Vietnam’s Private Sector: Unlocking Economic Growth and Investor Opportunities

Resolution 68-NQ/TW, issued by the Central Executive Committee, marks a pivotal moment as it clearly identifies the private sector as one of the most important drivers of the economy. This resolution is expected to boost private enterprises, especially in their access to medium and long-term capital.

Expanding Investment Opportunities

Experts agree that institutional reform is the fastest, most effective, and cost-efficient way to support businesses. The resolution will particularly benefit multi-industry corporations such as Vingroup, Masan, Viettel, Hoa Phat, Gelex, and Geleximco in terms of technological innovation and product development incentives.

As a result, investment prospects for the second half of 2025 are looking brighter, especially for companies capable of translating policies into tangible outcomes. Additionally, the focus on capital mobilization through the stock market will enable private enterprises to reduce their reliance on bank credit and attract international capital by expanding IPOs.

This lays a crucial foundation for Vietnam to advance toward its goal of upgrading its stock market by 2025.

Catalyzing a New Wave of Stock Investment

According to BIDV Securities Corporation’s (BSC) Q2/2025 industry report, over 30 listed companies are poised to benefit from both stimulus packages and long-term institutional reforms. These companies can be categorized into four groups:

First, the public investment and infrastructure group: This includes companies such as Hoa Phat (HPG), Coteccons (CTD), Vinaconex (VCG), and Deo Ca (HHV), which will be the primary beneficiaries as suppliers of materials and contractors for key infrastructure projects.

Meanwhile, real estate giants like Vinhomes (VHM), Vingroup (VIC), and Dat Xanh (DXG) can capitalize on the growing demand for satellite towns and social housing along newly developed highways, airports, and seaports.

Second, the oil and gas and energy group: With the resumption of key projects like Lot B-O Mon and LNG-powered electricity, companies such as PTSC (PVS), PV GAS (GAS), and PV Coating (PVB) will benefit from increased construction, electrical, and gas transportation activities starting in the second half of 2025.

Third, the aviation and retail group: This group is expected to benefit from the recovery in consumer spending and new visa policies. Vietnam Airlines (HVN), Vietjet (VJC), ACV, FPT Retail (FRT), The Gioi Di Dong (MWG), Masan (MSN), and Vincom Retail (VRE) are leading the way in this regard.

Fourth, the banking group: Recognized as the backbone of the economy and the primary channel for capital flow, leading commercial banks such as BIDV (BID), Vietcombank (VCB), VietinBank (CTG), Techcombank (TCB), MBBank (MBB), HDBank (HDB), VPBank (VPB), and ACB are well-positioned with their large customer base, technological capabilities, and ability to extend preferential credit to small businesses, households, and consumers.

Additionally, agribusinesses and food producers are benefiting from lower-cost imports of US raw materials. Companies like Dabaco (DBC) and BAF are experiencing reduced input costs. Similarly, energy companies such as GAS, POW, and NT2 are profiting from stable LNG supplies, resulting in lower operating costs.

Addressing Bottlenecks for Smoother Implementation

While policies to develop the private sector have been swiftly introduced, their implementation faces challenges. Businesses have identified the following bottlenecks:

+ Complex and lengthy administrative procedures that result in time and cost inefficiencies.

+ Difficulties in accessing land and credit, especially at the local level, where central policies may not be fully or consistently applied.

+ Inconsistent policy interpretation and application across different government agencies.

+ The sandbox regulatory framework for innovative startups is still novel and lacks specific implementation guidelines, hindering their access to capital. Access to capital remains a significant challenge for both small and large enterprises embarking on large-scale projects.

