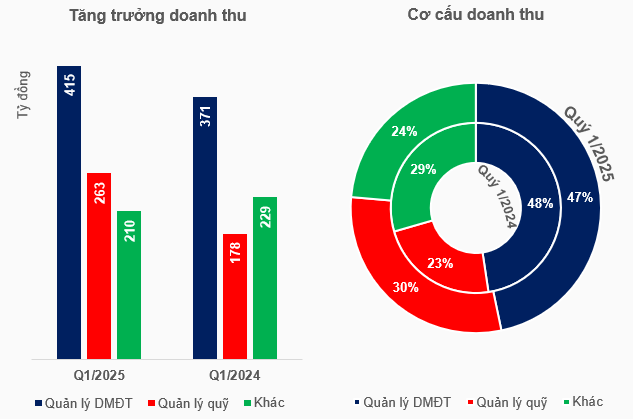

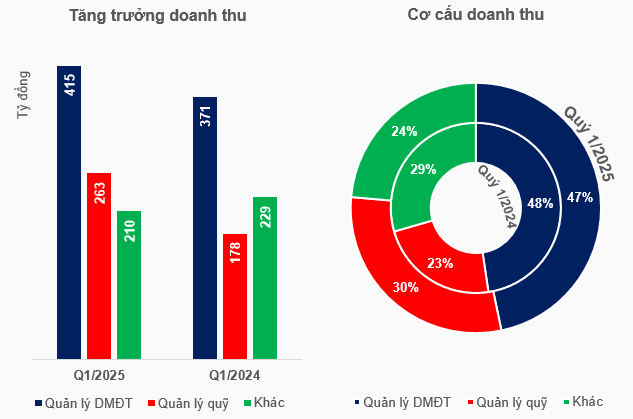

Strong growth in fund management and investment advisory revenue

In Q1 2025, the fund management industry generated over VND 887 billion in revenue, a 14% increase from the previous year. Investment portfolio management (investment trust) accounted for the highest proportion of revenue at 47%, despite a slight decrease from 48% in Q1 2024. Fund management contributed 30%, a significant increase from 23%, while other sources (investment consulting, performance bonuses, fund repurchase fees, etc.) made up the remaining 24%, down from 29%.

The two core areas of investment portfolio management and fund management both showed robust growth, with increases of 12% and 48%, respectively, reaching a scale of over VND 414 billion and over VND 263 billion. Meanwhile, revenue from other activities amounted to nearly VND 210 billion, a 9% decrease.

With investment portfolio management being the highest-proportion segment, revenue growth is understandable given the 3% year-on-year expansion in the scale of investment trust portfolios to over VND 600 trillion, 61 times the total assets.

Source: Consolidated by the author

|

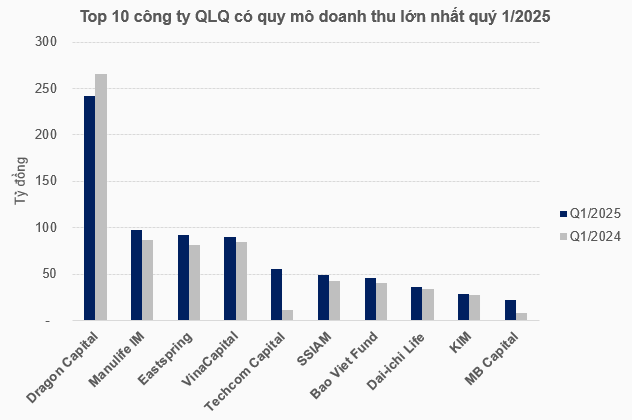

Dragon Capital, despite a 9% decrease in revenue compared to the previous year due to a decline in its dominant business segment, investment consulting, remained the industry leader with over VND 241 billion in revenue. Following Dragon Capital were Manulife IM with nearly VND 98 billion, Eastspring Investments with over VND 92 billion, and VinaCapital with nearly VND 90 billion.

