On March 18, 2025, the Vietnamese government issued Decree No. 69/2025, amending and supplementing a number of articles of Decree No. 01/2014 dated January 3, 2014, regarding foreign investors’ purchase of shares in Vietnamese credit institutions.

Effective May 19, 2025, banks participating in the State Bank of Vietnam’s weak credit institution restructuring plan will be allowed to increase their foreign ownership ratio to a maximum of 49%, up from the current 30% applicable to banks in general.

Three out of the four banks receiving the transfer will have their foreign ownership limit raised to 49%. |

Specifically, three private joint-stock commercial banks, HDBank, MBBank, and VPBank, have been permitted to raise their foreign ownership ceiling to a maximum of 49%. These banks are participating in the State Bank’s weak credit institution restructuring plan and are thus entitled to special treatment regarding credit growth limits, mandatory reserve requirements, and liquidity support.

However, among this group, Vietcombank is the only bank not eligible for the increased foreign ownership limit. According to the new regulation, Vietcombank does not qualify for a 49% foreign ownership limit because the state holds more than 50% of its capital.

Analysts at ACB Securities (ACBS) opined that the new decree facilitates banks’ ability to issue additional shares to foreign investors if they need to raise capital to inject into weak banks, thus expediting the restructuring process.

For instance, MB plans to contribute up to VND 5,000 billion to MBV Bank during the restructuring phase. Other banks are likely to have similar plans, which are part of the weak bank restructuring proposal.

Moreover, capital raising helps bolster the capital adequacy ratio (CAR) as the banks receiving the weak banks are granted high credit growth limits of 20-30% per year.

Currently, HDBank has a relatively high CAR of around 14%, but it relies on Tier 2 capital bonds. Therefore, the bank may consider increasing Tier 1 capital to reduce funding costs in the future.

Meanwhile, VPBank also boasts a high CAR of approximately 14% and has not utilized Tier 2 capital bonds extensively, so immediate capital raising may not be necessary.

In contrast, MB has a lower CAR of about 10% and has not tapped into Tier 2 capital. Thus, they may also consider raising capital in the future. However, ACBS suggests that state ownership in MB could be an impediment, as state-owned enterprises often resist ownership dilution.

VIS Rating, a Vietnam-based credit rating agency, expects the increased foreign ownership limit to facilitate banks’ attraction of new strategic investors’ capital, supporting robust asset growth.

According to estimates, the CAR could decline by 150-300 basis points by the end of 2026 if these banks do not raise new equity or issue Tier 2 capital bonds.

Historically, banks have primarily relied on retained earnings and Tier 2 capital bond issuance to meet their capital requirements. However, the process of selecting and finalizing agreements with foreign investors can span several years.

For instance, VPBank took about two years to sell a 15% stake to Sumitomo Mitsui Banking Corporation (SMBC) in 2023. HDBank has been seeking foreign investors for the past five years, and MB has not announced any plans to attract foreign strategic investors. Therefore, retained earnings and Tier 2 capital bonds are expected to remain the primary sources of capital for these banks.

In January 2025, the State Bank of Vietnam announced the transfer of GPBank to VPBank and DongABank to HDBank. In November 2024, CBBank was transferred to Vietcombank, and Oceanbank to MBBank. These transfers were made as part of the State Bank’s restructuring program to protect creditors and restore the banks’ normal operations. Before the transfers, the four banks had been under special control by the State Bank due to significant non-performing loans and accumulated losses.

Ngoc Mai

– 14:34 05/24/2025

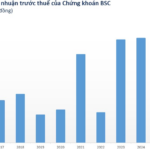

A Stockbroker Firm Finalizes Dividend Payout at 10%

Through this dividend payment, the charter capital is expected to increase by over VND 223 billion, raising it to nearly VND 2,454 billion.

Central Bank: No County-Level Branches, No Need for a Bicameral Government Structure

Are there any other adjustments you would like to make to this text? I can easily make further changes to ensure it suits your needs.

The State Bank of Vietnam emphasizes the unique structure of this organization, which lacks a district-level hierarchy. This arrangement effectively prevents conflicts that may arise during the transition to a new local government model. However, to align with practical considerations, certain legislative amendments are necessary.

Prime Minister Demands “Urgent” Action: Gold Trading Business Inspection Results to be Reported by May

“The latest directive, Government Telegram No. 64, signed by Prime Minister Pham Minh Chinh, outlines critical measures for effective management of the gold market. This comprehensive strategy aims to bring stability and order to the industry, addressing key concerns and laying the foundation for a robust and transparent gold market in the country.”

“ACB Approved to Raise Capital to Nearly VND 51,400 Billion”

“ACB has received the green light from the State Bank of Vietnam to boost its charter capital by issuing bonus shares, taking its total capital to an impressive VND 51.4 trillion. This move underscores ACB’s strong position and ambitious growth strategy, rewarding shareholders with increased value and setting a new precedent for Vietnam’s dynamic banking sector.”

The Great Gold Rush: Uncovering the Truth Behind the Speculative ‘Price Inflation’

The domestic gold price is currently trading at a premium of over 16 million VND per tael compared to international prices, returning to levels seen before the State Bank intervened in the gold market in 2024. The State Bank attributed the surge in domestic gold prices to various factors, including speculation and price manipulation by certain businesses and individuals taking advantage of market volatility.