According to preliminary statistics from the General Department of Vietnam Customs, Vietnam’s corn imports in the first four months of 2025 surpassed 3 million tons, valued at nearly $775.17 million. This represents a decrease of 12.8% in volume and an 11% decline in value compared to the same period in 2024. The average price stood at $258.2/ton, indicating a slight increase of 2%.

Specifically, in April 2025, corn imports reached 872,052 tons, equivalent to $228.3 million. This reflects a significant increase of 31.8% in volume and 36% in value compared to April 2024, with a modest 3.1% rise in price.

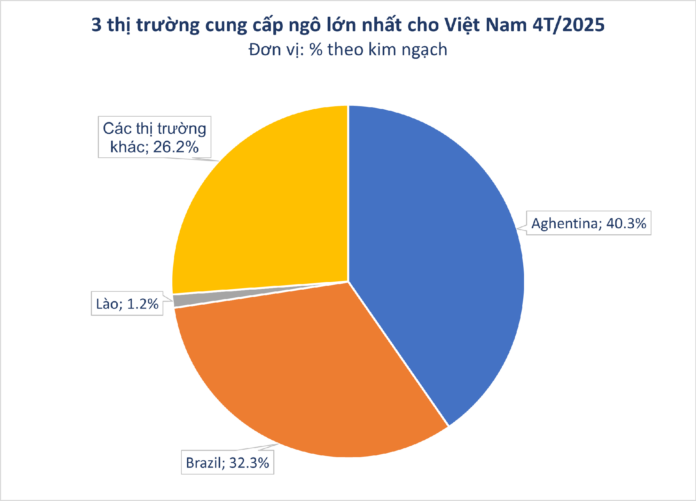

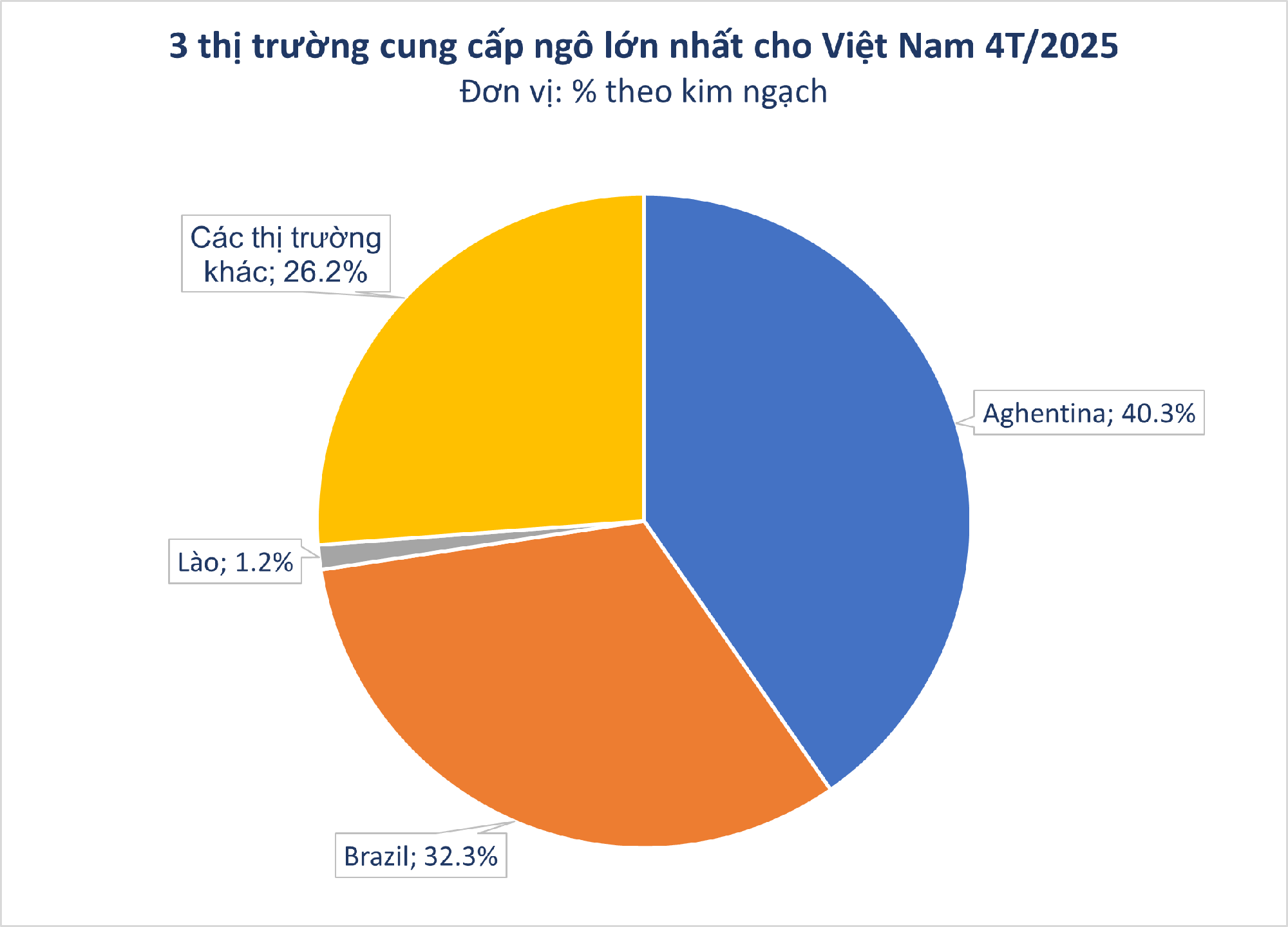

Argentina was Vietnam’s largest corn supplier in the first four months of 2025, accounting for 40.2% of the total volume and 40.3% of the country’s total corn import value. Vietnam imported 1.21 million tons of corn from Argentina, worth $312.73 million, a decrease of 7.1% in volume and 1.2% in value compared to the previous year.

Brazil, the second-largest market, supplied over 1 million tons of corn, valued at $250.17 million, in the same period. This signifies a substantial drop of 32.5% in volume and 34.5% in value compared to the first four months of 2024.

Notably, Laos has been one of Vietnam’s top three corn importers recently. Corn imports from this neighboring country in the first four months of 2025 amounted to 42,051 tons, valued at $9.46 million. The average import price decreased by 10.3% to $225/ton. Laos accounted for 1.4% of the total volume and 1.2% of the total value of Vietnam’s corn imports.

