At the annual General Meeting of Shareholders (GMOS) of Vietnam National Gas Corporation – JSC (PV GAS, code GAS) in 2025, the company’s leadership assessed that the global economy remained volatile, with increasing competitive pressures, especially in the energy supply chain, global energy transition, and sustainability demands.

Domestically, the actual domestic gas supply continued to decline. Upstream incidents tended to increase and often led to prolonged disruptions in gas supply. Additionally, LNG imports and consumption were unstable due to price and consumption demands.

Meanwhile, although there was growth in industrial customers, the fierce competition from alternative fuel sources resulted in unstable gas consumption. This, coupled with competition from domestic and foreign rivals, and the emergence of a new LNG provider (Hai Linh Company) in the market, posed direct challenges to PV Gas’s dominance.

In the LPG market, rivals were willing to offer prices lower than PV GAS to attract customers and were more flexible with financial policies, such as waiving contract performance guarantees and payment guarantees. Other potential foreign competitors were also making inroads into the Vietnamese LPG market, challenging PV GAS’s position. Furthermore, illegal LPG refilling and charging using the PV GAS brand continued to impact retail operations.

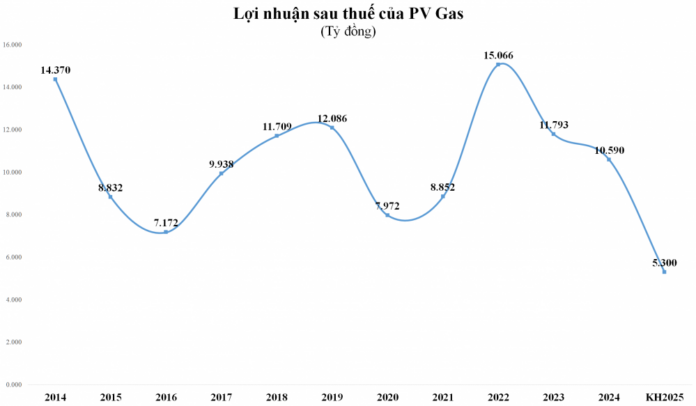

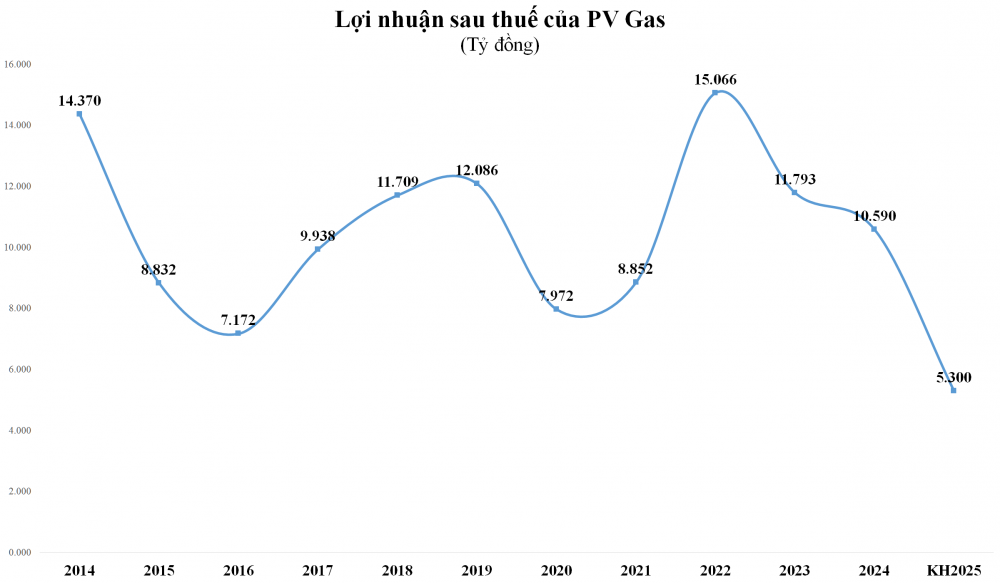

Amid these challenges, PV Gas set consolidated revenue and post-tax profit targets of VND 74,000 billion and VND 5,300 billion, respectively, for 2025, representing a 29% and 50% decrease from the previous year. These plans were based on an oil price scenario of $70/barrel.

In terms of output, the company aimed to receive 6.16 billion cubic meters of gas (including imported LNG) and consume over 5.88 billion cubic meters of gas (including LNG) during the year. LPG production and trading volumes were targeted at 370,000 tons and 1,900 tons, respectively.

For construction investment, the expected investment value was VND 2,900 billion, and the disbursement value for construction investment was VND 3,300 billion (entirely from equity capital).

Despite these cautious financial targets, PV Gas committed to striving for an 8% increase in consolidated revenue compared to the previous year, rather than a decrease as planned. As per the Q1/2025 financial statements, the company had achieved VND 25,675 billion in revenue and VND 2,763 billion in post-tax profits, representing a 10% increase compared to the same period last year and fulfilling 35% of the revenue plan and over 52% of the annual post-tax profit target.

It is also worth mentioning that PV Gas has a “tradition” of setting conservative business plans, often outperforming them. In the 2024 financial year, the company recorded nearly VND 130,000 billion in total revenue (up 12% from 2023); consolidated revenue of over VND 105,564 billion, exceeding the plan by 50% (up 14% from 2023); pre-tax profit of VND 13,172 billion, surpassing the plan by 82%; and post-tax profit of VND 10,590 billion, exceeding the plan by 83%. The company contributed nearly VND 7,100 billion to the state budget, exceeding the plan by 89% (up 10% from 2023).

Given the achievements in 2024, at the upcoming annual GMOS, PV GAS proposed a dividend payout of 21% in cash, equivalent to over VND 4,900 billion. PV GAS also presented a plan to allocate over VND 3,000 billion to the development fund to serve the goal of aggressive investment in the next phase, aiming for sustainable growth and development.

For 2025, PV Gas proposed a cash dividend payout of 18.5% and an allocation of 30% of post-tax profit to the development fund, as per the 2025 plan, amounting to VND 1,542 billion.

Additionally, PV Gas will present to the 2025 GMOS a plan to increase charter capital by issuing shares to existing shareholders. The maximum number of shares to be issued is nearly 70.3 million, equivalent to a value of nearly VND 703 billion at par value. The entitlement ratio is 3% (for every 1 share held, shareholders will receive 1 right, and for every 100 rights, they will receive 3 new shares). The shares will not be restricted from transfer, and the issuance will take place after the GMOS approval and the SSC’s announcement of receiving sufficient documents (expected from Q2-IV/2025).

“PV Gas Targets Profit Matching the First Half of the Previous Year, Issues 70 Million Bonus Shares”

“Amidst a volatile economic landscape, PV GAS, a leading Vietnamese gas company, foresees a challenging year ahead. With domestic gas sources dwindling and competition intensifying, the company has strategically set a cautious target for its 2025 earnings, aiming for half of the previous year’s profit after tax, as revealed in their Annual General Meeting documents.”

“FPTS Boosts Charter Capital to VND 3,365 Billion After Bonus Share Issuance”

On May 15th, FPTS successfully issued 30.59 million bonus shares to its 18,105 shareholders, thereby increasing its charter capital to VND 3,365 billion.

“VIX Brokerage Aims for 1.8X Profit Growth in 2025”

On May 23, 2025, the Annual General Meeting of Shareholders of VIX Securities Joint Stock Company (HOSE: VIX) approved an ambitious profit target, aiming for an 80% increase compared to the previous year’s performance. VIX attributes this bold growth strategy to its focus on high-quality human resources and cutting-edge technology.