Gold prices dropped significantly this morning (May 29) after a US federal court ruling rejected President Donald Trump’s tariff plans. Earlier, the precious metal had lost the key $3,300/oz mark during Wednesday’s trading session (May 28)

At 8:40 am Vietnam time, gold spot prices in the Asian market fell by $33.7/oz compared to the previous session’s close, equivalent to a drop of over 1%, to $3,254.7/oz, according to data from Kitco Exchange. Converted at Vietcombank’s selling rate, this price is equivalent to about VND 102.3 million/troy ounce, a decrease of VND 1.5 million/troy ounce compared to yesterday morning.

At the same time, Vietcombank quoted the USD at VND 25,780 (buy) and VND 26,170 (sell), an increase of VND 70 at both ends compared to the previous day.

In the New York session last night, gold prices closed at $3,288.4/oz, down $13.6/oz from the previous session’s close, equivalent to a drop of 0.4%.

Gold futures prices on COMEX fell 0.2% to close at $3,294.9/oz.

The direct cause of the sharp drop in gold prices in the Asian session this morning was the news about legal obstacles to Trump’s tariff plans.

On April 28, a US federal court ruled against President Donald Trump’s tariffs, saying Trump’s imposition of tariffs on all countries and territories with trade surpluses with the US exceeded his authority. The ruling also called for the tariffs to be “cancelled and the implementation of these tariffs to be permanently suspended.”

Trump’s tariff policies have been a major reason for the increased demand for safe-haven assets globally this year. Therefore, the blocking of Trump’s tariff plans by the US court is boosting investors’ risk appetite, leading to a decrease in demand for safe-haven assets such as gold.

US stock index futures turned positive after the ruling was announced, with the Dow Jones futures up as much as 500 points. The US dollar also strengthened against safe-haven currencies such as the Japanese yen, Swiss franc, and euro.

However, analysts believe that it is too early to conclude the fate of the tariff plans, and in an uncertain economic environment, gold will continue to be a preferred safe-haven investment.

On Wednesday, the US Federal Reserve (Fed) released the minutes of its May meeting. The minutes showed that policymakers believed the Fed should maintain a cautious monetary policy stance during a highly uncertain economic period. The Fed also mentioned the risk of “stagflation,” which could encourage investors to increase their gold holdings.

“The gold market has been fluctuating recently, mainly reacting to daily news without a clear price trend,” said senior analyst Jim Wyckoff of Kitco Metals.

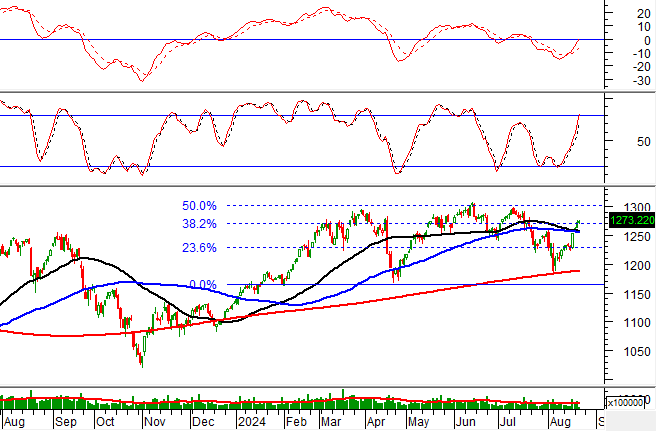

So far this year, gold prices have risen 26% and hit an all-time high of over $3,500/oz in April. On May 28, Goldman Sachs recommended a higher-than-normal allocation to gold in long-term investment portfolios, based on factors including increased US credit risk, pressure on the Fed, and continued net gold purchases by central banks.

The US dollar continued its recovery last night and this morning, after falling to a one-month low earlier this week. The dollar index closed at 99.88 on Wednesday, up from 99.5 in the previous session. This morning, the index touched nearly 100.3 – according to data from MarketWatch.

The world’s largest gold ETF, SPDR Gold Trust, bought a net 3.1 tons of gold in Wednesday’s session, raising its holdings to 925.6 tons – according to data from the fund’s website.

Gold, Oil, Rubber, and Iron Ore Markets: A Day of Declines

The commodities market witnessed a broad-based decline with gold prices dipping for the second straight session, iron ore and wheat slipping for the third consecutive session, and cacao falling for the fifth session in a row. This downward trend comes on the back of the US tariff reprieve for EU goods and a stronger US dollar.

“Market Update: Oil Prices Hold Steady, Gold Drops Nearly 1%”

The commodities market was subdued as the US and UK observed public holidays. On the close of trading for May 26, oil prices held firm, metals gained, while gold fell nearly 1%, and iron ore on the Dalian exchange hit a two-week low.

Expert Take: Stock-Picking Opportunities Wane as Cash Takes a Cautious Stance Ahead of Trade Talks Outcome

Let me know if you would like me to make any changes or modifications to this title.

The divergence among stocks may become more pronounced this week, as the lack of fresh supportive news may lead to a further distinction between strong and weak stocks. With limited positive catalysts, the ability to identify robust stocks becomes increasingly crucial, and cautious capital deployment is expected.