Vietnam’s stock market witnessed a volatile session on May 28, with the ‘Vin’ family of stocks shining bright and leading the VN-Index higher for the fourth consecutive session.

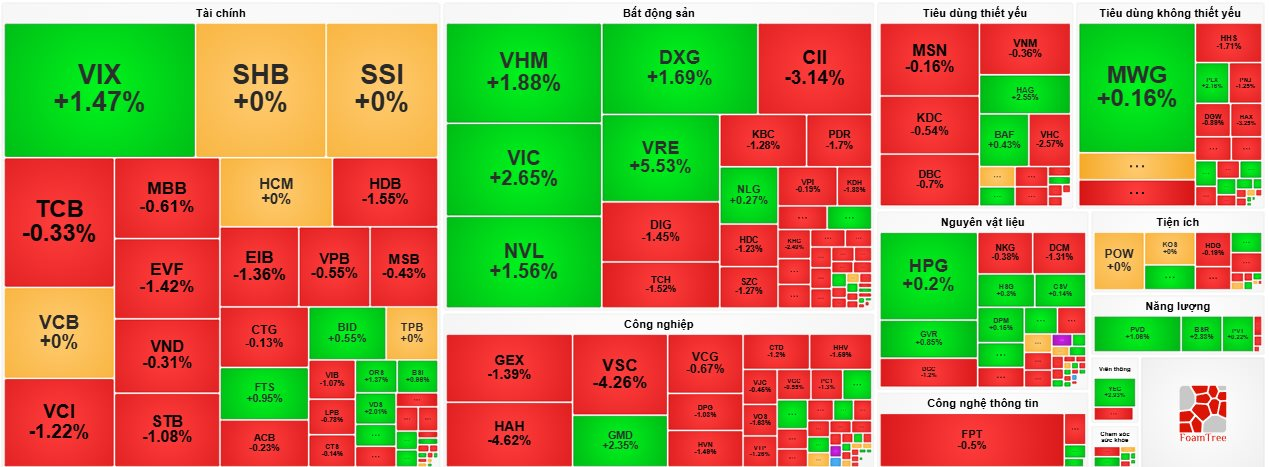

At the close of the trading day, shares of Vingroup, ticker VIC, rose by 2.65% to reach VND 97,000 per share, taking the lead in driving the main index upward. Following closely were two other Vin family stocks, VHM and VRE, which climbed by 1.88% and 5.53%, respectively.

Another Vin family stock, VPL, listed on the HoSE, also made a strong comeback, snapping a five-day losing streak. VPL shares closed 0.92% higher at VND 88,000 per share, bringing the company’s market capitalization to over VND 157,810 billion.

Positive signals about the companies’ financial performance in the 2024 fiscal year, coupled with encouraging first-quarter results, bolstered investor confidence in the recovery and growth potential of the Vingroup ecosystem, resulting in robust market demand.

VN-Index Extends Winning Streak to Four Days

The stock market experienced heightened volatility in the afternoon session of May 28 as short-term profit-taking intensified, resulting in a mixed market performance. The VN-Index managed to edge above the reference level, gaining slightly over two points before the market closed.

At the end of the trading day, the VN-Index climbed 2.06 points to reach 1,341.87. The HNX-Index rose 1.77 points to 223.56, while the UPCoM-Index gained 0.46 points to close at 98.60.

Market liquidity remained robust, albeit slightly lower than the previous session, with a combined trading value of nearly VND 24,900 billion (approximately USD 1 billion) across all three exchanges. On the HoSE alone, liquidity reached nearly VND 22,300 billion, a decrease of over VND 2,700 billion compared to the previous session.

Short-term profit-taking intensified, resulting in a mixed market performance on May 28.

Apart from the Vin family, energy stocks also stood out, with notable gainers including PVD (+1.06%), BSR (+2.83%), and PVT (+0.22%).

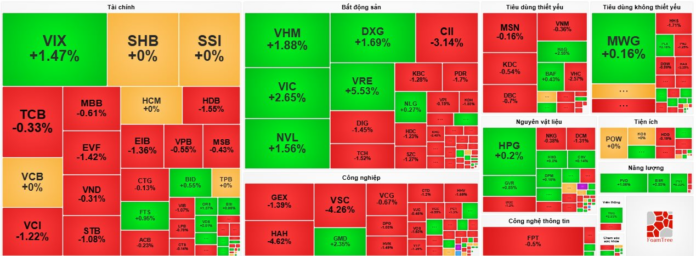

Additionally, several large-cap stocks witnessed strong upward momentum, such as VIX (+1.47%), NVL (+1.56%), DXG (+1.69%), GMD (+2.35%), HAG (+2.55%), and PLX (+2.16%).

On the flip side, key sectors were painted in red, including banking, transportation, construction, and manufacturing.

In the banking sector, several large-cap stocks witnessed significant declines, including HDB (-1.55%), STB (-1.08%), EIB (-1.36%), and VIB (-1.07%). This was followed by a slew of stocks that fell by less than 1%, including TCB, MBB, VPB, MSB, CTG, ACB, LPB, OCB, and NAB.

Transportation stocks also took a beating, with prominent losers including VSC (-4.26%), HAH (-4.62%), HVN (-1.49%), VOS (-1.63%), VTP (-1.26%), and VJC (-0.45%).

Similarly, construction stocks witnessed sharp declines, with GEX (-1.39%), DPG (-1.03%), CTD (-1.2%), PC1 (-1.3%), CTI (-1.44%), and DC4 (-2.55%) all trading in negative territory.

Large-cap stocks also faced heavy selling pressure, with notable losers including PDR (-1.7%), KBC (-1.28%), TCH (-1.52%), DIG (-1.45%), KDH (-1.83%), VHC (-2.57%), PNJ (-1.25%), GEE (-5.45%), DCM (-1.31%), and CTR (-1.37%).

Foreign investors maintained their net selling position on the HoSE for the fourth consecutive session, with a net sell value of nearly VND 200 billion.

Among the stocks, VCI faced the heaviest net selling, with a net sell value of VND 101.1 billion. This was followed by VNM (VND 82.29 billion), VCB (VND 62.39 billion), HAH (VND 60.13 billion), and SSI (VND 58.19 billion).

On the buying side, foreign investors showed strong interest in VHM, with a net buy value of VND 123.31 billion. This was followed by DXG (VND 79.47 billion), MWG (VND 63.12 billion), NLG (VND 49.19 billion), and GVR (VND 39.17 billion).

Foreign Sell-Off Surges: A Whopping 1.2 Trillion VND – Which Stocks Took the Biggest Hit?

The market witnessed a contrasting scenario, with FPT dominating the buying spree with a net buy value of VND 127 billion, while GMD also attracted robust net inflows, surpassing VND 100 billion.

“Defying the ‘Sell in May’ Adage, Bank Stocks Remain Attractive in May”

Contrary to the usual “Sell in May” sentiment that often makes investors hesitant, the Vietnamese stock market in May 2025 witnessed a positive performance from bank stocks. As the market leaders, bank tickers not only steered the VN-Index but also demonstrated enduring allure amid market fluctuations.