Illustration

Oil Prices Slip

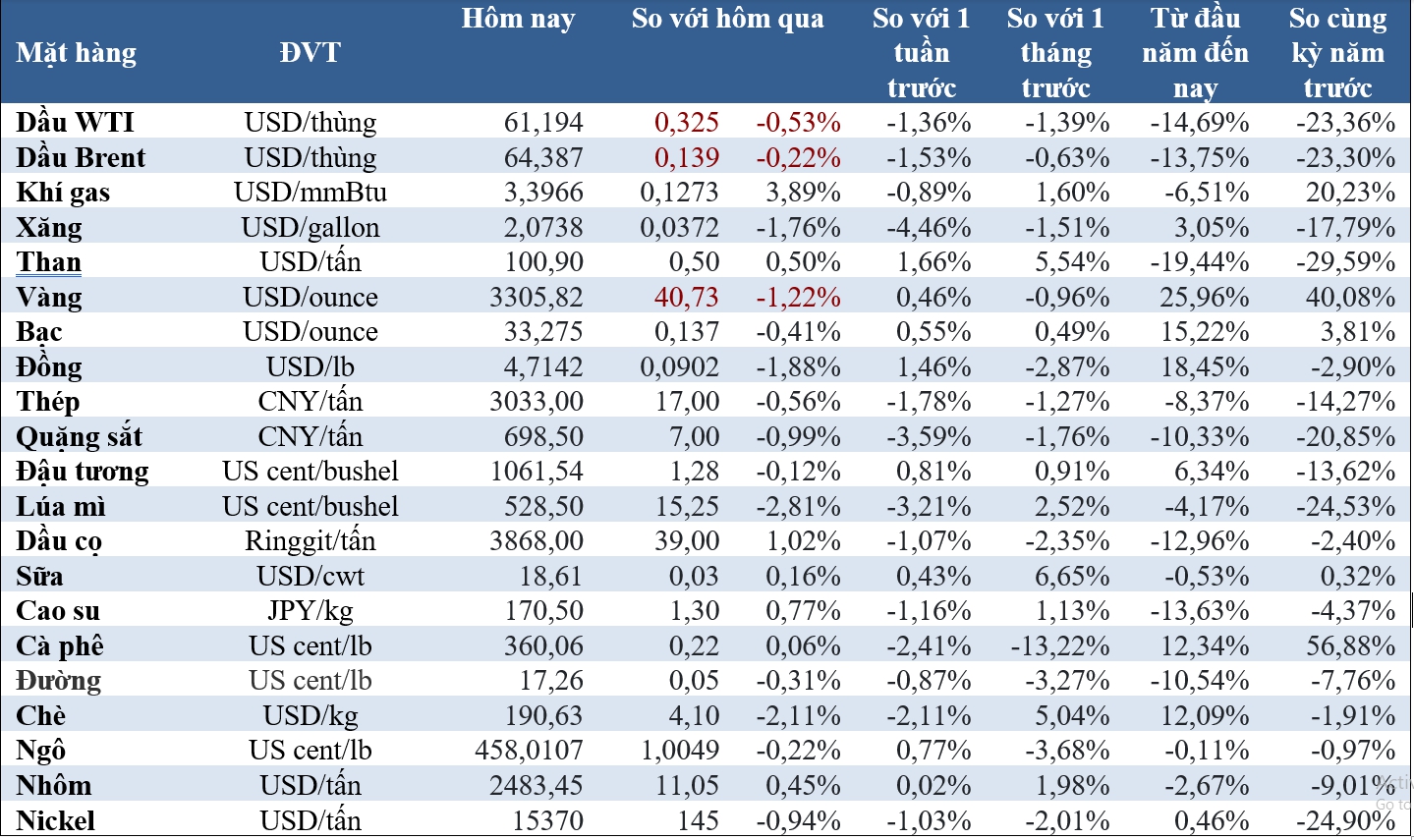

Oil prices slipped by 1% on Tuesday as investors fretted over potential supply glut amid progress in Iran-US talks and expectations that OPEC+ will boost output this week.

Brent crude oil futures settled down 65 cents, or 1%, at $64.09 a barrel, while U.S. West Texas Intermediate (WTI) crude fell 64 cents, or about 1.04%, to $60.89.

Markets expect the Organization of the Petroleum Exporting Countries and allies, known as OPEC+, to maintain their policy of gradual supply increases at a meeting on Wednesday. However, at another gathering on Saturday, they are likely to agree to boost output further in July.