Backed by large insurance companies, Manulife IM and Eastspring Investments’ revenues primarily came from investment trusts, accounting for 96% and 87% of their total revenue, respectively. The fund industry also noted similar business models, such as Bao Viet Fund at 93%, Chubb Life at 95%, and Dai-ichi Life at 99%. These fund management companies leverage the abundant capital from their insurance affiliates to invest in low-risk assets like government bonds and deposit certificates.

Another highlight in the top 10 by revenue scale was the presence of newcomer Techcom Capital, which achieved a remarkable 400% growth rate, reaching nearly VND 56 billion, driven by its fund management business. Notably, Q1 2024 was also Techcom Capital’s lowest revenue quarter, marking the beginning of a strong recovery.

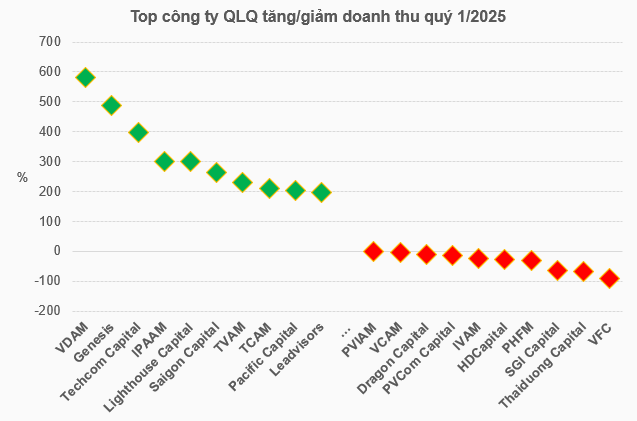

Techcom Capital’s impressive growth propelled it into the leading group in terms of revenue growth compared to the previous year. Overall, 14 companies achieved triple-digit revenue growth rates, with VDAM leading at 582%, out of a total of 32 companies that posted positive revenue growth.

On the other hand, the fund industry recorded a smaller number of companies experiencing revenue declines, with 11 in total, led by Viet Cat (VFC) with a 91% drop.

Source: Consolidated by the author

|

Source: Consolidated by the author

|

Slimmer profits; “chaebol”-backed firms drive profit growth

After expenses, the fund management industry’s net profit was nearly VND 328 billion, a modest 2% increase year-on-year. Additionally, the net profit margin decreased from 41% to 37%.

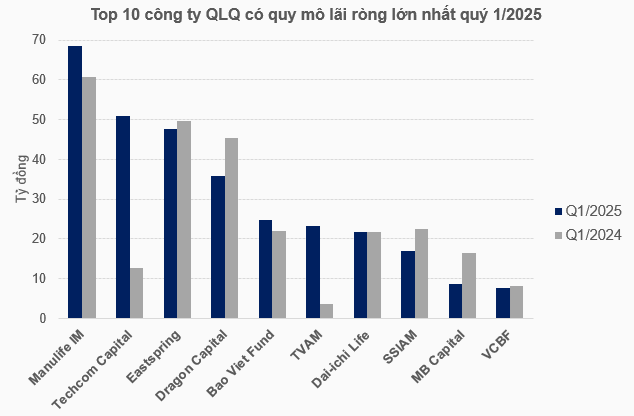

Eight companies had net profits in the tens of billions of VND. Half of them were backed by insurance companies, including Manulife IM with nearly VND 69 billion, Eastspring Investments with nearly VND 48 billion, Bao Viet Fund with nearly VND 25 billion, and Dai-ichi Life with nearly VND 22 billion. The remaining four were Techcom Capital with nearly VND 51 billion, Dragon Capital with nearly VND 36 billion, Thien Viet (TVAM) with over VND 23 billion, and SSIAM with over VND 17 billion.

Among these eight companies, TVAM stood out with the most impressive net profit growth in the industry, increasing by 6.3 times year-on-year, driven by revenue from investment portfolio management fees. TVAM’s financial activities were also notable, as they significantly streamlined their scale. These significant changes in TVAM’s consolidated financial statements resulted from a divestment transaction and the exclusion of data from Finsight JSC.

