According to SMC, the consolidated financial statements for the year 2024, audited by an independent auditor, contained two emphasis of matter paragraphs. However, these did not constitute qualifications, and did not affect the truth and fairness of the financial statements.

Specifically, the first emphasis of matter relates to the accounts receivable from Novagroup Joint Stock Company (Novagroup) and its related companies. As of December 31, 2024, this receivable amounted to over VND 1,115 billion. On December 20, 2024, SMC and Novagroup signed a debt confirmation and commitment to repayment. However, as the reporting date coincided with the Lunar New Year holiday, supplementary documents such as contracts, valuation certificates, and internal documents were not fully completed.

By April 26, 2025, Nova Group and related parties had provided all the necessary documents related to the receivable. These included commercial sale and purchase contracts, debt set-off contracts, agreement letters, asset valuation certificates provided by an independent valuation unit, and internal approval documents as per the law and the company’s charter. Consequently, SMC reviewed the entire debt, determining the value of the secured assets to be nearly VND 730 billion, accounting for over 65% of the total receivables.

The reversal of provisions of VND 335.2 billion improved 2024 profits, in line with Vietnamese Accounting Standard No. 23 (VAS 23).

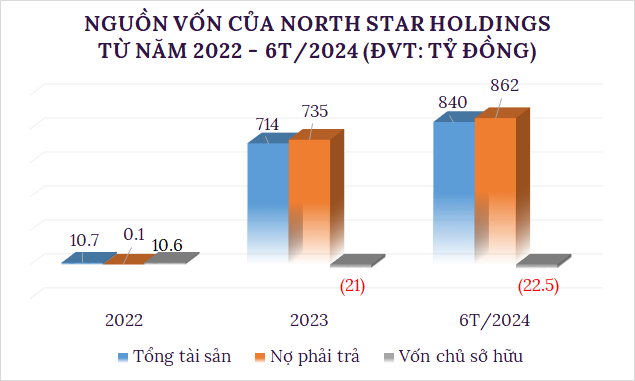

Additionally, the auditor expressed doubt about SMC’s ability to continue as a going concern due to its accumulated losses of VND 139,625 billion as of December 31, 2024, negative cash flow from operating activities of VND 508,075 billion, and current liabilities exceeding current assets by VND 622,624 billion. However, the company affirmed its compliance with the going concern assumption through measures such as streamlining its apparatus, disposing of inefficient assets, focusing on the Trading and Processing segments, and negotiating debt rescheduling to alleviate cash flow pressure.

Regarding addressing consecutive years of losses, SMC reported that its net profit for 2024 increased from VND 269,653 billion (according to the initial financial statements) to VND 65,573 billion after adjustments. This improvement was mainly due to the reversal of provisions for doubtful accounts (VND 335.2 billion) and the disposal of assets at the beginning of 2024, generating VND 303 billion from the sale of production lines and investments.

To stabilize operations, SMC is implementing comprehensive solutions: optimizing inventory through the disposal of stagnant raw materials, tightening credit management by negotiating early payment discounts for customers, reducing production costs by 10-15% through process improvements, and restructuring finances to definitively handle Novaland debt. In the first four months of 2025, the company partially disposed of the Sendo steel production line, transferred the Galvanizing line at the SMC Phu My Steel Plant, and maintained bank loans at optimal interest rates.

In terms of business performance, in the first quarter of 2025, SMC recorded net revenue of VND 1,847 billion, a 17% decrease compared to the same period last year. After expenses, the company reported an after-tax profit of VND 127 billion, a 29% decrease year-over-year. Nonetheless, this was a positive performance, as SMC had reported losses for the previous three quarters.

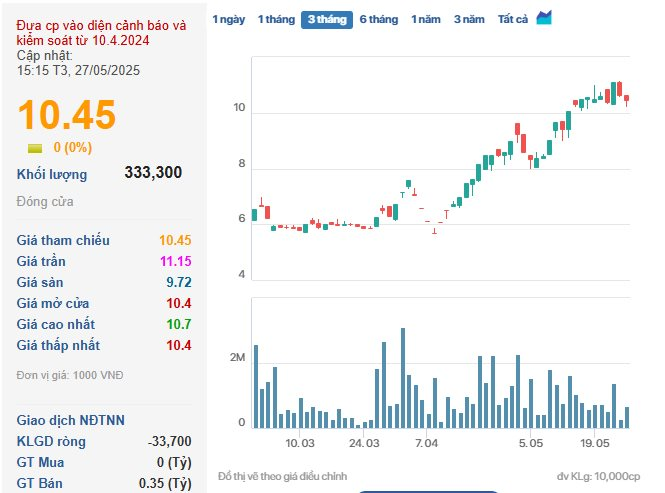

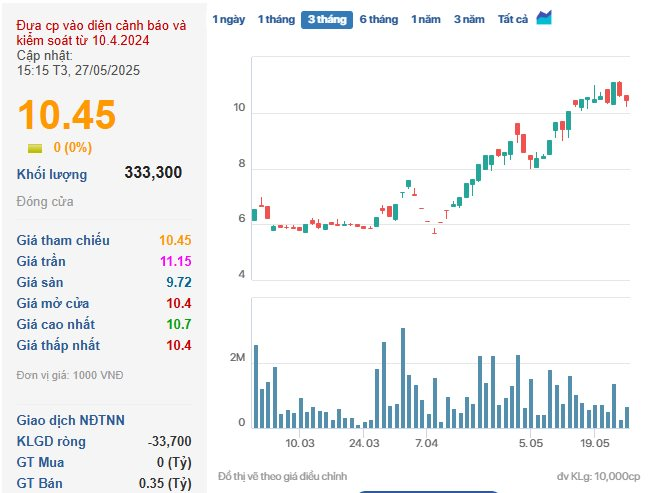

SMC share price increased by more than 75% in almost 2 months. (Source: Cafef)

In the stock market, as of the close on May 27, SMC shares traded at VND 10,450 per share, unchanged from the previous session, with a matched volume of 333,300 units.

Thanks to positive business results in the first quarter, SMC’s share price has soared by more than 75% since the beginning of April, increasing by about VND 4,540 per share. Currently, the company’s market capitalization stands at over VND 769 billion.

The Automotive Industry Stalls in Q1 Following the End of Registration Fee Incentives

The automotive industry witnessed a boost in the last quarter of 2024 due to a 50% reduction in registration fees. However, this momentum was short-lived as the first quarter of 2025 saw a decline in both vehicle sales and profits. While revenues increased year-over-year, profits took a hit, with only a select few businesses experiencing a turnaround through strategic restructuring.

“Novaland’s Receivables and Going Concern: SMC’s Response to the Audit Emphasis”

“Following the independent auditor’s report from Moore AISC, which included emphasis-of-matter paragraphs regarding trade receivables from the Novaland Group and going concern in the 2024 audited financial statements, CTCP Trade and Investment SMC (HOSE: SMC) submitted an explanatory letter to the Ho Chi Minh Stock Exchange (HOSE) on May 20, 2025. In the letter, the company also addressed its plan to rectify consecutive years of losses.”

“Searefico Plans to Sell Nearly 2 Million Treasury Shares to Boost Capital”

Searefico plans to sell 1.78 million treasury shares at a price no lower than VND 13,000 per share, expecting to raise a minimum of VND 23.14 billion. The sale is scheduled to take place in the fourth quarter of 2025.