Bancassurance bounces back

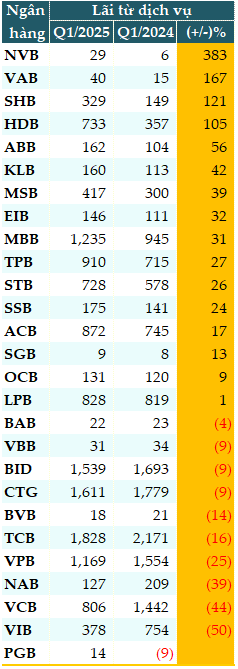

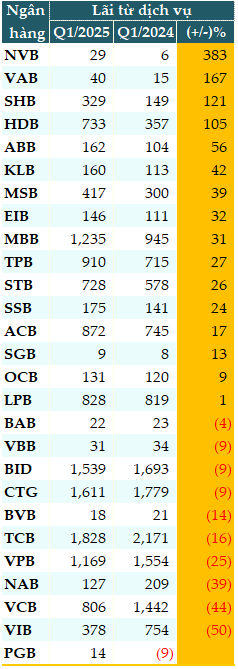

Data from VietstockFinance reveals that, in Q1 2025, service revenue at 17 out of 27 banks increased year-over-year.

Notably, NCB (NVB) witnessed the highest growth (4.8x), followed by VietABank (VAB, 2.7x), SHB (2.2x), and HDBank (HDB, 2x)…

In absolute terms, Techcombank (TCB) led with VND 1,828 billion in service revenue, followed by VietinBank (CTG) at VND 1,611 billion, BIDV at VND 1,539 billion, MB (MBB) at VND 1,235 billion, and VPBank (VPB) at VND 1,169 billion.

|

Q1 2025 Service Revenue for Banks (in VND billion)

Source: VietstockFinance

|

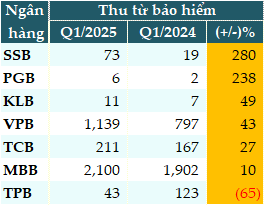

Within the service revenue structure, income from insurance sales and consulting typically accounts for a significant proportion. Disclosures from banks with notes to financial statements also indicate a noticeable recovery in insurance revenue.

For instance, at SeABank (SSB), insurance revenue reached VND 73 billion in Q1, a 3.8x increase year-over-year, while PGBank (PGB) recorded a more modest VND 6 billion, but still a 3.4x rise.

MB reported VND 2,100 billion in revenue from insurance sales and consulting, up 10% year-over-year; VPB generated VND 1,139 billion from this segment, a 43% increase; and TCB earned VND 211 billion, a 27% jump.

|

Q1 2025 Insurance Revenue for Banks (in VND billion)

Source: VietstockFinance

|

Is the insurance market making a comeback?

Assoc. Prof. Dr. Nguyen Huu Huan, Senior Lecturer at the University of Economics Ho Chi Minh City, explains that while banks no longer force customers to purchase insurance as they did in the past, cross-selling insurance (bancassurance) remains an actively promoted practice. Even though it’s not labeled as coercion, certain constraints are still imposed on customers when they take out loans.

For instance, with auto loans, borrowers are often required to purchase auto insurance from a bank-designated provider, leaving them with limited choice.

This policy has contributed to the revenue growth and the revival of the insurance market within the bancassurance model. However, it’s crucial to ensure that these insurance products genuinely meet customers’ needs and avoid any sense of coercion or unnecessary pressure.

Mr. Nguyen Quang Huy, CEO of the Faculty of Finance and Banking at Nguyen Trai University, analyzes that the rebound in bancassurance sales reflects initial recovery, but it’s premature to label it as sustainable. The underlying reasons for this growth could be attributed to restructuring the advisory team, enhancing sales process transparency, shifting from “hard-selling” to “value-based advising,” or regaining customer trust through improved product and service quality following the 2023-2024 crisis.

However, insurance demand has not witnessed a robust recovery yet, as the market sentiment remains cautious. The Ministry of Finance’s tighter legal framework contributes to market health but also slows down the recovery pace.

