Statistics from VietstockFinance reveal that in Q1 2025, the combined revenue of six automobile enterprises (listed on HOSE, HNX, and UPCoM) exceeded VND 10.3 trillion, a 28% increase compared to the same period last year. However, net profit declined by 10%, amounting to VND 1.3 trillion, the lowest in the past five quarters.

The primary reason for this discrepancy is the weakened consumer demand following the conclusion of the registration fee reduction policy in late November 2024, while input costs remained high, and competition among brands intensified. The cyclical nature of the industry also plays a role, as profits are not typically concentrated in the first three months of the year.

City Auto (HOSE: CTF): Revenue Surges, but Profit Plummets to a Four-Year Low

Despite a 34% surge in revenue, surpassing VND 2 trillion, attributable to the consolidation of Volkswagen’s distribution company, City Auto’s profit plummeted by 71%, resulting in a meager VND 2.2 billion.

According to the explanation provided, in addition to the industry’s cyclical nature, the decline in financial investment income significantly reduced support for an already fragile profit. This profit level is the closest to the bottom witnessed in the past four years for the Ford distributor.

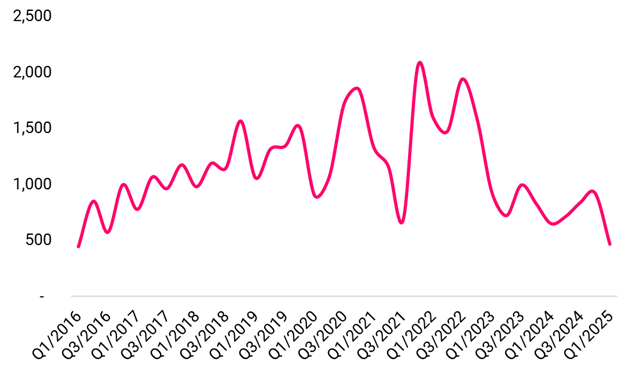

| City Auto’s profit plunges to its lowest since Q3 2021 |

Haxaco (HOSE: HAX): Revenue from Luxury Cars Plummets to the Lowest Level Since 2016

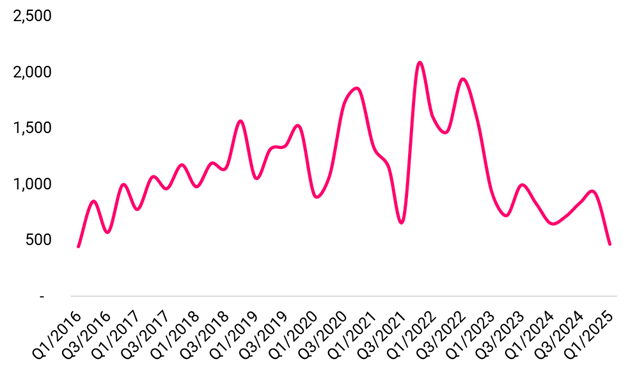

A similar scenario unfolded at Dich Vu Oto Hang Xanh (Haxaco), the distributor of Mercedes-Benz and MG vehicles. In Q1 2025, Haxaco’s consolidated revenue dipped by nearly 8%, settling at VND 959 billion. Profit plummeted by 77%, reaching VND 5.1 billion, marking the third-lowest level since 2021.

The primary culprit for this decline was the surge in outsourcing expenses, coupled with the continued growth in non-controlling shareholder interests. Notably, the parent company, responsible for the Mercedes-Benz business, recorded a 28% decline in revenue, amounting to VND 467 billion in Q1, the lowest since 2016. Haxaco attributed this downturn to weak buying power and a tendency toward tighter spending, which impacted the sales of luxury vehicles.

|

Parent company’s revenue plunges in Q1 2025 (Unit: VND billion)

Source: Author’s compilation

|

G-Automobile (HNX: GMA): Stands Out with a Sixfold Profit Surge

On the other hand, G-Automobile, another distributor of Mercedes-Benz vehicles, maintained a stable revenue level. In Q1 2025, G-Automobile’s revenue reached nearly VND 594 billion, a 6% increase. However, its net profit soared more than sixfold to over VND 5 billion, mainly due to improved profits from joint ventures and associated companies, coupled with reduced selling expenses.

| G-Automobile’s revenue remains stable after consolidating Mercedes-Benz An Du since 2022 |

Savico (HOSE: SVC): High Revenue, but Profit Distributed to Parent Company Shareholders Declines

Meanwhile, Dich Vu Tong Hop Sai Gon (Savico) witnessed a 37% surge in revenue, amounting to VND 5.5 trillion, making it the most successful Q1 in its history. Contrary to City Auto, Savico’s management attributed this improvement to a noticeable recovery in the automobile market in early 2025 compared to the previous year.

