Industrial Real Estate Prices Inch Up

According to JLL Vietnam data for Q1 2025, the Southern market introduced a new industrial park in Long An, expanding the limited land supply in major industrial hubs. With this addition, Ba Ria-Vung Tau and Long An provinces continued to lead in absorption rates, reaching 52ha and 42ha respectively, accounting for 80% of the region’s total absorbed area for the quarter.

The average industrial land lease price in the South increased slightly by 1% from the previous quarter to 182 USD/m2/lease term. In the medium term (2025-2029), the growth rate is expected to be 3-4%/year, lower than the previous period due to the development wave shifting to more peripheral areas.

Meanwhile, the Northern market recorded no new projects, maintaining a stable total supply of 12,628ha. However, the occupancy rate improved to 80% due to the absence of new supply and continued absorption of vacant areas from the previous quarter.

Lease prices in this region also increased slightly by 2% to 134.7 USD/m2/lease term, driven by Hai Phong and Hai Duong. In the next five years, lease prices in the North are expected to grow by 4-6%/year but may be influenced by US tax policies and geopolitical fluctuations.

Binh Duong leads in built-factory supply

The built-factory segment witnessed balanced growth in both the South and North. In the South, a new project in Loc An – Binh Son Industrial Park (Dong Nai) in the first quarter increased the total supply to 5.5 million m2, a nearly 16% increase over the same period last year.

Market sentiment remained stable with a positive net absorption of approximately 274,000m2. Binh Duong led the demand, focusing on Thu Dau Mot and Bau Bang. This performance contributed to an overall occupancy rate of over 87%. The average lease price in the South was 4.9 USD/m2/month, a 2% increase over the same period.

The North also recorded robust growth with over 65,000m2 of new built factories in Q1, bringing the total supply to 3.4 million m2. Net absorption reached approximately 94,000m2, and the occupancy rate increased to 89%.

The average lease price was 5.04 USD/m2/month, slightly higher than in the South, reflecting a 1% increase over the same period last year. This demand came from tenants in industries such as auto parts manufacturing, sports equipment, healthcare, mechanical accessories, and sanitary ware production, with businesses originating from countries like China, Taiwan, Hong Kong, and Japan.

In the next nine months, the North is expected to add nearly 1 million m2 of new built-factory area, intensifying competition and prompting investors to adopt flexible pricing strategies and tenant support policies.

The North Adds Nearly 1.2 Million m2 of New Built-Warehouse Space by the End of 2025

The built-warehouse market continues to expand in both regions, with a trend towards quality upgrades to meet modern storage standards.

In the South, BWID commissioned nearly 19,000m2 of two-story warehouses in Dong An 1 Industrial Park (Binh Duong), increasing the total supply to 2 million m2. However, leasing activities remained subdued, with net absorption of only about 88,000m2. The lease price was 4.9 USD/m2/month, a slight increase due to the persistent but unremarkable demand.

The North witnessed more vibrant developments with nearly 67,000m2 of new supply in Hung Yen and Bac Ninh, notably the DPL Vietnam Minh Quang project by WHA Group in collaboration with Daiwa House; this pushed the total supply past 1.3 million m2.

Net absorption exceeded 51,500m2, a 24% increase from the previous quarter, mainly from logistics and manufacturing tenants. The average lease price in the North was 4.7 USD/m2/month, a slight increase attributed to the entrance of new projects.

By the end of 2025, the North is projected to add nearly 1.2 million m2 of new built-warehouse space, bringing the total supply to almost 2.5 million m2, nearly twice the current supply.

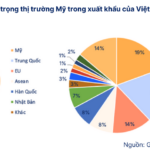

Trang Le, Senior Director of Advisory and Research at JLL Vietnam, commented that while the new US countervailing duties have disrupted the international business landscape, the long-term impact is not yet fully apparent. As a market heavily reliant on exports to the US, Vietnam is expected to face some short-term impacts. However, the long-term outlook remains positive but cautious, supported by recovering manufacturing activities and Vietnam’s strategic position in the global supply chain.

– 14:06 29/05/2025

What’s Behind the Surge in Seafood, Textile, and Construction Stocks?

Plunging in the morning session only to surge in the afternoon, the textile, seafood, port, and industrial park stocks witnessed a rare simultaneous surge.

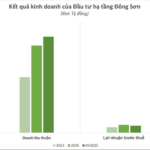

East Mountain Infrastructure Plans for 2025 Revenue of Approximately VND 700 Billion, Wins Billion-Dollar Transportation Contract in Hanoi

In 2025, Dong Son Infrastructure Investment remains committed to the timely execution of its ongoing five projects, honoring its pledges to investors. The company actively seeks out investment opportunities in industrial real estate and social housing projects, reinforcing its position in the market.

“US Tariffs Threaten FDI Appeal: Is Industrial Real Estate at Risk?”

The recent announcement of tariffs by the US, imposing up to 46% on exports from Vietnam, presents a significant challenge for various economic sectors, particularly industrial real estate. This industry has traditionally thrived on foreign direct investment and the demand for expanded production capabilities.