Therefore, while bancassurance is undoubtedly on an upward trajectory, it’s not yet at a stage of sustainable growth. We need to observe for another 2-3 quarters to confirm if this trend stabilizes.

Economist Tran Nguyen Dan assesses that the previous improper implementation of bancassurance by banks, which prompted regulatory intervention and revenue decline, does not guarantee that the current revenue increase signifies a genuine recovery.

In the past, digital banking witnessed robust growth, particularly in the sale of investment-linked products like UL (unit-linked) and ILP (investment-linked policy). However, subsequent regulations prohibited the sale of these investment-linked products to borrowers, which was unreasonable as individuals seeking loans typically lack stable financial resources and should not be compelled to invest further.

When banks could no longer offer investment-linked products, insurance companies swiftly adapted by introducing hybrid or endowment insurance plans that were already part of their portfolios.

Concurrently, both the State Bank and the Ministry of Finance instituted stringent regulations prohibiting coercing customers into purchasing insurance, especially borrowers. As a result, bancassurance revenue experienced a noticeable decline during this period.

Regarding the rebound in bancassurance sales in Q1 2025, Mr. Dan presents two possible scenarios.

In a positive scenario, banks have rectified their advisory processes, enhanced their service quality, and successfully matched their offerings to customers’ actual needs. Additionally, insurance companies have introduced products that align with market demands, making them easier to sell. This is the desired scenario for all stakeholders.

However, in a negative scenario that warrants further investigation, banks might still be coercing customers to purchase insurance but have adopted more subtle tactics to circumvent regulations. For example, the insurance contract signer might not be the borrower but a relative, thereby decoupling the loan and insurance contracts and helping the bank evade penalties.

The critical question is whether banks have genuinely improved their advisory services or merely shifted to a new method of evading regulations. To answer this, independent surveys, random customer interviews, or in-depth investigations are necessary to uncover the truth.

“Given the current economic challenges and financial constraints faced by individuals, stagnant incomes, and sluggish exports, the ability to pay for insurance is significantly impacted. Retaining existing policyholders and ensuring their renewals is already a challenging task, let alone attracting new customers.

Therefore, concluding a market recovery based solely on rising bancassurance revenue may be premature. A true recovery can only be declared when both the agency channel and the bancassurance channel exhibit concurrent growth. The current situation, where the agency channel is declining while bancassurance surges, deviates from the norm and warrants further analysis.” Mr. Dan added.

– 08:02 30/05/2025

Prudential Vietnam and HSBC Vietnam: Forging a Dynamic Bancassurance Alliance

Prudential Vietnam and HSBC Vietnam are proud to announce a strategic bancassurance partnership, combining their expertise to offer tailored financial solutions for the country’s burgeoning affluent market. This collaboration marks a significant step forward in providing comprehensive and innovative financial services to Vietnam’s high-net-worth individuals and families.

“Exclusive Benefits: Over $750,000 in Perks for Sacombank’s Insurance Customers.”

“To enhance the benefits for customers who purchase Dai-ichi Life Vietnam insurance policies distributed through Sacombank, from now until December 31, 2024, Sacombank is allocating over VND 17 billion to introduce a range of promotional programs under the theme “When Life is a Journey.” These promotions include attractive cashbacks, fee waivers, and gifts of 24k SBJ gold.”

A Life Insurance Company Loses Nearly $250 Million

FWD Life Insurance Company Limited (FWD Vietnam) has released its financial report for the six-month accounting period ending June 30, 2024.

“Sacombank Offers Over VND 17 Billion in Exclusive Benefits to Its Insurance Customers.”

“To enhance the benefits for customers who have purchased Dai-ichi Life Vietnam insurance policies distributed through Sacombank, from now until December 31, 2024, Sacombank is allocating over VND 17 billion to introduce a range of promotional programs under the theme ‘When Life is a Journey.’ These promotions include attractive cashbacks, fee waivers, and gifts of 24k SBJ gold.”