Together, these eight companies accounted for over VND 290 billion in net profits, equivalent to 88% of the industry’s total net profit. Within this group, five companies posted net profit growth compared to the previous year. Therefore, despite the majority of companies experiencing net profit declines or losses, the overall industry still managed a slight increase.

Source: Consolidated by the author

|

Over half of fund management companies face profit challenges

Although total revenue and profits increased, most fund management companies faced profit challenges, with either declining net profits or net losses in Q1.

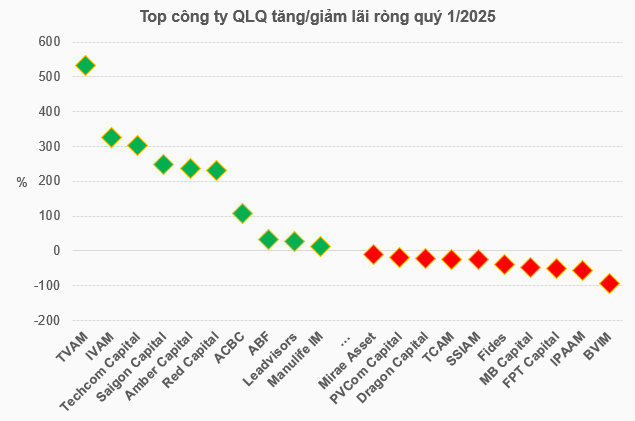

Leading the list of companies with declining profits was BVIM, with a 95% drop, resulting in a net profit of just under VND 30 million. This was followed by several larger companies, including SSIAM, with a 24% decrease to over VND 17 billion, Dragon Capital with a 21% drop to nearly VND 36 billion, and Mirae Asset (Vietnam) with a 10% decline to over VND 1.8 billion.

For SSIAM, financial income from bond interest was one-fifth of the previous year’s figure, while expenses related to agents distributing fund certificates and investment portfolio management increased by 33% due to enhanced sales efforts.

Dragon Capital’s profit decline resulted from decreasing revenue in investment consulting and the absence of investment financial gains.

For Mirae Asset (Vietnam), financial activities were the main reason for the profit decline, as they experienced a significant decrease in deposit interest income and no financial asset sales profits, specifically in stocks.

Source: Consolidated by the author

|

The industry recorded 14 companies suffering net losses, up from 10 in Q1 2024. VietCapital (VCAM) incurred the heaviest loss of over VND 4.7 billion. Additionally, several prominent companies shifted from profits in the previous year to losses in the current period, including UOBAMVN and VinaCapital.

UOBAMVN’s net profit turned into a nearly VND 4.3 billion loss despite a 19% increase in revenue. This was due to a 95% drop in financial income from the absence of fund certificate sales, coupled with a 7% increase in management expenses.

Despite VinaCapital’s revenue growth, a significant increase in agent commission expenses led to a net loss.

Thus, out of the 43 fund management companies in the statistics, more than half faced profit challenges. Various factors contributed to these results, mainly the decline in financial investment performance or the decision to increase expenses to expand operations.

Huy Khai

– 08:04 29/05/2025

The Timber Industry’s First Quarter Profit Squeeze

Revenue maintained its growth trajectory after a challenging period, but listed timber companies witnessed a freefall in profits during the first quarter of the year. Soaring costs are creating a stark divide in the industry.

“Thaigroup and LPBS Nominate Members for HAGL’s Board of Directors”

The Hoang Anh Gia Lai Joint Stock Company (HOSE: HAG) has unveiled its slate of nominees for the Board of Directors and Supervisory Board for the upcoming term (2025-2030), to be elected at the forthcoming 2025 Annual General Meeting of Shareholders. Notably, alongside current members, the nomination list features several candidates from the large shareholder group holding 121 million HAG shares.

The Long Chau Chain Accelerates with a “Breath-Taking” Pace: Averaging One New Store Opening Per Day Since the Start of the Year

As of the end of 2024, Long Chau’s network of pharmacies and vaccination centers boasted an impressive 2,069 stores. Fast forward to the present, and that number has skyrocketed to an astonishing 2,251, reflecting a substantial expansion of 182 additional stores.