According to a document published on May 27, businessman Doan Nguyen Duc (known as “Bau Duc”), as a major shareholder with over 30.26% of HAG‘s charter capital, has proposed a list of candidates for the new term of the Board of Management and Supervisory Board. Bau Duc has nominated himself to remain as Chairman of the Board of Management and has added current members Vo Truong Son, Vo Thi My Hanh, and Ho Thi Kim Chi to the team.

Notably absent from the list is current Board member Tran Van Dai, who has been replaced by Ho Kiet Tran. Ms. Tran is currently the Investment Director at CTCP Tu Van Dau Tu Huong Viet and also serves as a member of the Supervisory Board of CTCP Soi The Ky (HOSE: STK).

A notable development is the emergence of a group of large shareholders, including CTCP Tap doan Thaigroup (4.92%), LPBank Securities (LPBS, holding 4.73%), and an individual, Mr. Nguyen Phan Anh (1.82%). Together, this group holds 11.47% of HAG‘s charter capital, equivalent to over 121 million shares.

This group has nominated Vu Thanh Hue to the HAG Board of Management for the new term. Ms. Hue previously served as Chairman of the Board of LPBS from August to December 2023 and is currently the Vice Chairman of LPBS and Chairman of CTCP Bat dong san Thaihomes, a member of Thaigroup. She also holds a position as a member of the Board of Management of CTCP Du lich Kim Lien.

Ms. Vu Thanh Hue, nominated by the Thaigroup – LPBS group of shareholders for the HAG Board of Management for the term 2025-2030. Source: HAG

|

For the Supervisory Board, Bau Duc has nominated two candidates, including the current Head of the Supervisory Board, Do Tran Thuy Trang. The other nominee is Doan Nguyen Minh Hoa, who currently serves as Deputy Head of the Legal Department at HAG.

The Thaigroup and LPBS group has also nominated one candidate, Nguyen Tien Hung, who is a current member of the Supervisory Board.

Regarding the annual general meeting of shareholders for 2025, HAG‘s new resolution indicates a change in the meeting date from June 18 to June 6, citing the completion of preparations and the need to promptly approve the selection of the semi-annual financial statement audit firm for 2025.

The company has not yet disclosed its detailed business plan for 2025, but HAG‘s plan reveals a focus on fruit farming, particularly bananas and durians, in line with Vietnam’s Master Plan for Developing Key Fruit Trees by 2025 and 2030. The company aims to become Vietnam’s leading agricultural company by 2030, with a target scale of 30,000 hectares.

Bau Duc’s daughter failed to purchase 4 million HAG shares due to lack of funds

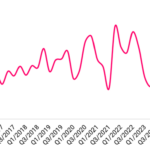

Updating on business performance, HAG experienced a significant decrease in 2024 compared to the previous year, with revenue reaching VND 5.8 trillion (-10%) and net profit of over VND 1 trillion (-39%). However, this marks the third consecutive year of net profits exceeding VND 1 trillion, a substantial improvement from previous years. HAG does not plan to pay dividends for 2025, likely due to accumulated losses of over VND 423 billion as of the end of 2024.

In the first quarter of 2025, HAG achieved nearly VND 1.38 trillion in net revenue, an 11% increase over the same period last year, mainly due to banana sales. With reduced expenses, net profit reached nearly VND 341 billion, a 59% increase year-on-year. Accumulated losses decreased significantly to only VND 83 billion.

| Positive results in recent years have enabled HAG to substantially reduce accumulated losses to VND 83 billion in the first quarter of 2025 |

– 1:56 PM, May 28, 2025

The Automotive Industry Stalls in Q1 Following the End of Registration Fee Incentives

The automotive industry witnessed a boost in the last quarter of 2024 due to a 50% reduction in registration fees. However, this momentum was short-lived as the first quarter of 2025 saw a decline in both vehicle sales and profits. While revenues increased year-over-year, profits took a hit, with only a select few businesses experiencing a turnaround through strategic restructuring.

The Ambitious Plans of Century Yarn’s Leadership: Aiming to Acquire 7 Million STK Shares

Mrs. Dang My Linh, Vice Chairwoman of Soi The Ky, has demonstrated her confidence in the company’s prospects by registering to purchase 7 million STK shares. This move will increase her ownership stake to 21.72%, underscoring her strong belief in the company’s future growth and potential.

“THACO Proposes High-Speed Rail Investment for North-South Corridor, Envisioning a 7-Year Construction Timeline”

“Vietnam’s leading automotive manufacturer, Truong Hai Auto Corporation (THACO), has expressed its interest in investing in the country’s high-speed North-South railway project. In a recent proposal to Prime Minister Pham Minh Chinh, THACO has showcased its ambition to diversify its portfolio and contribute to the nation’s infrastructure development.”