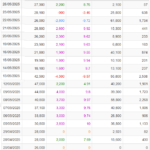

Leading foreign investment fund Dragon Capital has recently reported a purchase of shares in DXG, the stock code for the Real Estate Group, known as the Conglomerate Xanh (HoSE: DXG). On May 22nd, four member funds of Dragon Capital collectively purchased 2 million DXG shares. Amersham Industries Limited acquired 183,000 shares, Hanoi Investments Holdings Limited bought 1 million, Norges Bank secured 390,000, and Vietnam Enterprise Investments Limited purchased 427,000 shares.

Following this transaction, Dragon Capital’s total holdings increased from 121.4 million shares, representing a 13.94% stake, to 123.4 million shares, now accounting for 14.17% of the Conglomerate Xanh’s charter capital. May 26th was the day of change in Dragon Capital’s ownership percentage.

Dragon Capital increases its stake in the Real Estate Group to over 14%

This increase in ownership by Dragon Capital comes as the Real Estate Group announced that June 5th is the last day to finalize the list of shareholders eligible to receive bonus shares from the capital increase from owned capital sources.

On May 23rd, the State Securities Commission (SSC) received documentation regarding the issuance of shares to increase capital from the Group’s owned capital sources. Accordingly, the Group will issue over 148 million bonus shares to shareholders at a ratio of 100:17, meaning that for every 100 shares owned, shareholders will receive 17 new shares.

The newly issued shares will not be restricted from transfer, except for existing shareholders holding ESOP 2023 (bonus type) shares during the restricted transfer period. They will still receive the new shares but with the same transfer restrictions as the initial ESOP shares.

The capital source for this issuance is VND 1,480.4 billion, including VND 1,200 billion from audited post-tax profits as per the 2024 consolidated financial statements, and over VND 280.4 billion from capital surplus based on the company’s 2024 audited separate financial statements.

Upon completion of this issuance, the Real Estate Group’s charter capital will increase from nearly VND 8,726 billion to over VND 10,206 billion.

If Dragon Capital maintains its ownership of 123.4 million DXG shares until the record date, it is estimated to receive approximately 20.97 million shares from this bonus share issuance.

The Growth Investment Guru’s Fund Becomes Major Stakeholder in PNJ.

PNJ, or Phu Nhuan Jewelry Joint Stock Company, has a new major shareholder in the form of T. Rowe Price Associates, Inc., a prominent American investment fund. This development comes on the heels of Dragon Capital’s exit from the list of major shareholders, marking a significant shift in the company’s investor landscape.