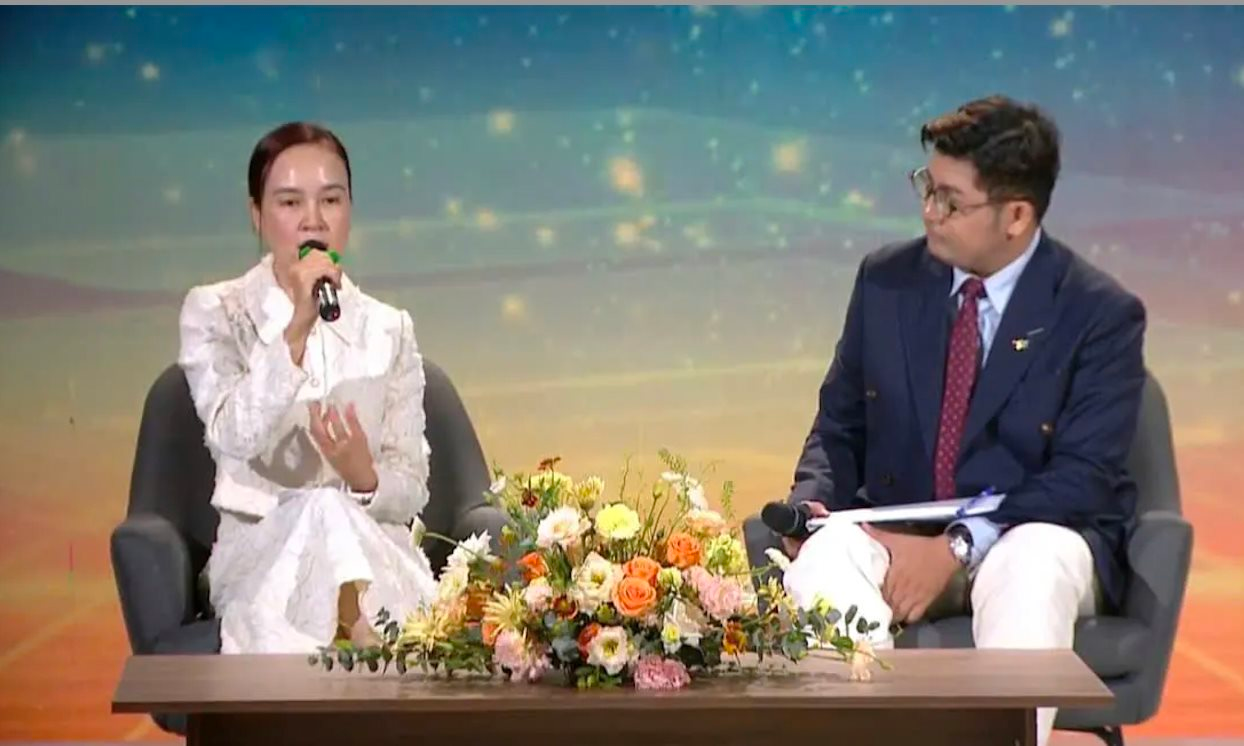

Ms. Nguyen Thanh Huong, Investment Director, Nam Long Group

Speaking at a recent VTV-hosted discussion on “Unblocking Institutional Barriers – Unleashing Private Sector Resources,” Ms. Nguyen Thanh Huong, Investment Director of Nam Long Group, shared that Resolution 68 has energized and boosted the confidence of the private business community.

“This is a significant step forward, enabling businesses to engage with international partners with greater confidence,”

she added.

However, she also acknowledged the challenges posed by the suspension of multiple real estate projects over the past 3–4 years, which has hindered the inflow of foreign investment. Nonetheless, international partners remain keen on investing in Vietnam and are open to long-term commitments.

Grand Way Nam Cường Kick-off Ceremony: Igniting the City of Nam Dinh – Birthing Prosperity

Over 500 business warriors from three of the most prestigious distributors in Northern Vietnam – Dat Xanh Mien Bac, AHS, and BHS – convened for the Nam Cuong Grand Way project’s kick-off ceremony. This event, hosted by the Nam Cuong Group, took place on the morning of May 29, 2025, at the Nam Cuong Hotel in Nam Dinh City.

“Riding the Wave of Investment: Hai Duong’s Real Estate Renaissance”

Amidst the restructuring of administrative boundaries, Hai Duong is undergoing a powerful transformation from a small provincial town to a new northern industrial super-province. Anticipating the trend of urban mergers and upgrades, the influx of investment in this region is creating a new wave in the real estate market.

AEON Locks in Investment for a Mega Shopping Center in the Mekong Delta: Over 20,000 sqm, Set to Open in 2026

AEON makes its debut in Tien Giang province with a massive 20,000 sqm shopping center, slated to open in Q4 2026. This exciting development marks AEON’s first venture into the province, and the company has wasted no time in getting started, having already acquired part of the project from the Tay Bac Group.