Vietnam is among the top 30 corn-producing countries globally, but it also ranks high in corn imports, following China, European countries, Mexico, Japan, South Korea, and Egypt.

The increase in Vietnam’s corn imports is driven by the high demand from the domestic livestock industry, particularly animal feed production, as domestic corn production falls short of meeting this demand.

Recently, China’s shift away from US agricultural products, especially corn, has benefited other buyers in Asia as cheap US supplies flood the market. According to the US Department of Agriculture (USDA), US corn exports to Japan in 2024-25 were 30% higher than the previous year, reaching 8.9 million tons as of May 15. Sales to Vietnam and Indonesia also surged after a period of no recorded imports.

The year 2025 is expected to witness significant shifts in the structure of US agricultural supply, with prices and trade policies becoming decisive factors in land allocation between the two main crops, corn and soybeans. Corn and soybeans are concurrently produced in the US and often compete for acreage during the growing season.

For some animal feed and livestock producers, South American corn is preferred due to its harder texture and lower dust content. However, US corn is currently more attractively priced. American corn is highly competitive in Southeast Asia, according to Caleb Wurth, regional director of the US Grains Council.

The Ultimate Guide to Vietnam’s Insatiable Appetite for Imports: How 30th in Global Planting Area Isn’t Enough

Despite having an abundance of arable land, Vietnam continues to import substantial quantities of agricultural produce annually.