Meanwhile, Iranian and American delegates ended their fifth round of indirect talks in Rome last week. While there were limited signs of progress, significant disagreements remain, notably over Iran’s uranium enrichment activities.

Gold Falls for a Second Straight Session

Gold prices fell for a second straight session as risk appetite improved after former U.S. President Donald Trump’s decision to delay tariffs on the European Union.

Spot gold fell 1.2% to $3,302.10 per ounce, after rising nearly 5% in the previous week.

U.S. gold futures for June 2025 delivery settled down 1.9% at $3,300.40.

A stronger U.S. dollar and gains in U.S. equity markets also weighed on gold. The dollar’s rise and a shift in investor sentiment back to riskier assets pressured the precious metal.

Iron Ore Extends Losses

Iron ore prices fell for a third straight session amid concerns about curbs on steel production in China, the world’s top consumer, against a backdrop of persistent oversupply.

The September iron ore contract on China’s Dalian Commodity Exchange ended the session down 1.76% at 698.5 yuan ($97.16) a ton.

The June 2025 iron ore futures on the Singapore Exchange fell 0.95% to $96.15 a ton.

On Tuesday, Tang Zujun, vice chairman of the China Iron and Steel Association, spoke at an industry event in Singapore, stating that China is working to curb the expansion of its steel industry to address the imbalance between supply and demand.

Copper Slides on Strong Dollar and Trade Concerns

Copper prices slipped on Tuesday, pressured by a stronger U.S. dollar and uncertainties surrounding U.S. tariffs. Three-month copper on the London Metal Exchange fell 0.2% to $9,595.50 per ton, after earlier touching its highest since May 14 at $9,640.

Copper futures for July delivery on the COMEX fell 2% to $4.74 per lb, widening the discount for the LME contract to $8.55 per ton.

The stronger dollar also weighed on the market, making dollar-denominated commodities more expensive for buyers using other currencies.

Cocoa Continues to Decline

Cocoa futures on the New York exchange fell for a fifth straight session, dropping $25, or 0.3%, to $9,739 per ton, while London cocoa fell 1.2% to £6,562 per ton.

However, cocoa arrivals at ports in Ivory Coast, the world’s top grower, remained sluggish amid concerns over the quality of mid-crop beans.

A total of 20,000 tons of cocoa arrived at Ivory Coast ports in the week to May 25, down from 32,000 tons in the same week last season.

Sugar Slips

Sugar prices slipped on expectations of rising supply and lack of new demand. Raw sugar fell 0.07 cents, or 0.4%, to 17.22 cents per lb. White sugar also declined by 0.2% to $482.60 per ton.

Wheat Falls on Improved Weather Conditions

Wheat futures on the Chicago Board of Trade fell for a third straight session as rains in the U.S. Plains improved moisture levels for crops, bolstering supply expectations.

Corn prices also declined, but losses were limited by a stronger dollar and favorable prospects in Brazil. Soybean prices rose after former President Donald Trump delayed tariffs on goods from the European Union.

Wheat futures for July delivery on the CBOT fell 14 cents to $5.28-1/2 per bushel. Soybean futures for July delivery rose 2-1/4 cents to $10.62-1/2 a bushel, while corn ended the session at $4.59-1/2 per bushel.

Analysts noted that raw sugar prices were losing momentum due to a lack of new demand and Brazil’s ongoing sugar production. They predicted that raw sugar prices could fall further to the range of 16.5-17.0 US cents.

Arabica Coffee Rises, Robusta Falls

Arabica coffee prices rose 0.7 cents, or 0.2%, to $3.617 per lb, while robusta coffee fell 2% to $4,696 per ton.

Rubber Prices Climb

Rubber prices on the Tokyo Commodity Exchange rose on Tuesday, supported by concerns over tight domestic supply amid relatively low inventory levels. A rebound in Shanghai futures and a weaker yen also provided a boost.

The November rubber contract on the Osaka Exchange rose 8.7 yen to 325.9 yen ($2.30)/kg.

The September rubber contract on the Shanghai Futures Exchange climbed 125 yuan to 14,495 yuan ($2,015) per ton.

Official data showed that China’s industrial profits accelerated in April, giving policymakers reason for optimism that recent stimulus efforts are supporting the economy despite trade tensions with the U.S.