On May 28, Mr. Nguyen Hoang Minh, Vice President of Dia Oc Saigon 5, a leading real estate development company in Ho Chi Minh City, expressed his dismay as he led us to the construction site of the Binh Dang Commercial Services and Apartment project in District 8. The project has been stalled for nearly six years due to administrative hurdles, and despite efforts, it remains unresolved.

According to Mr. Minh, the company initiated the project’s investment procedures before its privatization in September 2016. The project received its construction permit and commenced in January 2018, but work had to halt after completing the foundation, basement, and ground floor in July 2019 due to legal entanglements.

The initial obstacle arose from the change in the project’s legal entity as the company transitioned from a state-owned enterprise to a joint-stock company, encountering challenges during privatization, enterprise valuation, and land price appraisal. Consequently, the new name change from an LLC to a joint-stock company was not updated, leading to the project’s suspension.

An aerial view of the stalled project

Over the years, the company has tirelessly worked to resolve the issue, and in June 2024, the Ho Chi Minh City People’s Committee directed the relevant departments to address the legal entity update. The company rejoiced, believing that the project could finally restart. The city’s leadership, including Vice Chairman Bui Xuan Cuong, emphasized the importance of promptly resolving the company’s challenges and preventing further losses of state capital.

However, when the company submitted the application for the second phase of the construction permit, the Department of Construction demanded an updated 1/2000 planning approval from the District 8 People’s Committee. Simultaneously, the company was instructed to contact the Department of Planning and Investment (now the Department of Finance) to adjust the project’s investment approval decision due to a two-year time limit for project implementation, whereas the project had already been delayed for six years.

Despite the company’s efforts, the relevant departments have only provided back-and-forth guidance without offering concrete and definitive solutions.

Mr. Minh emphasized that since the end of 2024, the People’s Committee has sent four dispatches requesting the departments and the District 8 People’s Committee to address the project’s hurdles, but for unknown reasons, the issue remains unresolved.

“Dia Oc Saigon 5 has a 30-year history and a track record of successfully developing multiple projects. Unfortunately, this single procedural obstacle has pushed us to the brink of financial ruin. Over 50% of our staff have left, and we pay over VND 1 billion in bank interest each month. To make matters worse, we have received notifications from our banks that if our financial situation does not improve, the project risks being classified as non-performing, resulting in significant opportunity costs and state capital losses,” shared Mr. Minh.

Dia Oc Saigon 5’s leadership expressed their dismay over the unresolved obstacles.

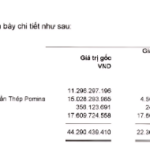

Dia Oc Saigon 5, a subsidiary of the Saigon Real Estate Corporation, is a state-owned enterprise with the state holding 99.78% of its charter capital, equivalent to over VND 362 billion.

The Binh Dang Commercial, Service and Residential Area project boasts a prime location, fronting four roads, with the main road being National Highway 50 in the center of District 8. The project initially had a total investment capital of nearly VND 600 billion and was designed to comprise 276 apartments.

To date, the company has invested approximately VND 260 billion in the project, including bank loans, for the foundation and related works. However, due to the unresolved legal entanglements, the project remains stagnant.

High-Speed North-South Rail: Aiming for $22 Billion Revenue from Land and Advertising

According to experts, the key to enhancing land value along the North-South high-speed railway lies in embracing the Transit-Oriented Development (TOD) model. This approach focuses on creating urban areas that prioritize public transportation, with the potential to generate an estimated $22 billion in revenue from land development and commercial exploitation along the high-speed rail corridor.

The Nissan Crisis: Facing a $1.7 Billion Payment Next Year and a Historic Debt, with Major Headwinds from China

Nissan has experienced a notable decline in sales and profits in recent times, but is the situation as dire as the automaker’s leadership has admitted?