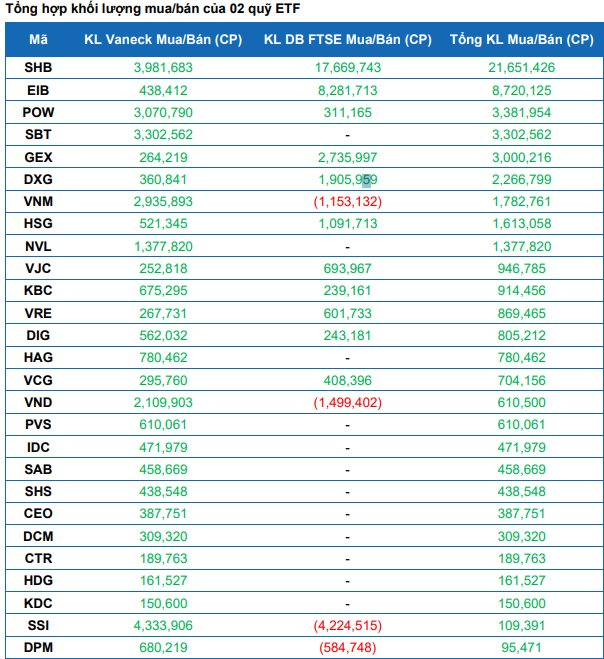

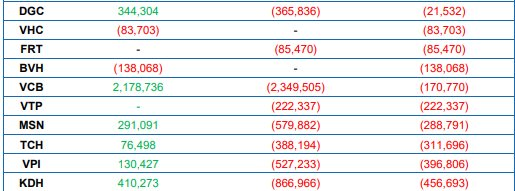

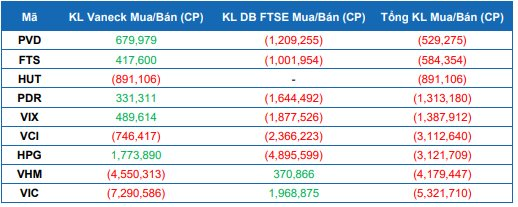

Yuanta estimates that the FTSE ETF will buy a significant amount of SHB shares (17.7 million), EIB (8.3 million), and sell HPG (-4.9 million), SSI (-4.2 million), and VCI (-2.4 million) to restructure its portfolio.

Similarly, Yuanta predicts that the

MarketVector Vietnam Local (VNM ETF reference)

will also not add or remove any stocks in the Q2 2025 review.

Additionally, Yuanta estimates that the VNM ETF will buy a significant number of SHB shares (4 million), SSI (4.3 million), SBT (3.3 million), POW (3.1 million), and VNM (2.9 million).

On the selling side, VIC and VHM are the two codes with the largest reduction in weight. VNM ETF is expected to sell 7.3 million VIC shares and 4.6 million VHM shares. VCI, MSN, BVH, and HUT are also in the group of stocks to be sold.

Combining the two funds, SHB is the code with the highest net purchase volume, with more than 21.6 million shares. Following SHB, EIB, POW, SBT, and GEX are also in the top buying group. In contrast, VIC, VHM, HPG, and VCI are the codes facing the most selling pressure during this restructuring.

The First Time Since Early 2025: Vietnam Equity-Focused ETFs See Inflows

Vietnam-focused equity ETFs witnessed their first net inflows since the start of 2025, attracting nearly VND 216 billion.

“SHB’s Market Capitalization Surpasses $2 Billion: A Testimony to its Robust Financial Foundation and Relentless Pursuit of Excellence”

With a robust and ever-growing financial foundation, Saigon-Hanoi Commercial Joint Stock Bank (SHB) sets its sights on an ambitious goal: to reach VND 1 quadrillion in total assets by 2026. This bold target underscores SHB’s determination to solidify its leading position in Vietnam’s financial landscape and expand its regional presence, all while supporting the nation’s journey into a new era of prosperity.

“SHB’s Market Capitalization Surpasses $2 Billion: A Testament to its Robust Financial Foundation and Relentless Pursuit of Excellence”

With a robust and ever-growing financial foundation, Saigon-Hanoi Commercial Joint Stock Bank (SHB) sets its sights on an ambitious goal: to reach VND 1 quadrillion in total assets by 2026. This bold target underscores SHB’s commitment to solidifying its position in the domestic financial market while expanding its regional presence. As SHB forges ahead, it stands as a proud partner in the nation’s journey towards a new era of prosperity and progress.

“Capital Outflow from Vietnam ETFs Persists”

During the week of May 12-16, 2025, Vietnam-focused equity ETFs experienced net outflows of over VND 210 billion.