Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 910 million shares, equivalent to a value of more than 20.7 trillion dong; HNX-Index reached over 99 million shares, equivalent to a value of more than 1.6 trillion dong.

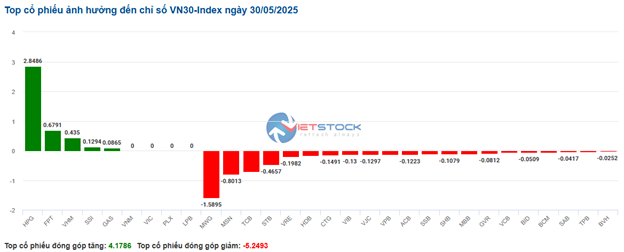

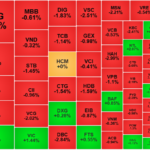

VN-Index opened the afternoon session with a prolonged tug-of-war despite the return of buyers, but selling pressure remained slightly higher, causing the index to fail to reclaim the reference level and close in the red. In terms of impact, CTG, MWG, BID, and HVN were the most negative influences on the VN-Index, with a 2.8-point drop. On the other hand, VIC, VHM, GAS, and HPG remained in the green and contributed more than 2.8 points to the overall index.

Similarly, the HNX-Index also had a rather pessimistic performance, with the index negatively impacted by KSV (-1.6%), HUT (-4.51%), PVS (-3.51%), and NVB (-3.51%).

|

Source: VietstockFinance

|

The energy sector was the group with the sharpest decline in the market, falling 2.71%, mainly due to PVS (-3.51%), PVD (-2.39%), PVC (-2.04%), and PVB (-2.09%). This was followed by the telecommunications and industrial sectors, which fell by 1.3% and 1.15%, respectively. On the other hand, the real estate sector was the only group to see gains, rising 0.33%, mainly due to VIC (+1.44%), VHM (+0.91%), NVL (+1.43%), and DXG (+0.28%).

In terms of foreign trading, foreigners continued to sell a net amount of more than 1,085 billion dong on the HOSE exchange, focusing on HPG (188.65 billion), MWG (132.3 billion), STB (110.14 billion), and DIG (74.32 billion). On the HNX exchange, foreigners sold a net amount of more than 24 billion dong, focusing on PVS (34.52 billion), SHS (27.11 billion), HUT (9.99 billion), and MBS (5.33 billion).

| Foreign Trading Buy-Sell Net |

Morning Session: Foreigners Dumped Stocks, VN-Index Lost More Than 5 Points

Selling pressure continued to increase, pushing the VN-Index downhill towards the end of the morning session, temporarily closing at 1,336.42 points, down 0.41%. The HNX-Index also turned red, falling to 223.96 points. The breadth continued to favor the sell-side with 447 losers, 211 gainers, and 886 unchanged.

Despite the large number of declining stocks, the impact of the leading decliners was not too significant. TCB, CTG, and BID were the most negative influences, taking away nearly 1.5 points from the VN-Index. Meanwhile, the trio of VIC, VHM, and HPG acted as pillars, contributing a total of nearly 2.5 points to the index, thereby helping to curb the decline amid strong market fluctuations.

The industrial and telecommunications sectors temporarily “bottomed out” with a decline of around 1%. The red color spread widely, with notable declining stocks with significant volume in these two sectors including CII (-1.29%), VCG (-1.35%), HAH (-4.6%), VSC (-1.82%), CTD (-2.43%), HVN (-1.92%), ACV (-2.24%), GMD (-2.48%), DPG (-1.35%); CTR (-1.5%), YEG (-1.23%), and VGI (-1.16%).

In the financial sector, although many securities stocks such as FTS (+3.44%), CTS (+4.56%), VCI (+1.11%), BSI (+1.94%), BVS (+2.88%), etc., became prominent bright spots in the morning session, most banking and insurance stocks were submerged in red, causing the financial sector index to fall by 0.5%.

The real estate sector is barely holding on to a weak green thanks to the support of VIC (+1.13%), VHM (+1.04%), and NVL (+1.08%). However, most of the remaining stocks are also facing significant adjustment pressure. PDR, HDG, DIG, SGR, QCG, CKG, BCM, SIP, IDC, SZC, etc., fell by more than 2%.

| Foreign Trading Buy-Sell Net as of the Morning Session on May 30, 2025 |

Foreigners continued to put pressure on the market by net selling more than 950 billion dong on all three exchanges in the morning session alone. Their trading trend is becoming a major obstacle for the market, especially as the selling pressure remains focused on large-cap stocks. MWG, HPG, and STB topped the net sell list with values of 149, 94, and 87 billion dong, respectively. Meanwhile, NVL, MBB, and FTS were net bought the most, but the values were modest, below 53 billion dong, not enough to create a support for the market.

| Top 10 Stocks with the Strongest Foreign Net Buying and Selling in the Morning Session of May 30, 2025 |

10:30 AM: Selling Pressure Persists, Indices Move in Opposite Directions

The market continued to witness a cautious sentiment, resulting in fluctuations around the reference levels. As of 10:30 AM, the VN-Index decreased slightly by 0.77 points, trading around 1,341 points. Conversely, the HNX-Index increased by 0.55 points, trading around 224 points.

