The market witnessed a significant downturn in the afternoon session as bottom-fishing stocks from the volatile May 26 session settled into accounts. It wasn’t just the blue-chips’ weakness that pulled the VN-Index below reference at times, but the contracting breadth also indicated widespread losses.

On May 26, the VN-Index fell as much as 1.95% with hundreds of stocks losing 2-3% in value. This afternoon, profit-taking signals were evident as the breadth on the HoSE narrowed rapidly. While 158 stocks advanced and 128 declined at the morning close, by 2 pm, only 119 stocks were in the green against 201 in the red. At the HoSE closing bell, 133 stocks had gained while 184 had lost.

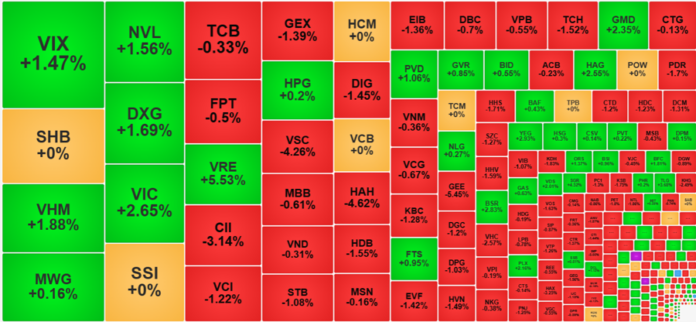

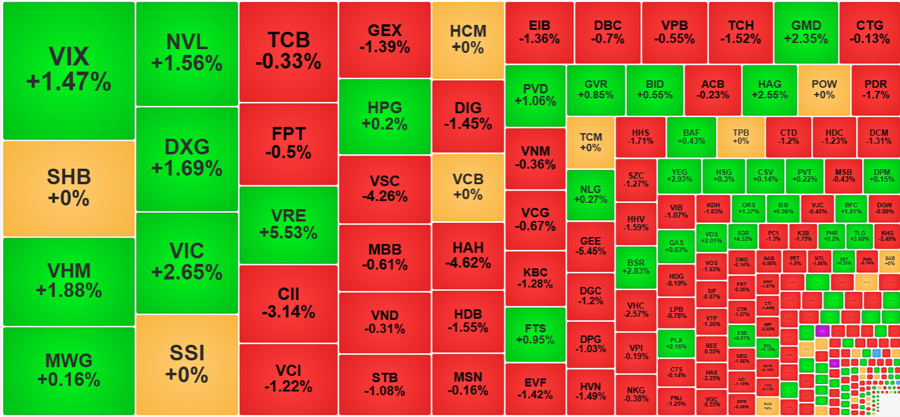

The stock price landscape was also much weaker compared to the morning session. While only 36 stocks had declined by over 1% in the morning, this number rose to 109 at the close. Although some large-cap stocks supported the VN-Index during the closing auction, helping it eke out a small gain of 2.06 points (+0.15%) over the reference price, the majority of stocks ended in negative territory. The index-heavyweight stocks couldn’t change the overall downward trend.

VHM played a crucial role in the VN-Index’s late recovery. In the last 15 minutes of continuous matching, the stock price rose from 74,600 VND to 76,100 VND, an increase of more than 2%, before retreating slightly in the closing auction but still closing above the reference price by 1.88%. While VIC didn’t fluctuate as much as VHM, it maintained a 2.65% gain. BID was also notable, turning around from -0.56% at the continuous auction close to end the day up 0.55%. In terms of market capitalization, BID currently ranks fourth, after VCB, VIC, and VHM. Other strong performers included VRE, which rose 5.53%, and VPL, which gained 0.92%. These four Vin stocks alone contributed over 4.6 points to the index.

The VN30 basket also benefited significantly from the aforementioned stocks, despite a breadth of only 10 gainers against 15 decliners. VIC alone contributed more than 4 points to the VN30-Index, which rose a total of 4.74 points. VHM also added over 2 points to the index.