While the gross profit margin remained high at 7.9%, the profit distributed to parent company shareholders decreased by 20%, settling at nearly VND 11 billion.

| Savico’s profit remains stagnant despite revenue growth |

TMT Motors (HOSE: TMT): Impressive Turnaround after Three Loss-Making Quarters

One of the few bright spots in Q1 was Oto TMT, which witnessed a nearly 31% surge in revenue, reaching VND 676 billion. Its net profit stood at VND 34 billion, a 122-fold increase compared to the same period last year. This was TMT Motors’ most profitable quarter since 2022.

According to the management, this remarkable turnaround resulted from product restructuring, focusing on competitive Euro 5 truck lines. Additionally, the release of inventory and full repayment of bank loans led to a significant reduction in financial expenses.

| TMT Motors returns to profitability after a challenging period |

VEAM (UPCoM: VEA): Profit from Honda Declines, Impacting Overall Results?

Meanwhile, Tong Cong Ty May Dong Luc Va May Nong Nghiep Viet Nam maintained its lead in profit but witnessed a significant decline compared to the previous year. A reduction of 11% in profit recorded from joint ventures and associated companies, amounting to over VND 1.1 trillion, was the primary reason for the drop in net profit to VND 1.26 trillion.

Although not reported in detail, this decline in profit may be attributable to Honda Vietnam, in which VEA holds a 30% stake.

| Profit from VEA’s joint ventures and associated companies dips to the lowest since Q3 2021 |

Automobile Consumption Cools Down: Hopes Pin on the Second Half of the Year

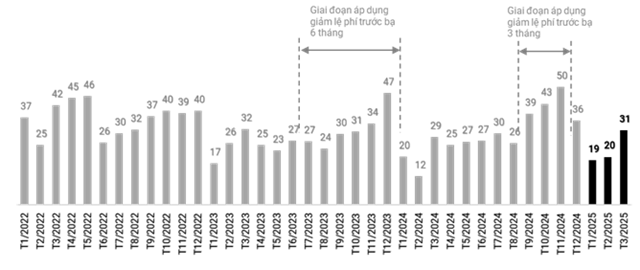

According to data from VAMA and TC Group, a total of 70,400 vehicles were sold in Q1 2025, reflecting a 15.4% increase compared to 2024, but a 7% dip compared to 2023, and significantly lower than Q1 2022, which saw 104,000 vehicles sold.

March 2025 witnessed a strong rebound, with over 31,000 vehicles sold, following two relatively weak months (January and February recorded sales of 18,750 and 20,203 vehicles, respectively).

In terms of market share, Toyota led the way with 11,830 vehicles sold, a 62% increase. Hyundai followed closely with 11,464 vehicles, a 13% increase. Mitsubishi and Ford also posted growth, with increases of 31% and 18%, respectively.

|

Q1 2025 vehicle sales grow but remain below 2023 and 2022 levels (Unit: thousand units)

Source: Author’s compilation

|

Despite the Q1 results falling short of expectations, many industry leaders remain optimistic about Q2 as a stepping stone to improvement before entering the year-end peak sales season.

At the 2025 Annual General Meeting of Shareholders, City Auto’s Deputy General Director, Tran Quang Tri, emphasized the industry’s cyclical nature, with profits typically concentrated in Q3 and Q4 when brands introduce incentive policies. This explains why the low results in Q1 do not necessarily reflect the expected profit goals for the full year.

Haxaco’s Chairman, Do Tien Dung, acknowledged the challenges in the first half of 2025 but maintained confidence in a recovery in the latter six months as the economy stabilizes.

TMT Motors expressed optimism about Q2, anticipating improvements with the implementation of a new salary mechanism, which will help reduce product costs and enhance profitability.

– 10:00 28/05/2025

“Novaland’s Receivables and Going Concern: SMC’s Response to the Audit Emphasis”

“Following the independent auditor’s report from Moore AISC, which included emphasis-of-matter paragraphs regarding trade receivables from the Novaland Group and going concern in the 2024 audited financial statements, CTCP Trade and Investment SMC (HOSE: SMC) submitted an explanatory letter to the Ho Chi Minh Stock Exchange (HOSE) on May 20, 2025. In the letter, the company also addressed its plan to rectify consecutive years of losses.”

“Binh Dien Fertilizer to Dish Out Nearly VND 143 Billion in Dividends to Shareholders”

“Binh Dien Fertilizer plans to spend over VND 142.9 billion on dividends for its shareholders for the fiscal year 2024, with a generous payout ratio of 25%. The record date for shareholders to be eligible for this dividend is set for June 12, 2025.”

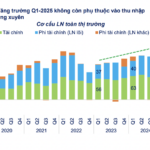

Enterprise Profits for Q1 2025: A Steady 12% Increase, Emphasizing Quality and Sustainability, Free from Reliance on Financial Income.

The net profit after tax for the whole market increased by 12% year-on-year, significantly lower than the average quarterly growth rate in 2024 (+20.5%/quarter). However, this growth reflects a more substantial and stable performance, as it is no longer heavily reliant on financial income contributions.