Familiar Face Takes the Helm

On May 28, VIX announced the appointment of Mr. Nguyen Tuan Dung as Chairman of the Board, following a brief stint as a board member. The position had been vacant since Thai Hoang Long‘s resignation in September 2024.

According to the disclosure statement, Mr. Dung currently holds nearly 594,000 VIX shares, representing a 0.04% stake in the company.

Born in 1977, Mr. Nguyen Tuan Dung holds a Bachelor’s degree in International Economics. He previously served as the board supervisor from February 2023 to April 2023, filling in for Nguyen Thi Tuyet, until Thai Hoang Long took office.

On the same day, VIX also announced the appointment of Tran Hong Van as the new Head of the Supervisory Board, replacing Trinh Thi My Le. Additionally, Du Van Toan was appointed as the Company Administrator, succeeding Mr. Nguyen Tuan Dung.

Upcoming Issuance of 73 Million Shares as Dividends

VIX plans to issue shares as dividends in the latter part of Q2 to the early part of Q3 2025, following approval from the State Securities Commission. This will increase the charter capital from over VND 14,585 billion to over VND 15,314 billion.

This dividend plan was approved at the 2025 Annual General Meeting of Shareholders (AGM) on May 23. Dividends were a hot topic of discussion at the AGM.

Mr. Nguyen Tuan Dung, then the board member, stated that the 5% dividend ratio was the maximum feasible at present, based on current regulations.

|

In response to a shareholder’s suggestion to consider partial cash dividends in subsequent years, Mr. Dung asserted that both cash and stock dividends had been carefully considered.

VIX‘s leadership emphasized that stock dividends offered two advantages. Firstly, transferring profits to charter capital would enhance the company’s financial strength and borrowing and investment capacity, thereby boosting future profits. Secondly, given VIX‘s high market liquidity, shareholders could easily sell their received shares to monetize their investment if needed.

According to VIX‘s management, aside from the 2024 dividend payment, the company has no other plans for capital increases. Future plans will depend on actual circumstances and will be subject to shareholder approval.

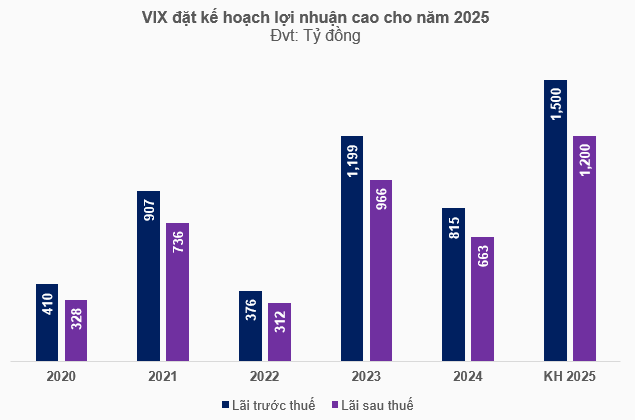

At the AGM, shareholders also approved the 2025 business plan, targeting a pre-tax profit of VND 1,500 billion and a post-tax profit of VND 1,200 billion. These figures represent increases of 84% and 81%, respectively, compared to the previous year. Previously, VIX had set ambitious targets for 2024 but only achieved 62% and 63% of the pre-tax and post-tax profit goals, respectively.

Source: VietstockFinance

|

In Q1 2025, VIX recorded operating revenue of nearly VND 980 billion, a 2.7-fold increase year-over-year. This positive revenue growth contributed to a post-tax profit of over VND 372 billion, a 2.3-fold increase compared to the same period last year. With these results, the company achieved 31% of its post-tax profit target for the year.

– 16:46 28/05/2025

“PV Gas Targets Profit Matching the First Half of the Previous Year, Issues 70 Million Bonus Shares”

“Amidst a volatile economic landscape, PV GAS, a leading Vietnamese gas company, foresees a challenging year ahead. With domestic gas sources dwindling and competition intensifying, the company has strategically set a cautious target for its 2025 earnings, aiming for half of the previous year’s profit after tax, as revealed in their Annual General Meeting documents.”

“Traphaco Confirms Date for 2024 Second Dividend Payment”

Traphaco has announced that June 16th is the last day for shareholders to register to receive the second round of cash dividends for 2024, with a payout ratio of 20%. This round of dividends will cost the company approximately VND 82.9 billion.