The divergence among large-cap stocks is making it challenging for the VN-Index to sustain its upward momentum above the 1340 level. While the index reached a new intraday high of 1,436.99 points, it closed at 1,341.87 points. Although the closing price marked a new peak, the trading dynamics suggest that this wasn’t a breakout event. The market moved slowly, and the main index was propped up by heavyweight stocks. Moreover, today’s trading volume decreased by about 11% compared to yesterday.

The weakness in stock prices this afternoon is evident. Among the 109 stocks that declined by over 1% at the close, nearly 30 had high liquidity, exceeding 100 billion VND in trading value. This clearly indicates increased selling pressure, especially considering that the total trading volume on the HoSE in the afternoon session rose by nearly 19% compared to the morning, with a 20% increase in the VN30 basket.

Midcap stocks witnessed notable declines: CII fell 3.14% with a liquidity of 440.4 billion VND; GEX decreased by 1.39% with 403.5 billion VND; HAH dropped by 4.62% with 279.6 billion VND; GEE declined by 5.45% with 140.9 billion VND; HHS fell by 1.71% with 120.5 billion VND; and VHC decreased by 2.57% with 100.5 billion VND. Many stocks with liquidity in the range of several billion VND also posted losses of 1-2%.

On the upside, the resilience of the inflows is narrowing and concentrating on a few stocks. Most of the gainers today also witnessed intraday reversals. For instance, VIX, which closed with a gain of 1.47% and extremely high liquidity of 1,038 billion VND, had already reached its peak near the end of the morning session, surging by 4.41%. NVL, which rose 1.56%, had slipped by 2.25% from its 1:12 pm peak. PVD spent the entire afternoon in a downward spiral, ultimately losing 3.05% from its peak, ending the day with a modest gain of 1.06%. Stocks like GMD, HAG, BSR, YEG, PLX, ORS, and VDS also slid by over 1% from their morning highs. These were among the best-performing stocks in terms of liquidity and price action in the advancing group.

A small bright spot this afternoon was the foreign investors’ net buying, which turned positive at 238.4 billion VND after net selling of 422 billion VND in the morning. They reduced their selling by 28% and increased their buying by 33% compared to the morning session. The stocks that attracted net buying included VHM (+122.3 billion VND), DXG (+79.5 billion VND), NLG (+76.8 billion VND), MWG (+76.1 billion VND), GVR (+39.3 billion VND), VIC (+38.9 billion VND), CTG (+32 billion VND), and KBC (+30.4 billion VND). On the net selling side, VCI (-101.2 billion VND), VNM (-82.3 billion VND), VCB (-62.4 billion VND), HAH (-59.1 billion VND), SSI (-58.1 billion VND), PVD (-54 billion VND), VRE (-47.5 billion VND), STB (-47.2 billion VND), and SHB (-32.6 billion VND) stood out.

The Powerhouse Stocks Push VN-Index to New Heights, but Trading Volume Takes a Surprising Dip

The HoSE saw three of its top 10 large-cap stocks surge by over 1% this morning, providing a significant boost to the VN-Index, which climbed to 1345.86, a 0.45% increase. With this rise, the index has surpassed its 36-month peak witnessed in mid-March. However, the market enthusiasm was muted, with HoSE’s matching liquidity dropping by 18% compared to yesterday’s morning session.

The VN-Index Surges to a 3-Year High, but Many Investors’ Accounts are Yet to Reap the Benefits: Insights from VPBankS Experts

“There are still investment opportunities in various sectors and stock groups that were affected during the previous period, offering relatively safe valuation entry points,” the expert emphasized.

“Defying the ‘Sell in May’ Adage, Bank Stocks Remain Attractive in May”

Contrary to the usual “Sell in May” sentiment that often makes investors hesitant, the Vietnamese stock market in May 2025 witnessed a positive performance from bank stocks. As the market leaders, bank tickers not only steered the VN-Index but also demonstrated enduring allure amid market fluctuations.