According to the announcement sent to the State Securities Commission and the Ho Chi Minh City Stock Exchange (HoSE), Vosco has received the resignations of Mr. Hoang Le Vuong – Member of the Board of Management, Mr. Phan Nhan Thao – Independent Member of the Board, and Mr. Bui Anh Thai – Member of the Supervisory Board.

In his resignation letter, Mr. Hoang Le Vuong stated that his decision to step down from his position as a Board member, effective April 18, 2025, was to take up a new role assigned by the Vietnam Maritime Corporation (VIMC) as their representative for state capital in another member company.

Mr. Bui Anh Thai also officially resigned on the same day, citing the need to focus on his work at VIMC and other assigned tasks.

As for Mr. Phan Nhan Thao, his resignation letter was addressed to the General Meeting of Shareholders and the Vosco Board of Directors, expressing his wish to step down from his position as an Independent Board member from April 18, 2025, onwards to focus on his professional work at the CB & DVHH and other assigned tasks.

In terms of business performance, Vosco reported a dismal first quarter of 2025, with a net loss of nearly VND 54 billion – the deepest loss since the first quarter of 2020 and the company’s third consecutive quarterly loss.

In the first three months of the year, Vosco’s revenue plummeted by 58% compared to the previous year, standing at VND 462 billion. This decline was mainly due to the absence of revenue from commodity trading activities, unlike in 2024. Meanwhile, the cost of goods sold amounted to VND 497 billion, surpassing revenue and resulting in a negative gross profit of VND 34.7 billion.

Financial expenses for the period also surged by nearly five times compared to the previous year, reaching VND 6.3 billion. This was a consequence of a 26% increase in total liabilities, amounting to VND 1,138 billion, which led to a higher debt-to-equity ratio.

Vosco attributed the challenging market conditions for dry cargo ships in the first quarter of 2025 to a significant drop in freight rates due to oversupply. The company assessed that this period was “worse than the initial COVID-19 outbreak,” severely impacting their business operations.

Despite facing these challenges, Vosco maintains ambitious business plans for 2025, targeting a revenue of VND 5,300 billion, a 12.1% decrease from the previous year. They anticipate a pre-tax profit of VND 376 billion, a 9.6% reduction. The company also intends to invest in and lease additional Supramax and Ultramax bulk carriers, MR product tankers, chemical tankers, and container ships to enhance their transport capacity and adapt to market fluctuations.

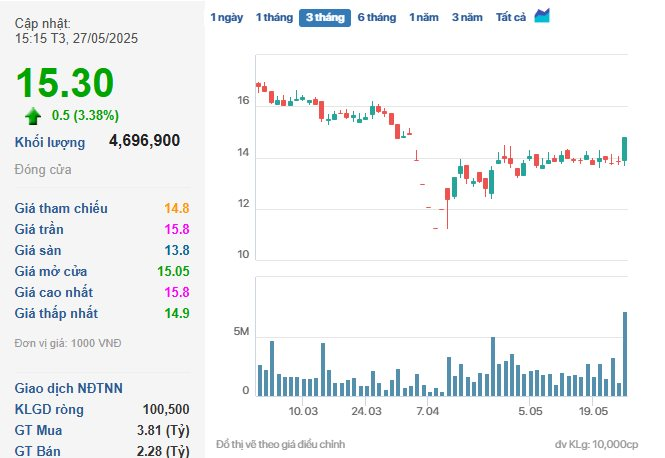

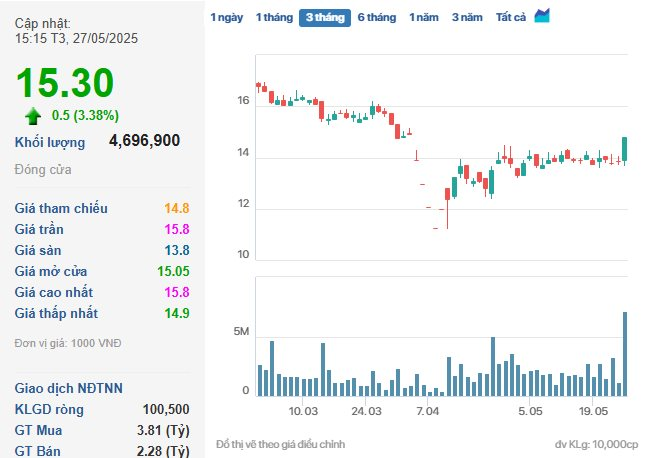

VOS shares soar in recent trading sessions. (Source: Cafef)

In the stock market, as of the closing bell on May 27, VOS shares were trading at VND 15,300 per share, a significant surge of 3.38% from the previous session, with a matched volume of nearly 4.7 million shares.

This marked the third consecutive gaining session for VOS, with its market price climbing nearly 11%, equivalent to an increase of VND 1,500 per share. Currently, Vosco’s market capitalization stands at VND 2,142 billion.

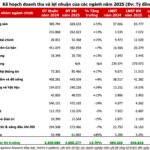

“Sifting Through Sand for Gold”: Unveiling the Industries Poised for a New Growth Cycle in 2025’s Business Plans

The market’s profit outlook for 2025 is positive, according to Agriseco, but there is a distinct divergence between industry sectors.

The Virtual Capital Distribution Company’s Complaint Rejected

The Supreme People’s Procuracy has officially rejected all complaints from Top One Distribution JSC (UPCoM: TOP), upholding the indictment of the company’s former leaders for fraud and embezzlement. The once-inflated enterprise, with a purported capital of over VND 250 billion, now faces a comprehensive crisis, with its stock stuck at VND 1,000 per share and trading allowed only once a week.

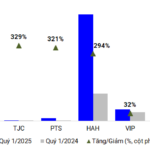

The Ocean Freight Industry: A Slow Start to Q1

The maritime transport industry witnessed a mixed performance in 2025, following two positive quarters in the latter half of 2024. While total revenues experienced a slight uptick, profits for many businesses took a hit due to extended Lunar New Year holidays, a weakened international market, and elevated repair and depreciation costs.