VN-Index Continues Positive Trend, Led by Vingroup’s Strong Performance

The VN-Index maintained its positive trajectory after reaching a 3-year peak, largely driven by the strong performance of the Vingroup conglomerate. However, the momentum showed signs of slowing down towards the end of the trading day. At the close of May 28, the VN-Index posted a modest gain of 2.06 points, settling at 1,341.87.

While trading volume fell slightly from the previous session, the HoSE still witnessed robust activity with a matching value of approximately VND 20,880 billion.

Foreign investors’ trading remained a downside, with a net sell position of nearly VND 209 billion for the day.

On the HoSE, foreign investors net sold approximately VND 198 billion

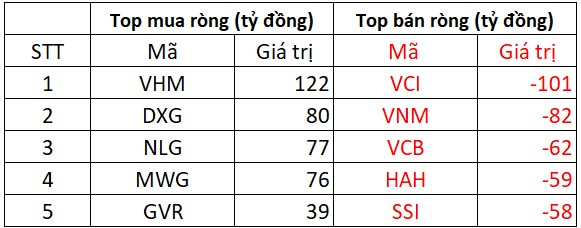

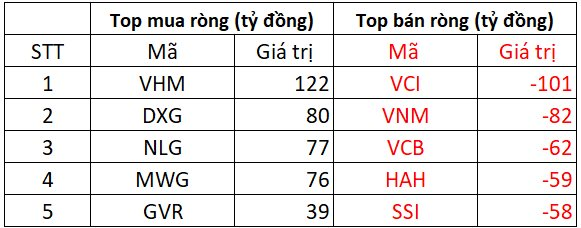

In the selling session, VCI witnessed the largest net sell-off by foreign investors, amounting to VND 101 billion. Other notable stocks that experienced significant net selling pressure included VNM (-VND 82 billion), VCB (-VND 62 billion), HAH (-VND 59 billion), and SSI (-VND 58 billion).

Conversely, VHM attracted strong buying interest from foreign investors, resulting in a net buy value of VND 122 billion. DXG also witnessed robust net buying, amounting to VND 80 billion. Additionally, NLG, MWG, and GVR enjoyed net buying positions ranging from VND 39 billion to VND 77 billion.

HoSE: Foreign Investors’ Net Buying and Selling on May 28, 2025

On the HNX, foreign investors net bought nearly VND 25 billion

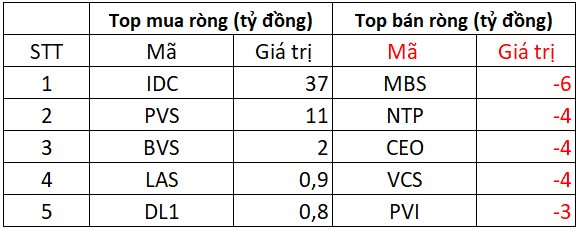

In terms of net buying on the HNX, IDC witnessed robust demand from foreign investors, resulting in a net buy value of VND 37 billion. PVS also attracted net buying interest, amounting to VND 11 billion. Additionally, BVS, LAS, and DL1 experienced net buying positions, albeit at lower levels.

On the selling side, MBS faced the highest net selling pressure, amounting to VND 6 billion. NTP, CEO, and VCS experienced similar net selling pressure of around VND 4 billion each, while PVI witnessed a net sell-off of VND 3 billion.

HNX: Foreign Investors’ Net Buying and Selling on May 28, 2025

On the UPCOM, foreign investors net sold approximately VND 36 billion

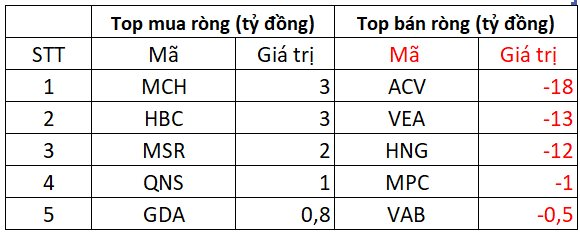

In terms of net buying on the UPCOM, MCH and HBC attracted buying interest, resulting in net buy values of VND 3 billion each. MSR and QNS also witnessed net buying positions of around VND 1-2 billion each.

Conversely, ACV, VEA, and HNG faced net selling pressure, with net sell values of VND 18 billion, VND 13 billion, and VND 12 billion, respectively. MPC experienced a minor net sell-off of VND 1 billion, while the impact of net selling in VAB was negligible.

UPCOM: Foreign Investors’ Net Buying and Selling on May 28, 2025

Profits Pressure Mounts, Blue-Chip Stocks Keep Index in the Green

The market took a significant turn for the worse in the afternoon session as bottom-fishing stocks from the volatile May 26 session flowed into accounts. It wasn’t just the weakness in blue-chips that pushed the VN-Index below reference levels; the contraction in breadth also indicated a widespread decline in stock prices.

Foreign Sell-Off Surges: A Whopping 1.2 Trillion VND – Which Stocks Took the Biggest Hit?

The market witnessed a contrasting scenario, with FPT dominating the buying spree with a net buy value of VND 127 billion, while GMD also attracted robust net inflows, surpassing VND 100 billion.

‘The Privileged Few’: A Tale of Stock Market Privilege

Mr. Nguyen Trong Minh, the son of former Ha Do Group’s Chairman, Nguyen Trong Thong, is planning to purchase 4 million HDG shares, amounting to over a hundred billion VND. Meanwhile, Mr. Le Viet Hieu, the son of Le Viet Hai – the Chairman of Hoa Binh Construction Group – will be investing approximately 3 billion VND to acquire 500,000 HBC shares.