The Department of Construction has announced that, upon review, the investor has not provided documentation from the competent state agency confirming that the Company has fulfilled its financial obligations regarding land use fees for the project.

In a communiqué issued on December 31, 2020, the People’s Committee of the city approved in principle the investment project for the high-rise area belonging to the residential area project in Thanh My Loi ward, with a timeline of 3.5 years from the date of issuance of the document approving the investment proposal. However, up to now, the Company has not provided documents from state agencies approving adjustments, extensions of schedules, and project implementation periods.

In addition, the investor has also not provided documents from the bank agreeing to perform the procedures related to the guarantee of the investor’s financial obligations to the home buyers in case the houses are not handed over as committed.

Therefore, the Department of Construction requested Thai Binh Company to provide the above-related documents to complete the dossier within 30 days.

The project is located on Dong Van Cong Street, Thanh My Loi Ward, Thu Duc City, Ho Chi Minh City.

|

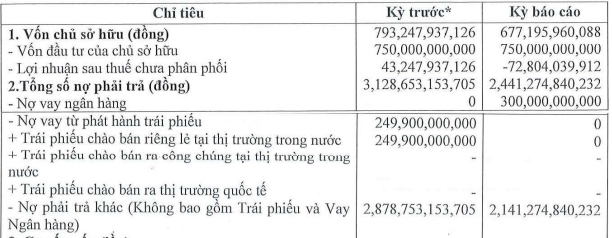

It is known that Thai Binh Company has a charter capital of VND 750 billion and is currently a subsidiary owned by Novaland (HOSE: NVL) with a holding rate of 99.95%. In December 2019, NVL’s Board of Directors approved the guarantee for the bond issuance of Thai Binh Company with a maximum bond value of VND 500 billion. In 2019 and 2021, Thai Binh raised two bond lots valued at VND 500 billion and VND 300 billion, respectively. According to HNX records, neither of these two lots is still in circulation. By the end of 2024, the Company had no more bond debt.

|

Thai Binh Company’s payables as of the end of 2024

Source: HNX

|

According to NVL’s report, Thai Binh Company is developing the Victoria Village project in Thu Duc, with an area equal to the above project. The product lines include townhouses, villas, apartments, and shophouses. The project started in Q2/2017, and NVL reported that the low-rise area had been handed over since Q3/2019 and the land-use right certificates had been granted in 2024. The high-rise area comprises four 25-story towers, one basement, and 1,044 apartments, expected to be handed over from Q1/2026.

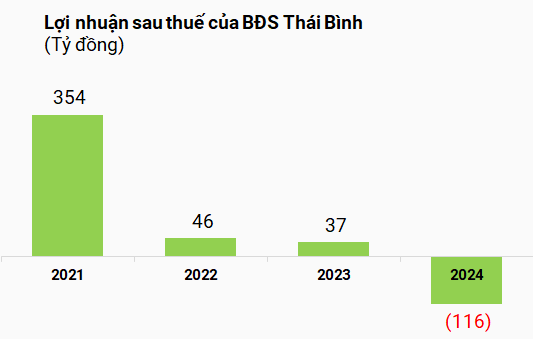

The business results for the period of 2021-2024 show that 2021 was the year with the highest profit, reaching VND 354 billion, while 2024 was the year with the sharpest drop, with a loss of VND 116 billion.

Compiled by the author

|

Thu Minh

– 12:16 30/05/2025

NewGen Invest – Strategic Distributor of Vinhomes Green City & Vinhomes Southern Region

NewGen Invest, a leading real estate investment firm, has reached new heights with its pivotal role in the distribution of Vinhomes Grand Park, an iconic development in the heart of Ho Chi Minh City’s vibrant eastern district. Now, the company has been entrusted yet again by Vinhomes as a strategic distributor for their newest project, Vinhomes Green City. This testament to NewGen Invest’s expertise and standing in the industry showcases their ability to consistently deliver exceptional results.

“Provincial Land Prices are on the Rise: Investors Eye the Market”

The land plots priced at 30-35 million VND per square meter in the vicinity of Ho Chi Minh City, such as Can Giuoc, Duc Hoa, Ben Luc in Long An, and Long Thanh in Dong Nai, are becoming scarce. Compared to the same period last year, land prices have surged by 10-25%, depending on the lot and location. The primary supply entering the market is currently very limited.

“Novaland Guarantees $73 Million Loan for its Subsidiary”

Novaland leverages an array of real estate assets to secure a substantial loan of 1.75 trillion VND for its subsidiary, Nova Riverside. This strategic move showcases the group’s financial prowess and highlights the value of their diverse property portfolio.