Vietnam’s stock market extended its rally, with a shift in focus from large-cap to Midcap stocks, a contrast from previous weeks where the main index was propelled by large-cap stocks.

At the close of May 27, the VN-Index rose 7.3 points to 1,339.81. Trading liquidity improved significantly from the previous session, with the matched order value on HoSE reaching approximately VND 23,593 billion.

However, foreign investors’ net selling was a downside, with a net sell-off of over VND 1,178 billion in this session. Specifically:

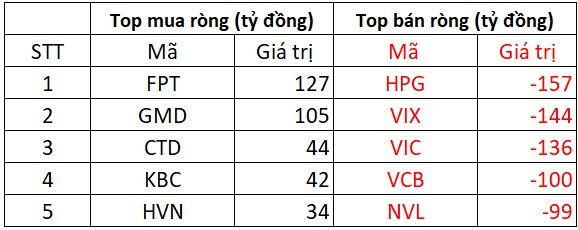

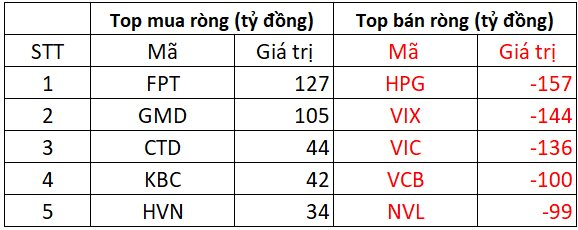

On HoSE, foreign investors net sold nearly VND 1,106 billion

In the selling session, HPG was the most net sold stock in the market, with a net sell value of VND 157 billion. This was followed by VIX, VIC, and VCB, which were also net sold by over VND 100 billion each. NVL trailed with a net sell-off of about VND 99 billion.

Conversely, FPT witnessed the strongest net buying in the market, with a net buy value of VND 127 billion, followed by GMD with a net buy value of over VND 100 billion. CTD, KBC, and HVN also saw net buying in the range of VND 34-44 billion per stock.

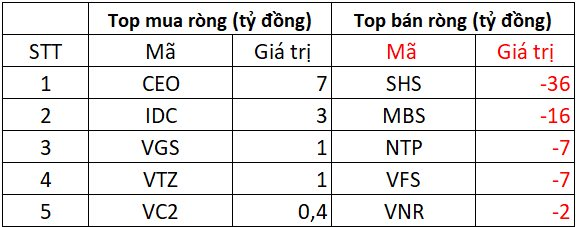

On HNX, foreign investors net sold nearly VND 61 billion

In the buying session, HNX stocks that were net bought included CEO (VND 7 billion) and IDC (VND 3 billion). Additionally, VGS and VTZ saw net buying of about VND 1 billion each.

Conversely, SHS witnessed the strongest net selling, with a net sell value of VND 36 billion, followed by MBS with VND 16 billion. NTP, VFS, and VNR also experienced mild net selling of a few billion VND each.

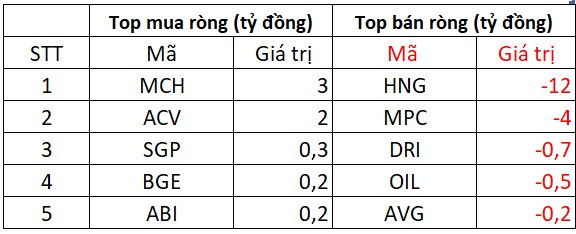

On UPCOM, foreign investors net sold approximately VND 12 billion

In terms of net buying, MCH and ACV led with net buy values of VND 2-3 billion each, followed by SGP, BGE, and ABI, which saw net buying of a few hundred million VND each.

Conversely, HNG experienced a net sell-off of VND 12 billion, and MPC was net sold for VND 4 billion. DRI, OIL, and AVG also witnessed negligible net selling.

The VN-Index Surges to a 3-Year High, but Many Investors’ Accounts are Yet to Reap the Benefits: Insights from VPBankS Experts

“There are still investment opportunities in various sectors and stock groups that were affected during the previous period, offering relatively safe valuation entry points,” the expert emphasized.

“Defying the ‘Sell in May’ Adage, Bank Stocks Remain Attractive in May”

Contrary to the usual “Sell in May” sentiment that often makes investors hesitant, the Vietnamese stock market in May 2025 witnessed a positive performance from bank stocks. As the market leaders, bank tickers not only steered the VN-Index but also demonstrated enduring allure amid market fluctuations.

Market Beat: Stocks End Higher, Energy Sector Soars

The market ended the session on a positive note, with the VN-Index climbing 2.06 points (+0.15%) to reach 1,341.87, while the HNX-Index gained 1.77 points (+0.8%), closing at 223.56. The market breadth tilted in favor of gainers, with 388 advancing stocks against 360 declining ones. However, the large-cap VN30 index painted a mixed picture, as 15 stocks declined, 10 advanced, and 5 remained unchanged.

The Vietnamese Stock Market Soars: A 29% Surge and a Whopping 11x Dividend Payout

The 2024 dividend yield marks a significant milestone as it represents the highest cash dividend that the company’s shareholders have ever received.

Market Beat: Vingroup Leads the VN-Index’s Green Charge

The market remained in the green throughout the morning session. By the mid-session break, the VN-Index had gained over 6 points (+0.45%), climbing to 1,345.86; while the HNX-Index rose nearly 1%, reaching 223.97. Market breadth was positive, with 415 advancers, 250 decliners, and 919 stocks trading unchanged.