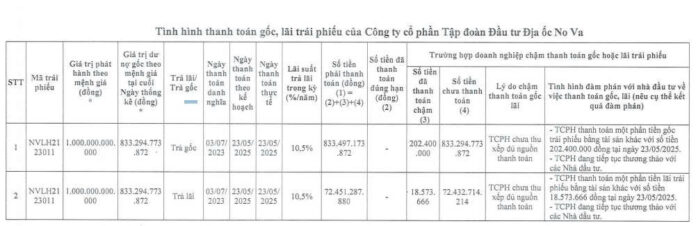

According to a recent announcement by the Hanoi Stock Exchange (HNX), Nova Real Estate Investment Group Joint Stock Company (Novaland, stock code: NVL, listed on HoSE) disclosed information regarding its bond principal and interest payments.

As per the schedule, on May 23, 2025, Novaland was due to make payments totaling nearly VND 906 billion in principal and interest for the bond code NVLH2123011. This included approximately VND 833.5 billion in principal and nearly VND 72.5 billion in bond interest.

However, due to a lack of financial resources, the company has only managed to pay nearly VND 221 million through alternative assets, leaving almost VND 905.8 billion in principal and interest unpaid.

Source: HNX

The company is currently in negotiations with investors regarding the delayed payment of the aforementioned bond debt.

It is understood that the bond code NVLH2123011 was issued by Novaland on September 1, 2021, with a total issuance value of VND 1,000 billion, a term of 2 years, and a maturity date of September 1, 2023.

The proceeds from this bond issuance were intended for capital contribution and investment cooperation in the development of the Phuoc Hung Island Urban Area project in Tam Phuoc Ward, Bien Hoa City, Dong Nai Province (commercially known as the Phoenix Island project) and other investment projects of Novaland.

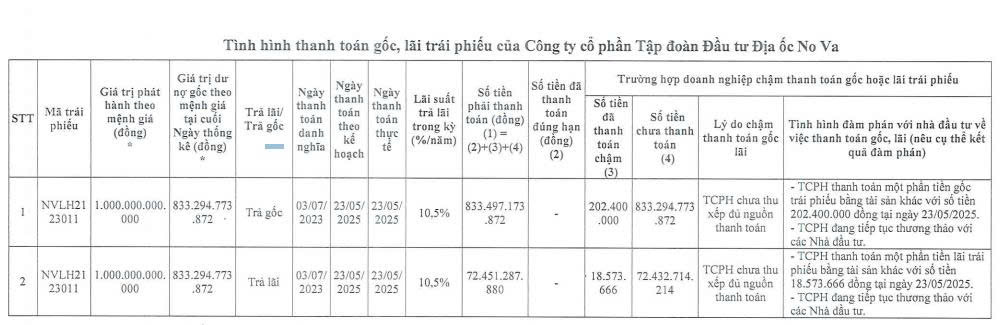

In a similar development, on May 18, 2025, Novaland also made a partial payment of nearly VND 6.8 billion out of a total of over VND 651.9 billion in principal for the bond code NVLH2123014, leaving more than VND 645.1 billion unpaid.

The bond code NVLH2123014 comprises 10 million bonds with a par value of VND 100,000 per bond, totaling VND 1,000 billion in issuance value. These bonds were issued on November 18, 2021, with an 18-month term and an expected maturity date of May 18, 2023.

In other news, Novaland recently notified the Vietnam Stock Exchange, HNX, and the Ho Chi Minh City Stock Exchange (HoSE) of changes in its personnel.

Consequently, Mr. Cao Tran Duy Nam, Novaland’s Deputy General Director, was appointed as the company’s legal representative (Deputy General Director) effective May 22, 2025.

In addition to Mr. Nam, Novaland has two other legal representatives: Mr. Bui Thanh Nhon, Chairman of the Board of Directors, and Mr. Duong Van Bac, General Director.

The Cash Flow “Ditches” Blue-Chips: Small-Cap Stocks Surge Ahead

The lackluster performance of leading large-cap stocks is weighing heavily on the VN-Index, while the broader market continues to show resilience. This marks a reversal from previous weeks, when the index was propelled by these very same stalwarts, but investors saw limited gains as most stocks lagged.