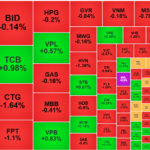

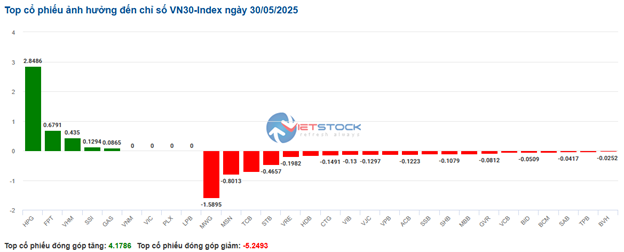

Stocks in the VN30 basket faced widespread selling pressure, resulting in a loss of more than 5.2 points from the overall index. Notably, MWG, MSN, TCB, and STB subtracted 1.59 points, 0.8 points, 0.7 points, and 0.46 points, respectively. On the buying side, only a few stocks managed to stay in positive territory, including HPG, FPT, VHM, and SSI, contributing more than 4.1 points to the index.

Source: VietstockFinance

|

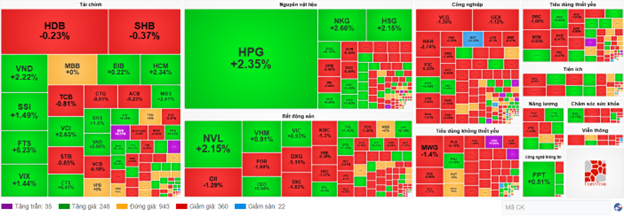

Money continued to flow out of the financial sector, causing most stocks to dip into the red. Specifically, BID declined by 0.82%, TCB by 0.81%, CTG by 0.77%, and MBB by 0.2%. Only a handful of stocks in the financial services sector managed to stay in positive territory, such as SSI, which rose by 0.43%, VCI by 1.24%, VND by 0.63%, and MBS by 0.37%. However, their impact was not significant.

Next, the consumer staples sector experienced strong divergence, with selling pressure slightly dominating as leading stocks in the sector turned red. MSN fell by 0.95%, SAB by 0.41%, MCH by 1.17%, and QNS by 1.04%. Conversely, some stocks managed to stay in the green, including VNM, which rose by 0.18%, HAG by 0.36%, VSF by 0.3%, and VCF by 0.21%…

On a positive note, the information technology sector maintained its recovery momentum, increasing by 0.63%. Buying interest mainly focused on large-cap stocks such as FPT, which rose by 0.6%, CMG by 0.73%, and VTB by 3.5%.

Compared to the opening, the sell-side continued to dominate. There were 360 declining stocks and 248 advancing stocks.

Source: VietstockFinance

|

Opening: Fluctuations Dominate the Early Session

The market witnessed notable fluctuations in the early morning session. Specifically, the VN-Index and HNX-Index experienced slight corrections. The VN-Index decreased by 0.16%, equivalent to a loss of 2.2 points, retreating to 1,339.86 points. Meanwhile, the HNX-Index declined by 0.4 points, falling to 223.9 points.

Within the VN30 basket, the breadth indicated a dominance of sellers, with 16 declining stocks, only 9 advancing stocks, and 5 stocks trading at reference prices. In terms of impact, on the positive side, FPT contributed 0.93 points, VPB 0.21 points, VIB 0.06 points, and SAB 0.05 points, serving as the main pillars. Conversely, VCB, BID, CTG, and HPG subtracted 1.74 points, 1.01 points, 0.72 points, and 0.68 points, respectively, exerting the most significant drag on the overall index.

Considering sector performance, some sectors witnessed notable movements. The securities sector declined by 0.71%, with prominent stocks such as SSI falling by 0.74%, VND by 0.83%, VCI by 0.92%, HCM by 0.55%, SHS by 0.56%, and VIX by 1.23%.

The banking sector also decreased by 0.61%, pressured by large-cap stocks such as VCB, which fell by 0.83%, BID by 0.97%, and CTG by 0.78%. However, some stocks managed to stay in positive territory or incurred minor losses, including VPB, which rose by 0.67%, TCB, which fell by 0.23%, and MBB, which declined by 0.41%.

The steel & galvanized steel sector fell by 0.84%, with representatives such as HPG decreasing by 1.03%, HSG by 0.93%, and NKG by 1.15%.

In contrast, the real estate industry exhibited divergence, with the industrial real estate sector slightly declining by 0.01%. Some stocks recorded growth, including IDC, which rose by 0.16%, and

Stock Market Wrap-up for Week of May 26-30, 2025: A Pause in the Rally

The VN-Index stalled its upward trajectory following a significant dip last week. The index retreated to test the old peak from March 2025 (1,320-1,340 points). Meanwhile, persistent net selling by foreign investors continues to weigh on the market. If this trend persists, the short-term outlook may face challenges, indicating potential hurdles for a smooth correction.

The Hot Stock Divide: VN-Index’s “Quirky” Rise

The mounting pressure on blue-chip stocks dragged the VN-Index down for most of today’s afternoon session. It would have dipped further than 0.01 points if it weren’t for the sudden boost to VHM in the final trading phase. A divergence is emerging, with sell-offs in previously hot stocks while others are being aggressively pushed up.

Market Pulse May 29: Real Estate Rides to the Rescue as Large-Cap Stocks Take a Tumble

The VN-Index ended the session on May 29 down 0.01 points to 1,341.86, while the HNX-Index and UPCoM-Index posted gains, rising 0.74 points to 224.3 and 0.03 points to 98.62, respectively. The real estate sector was the main driver, with Large Cap stocks facing pressure during the session.

The Red Sea of Stocks: Foreign Investors Sell-Off Billions

The selling pressure soared on the last trading day of the week, with most stocks, blue-chips, and speculative plays, ending in the red. Although VIC and VHM attempted to prop up the VN-Index, which closed down only 0.69%, over 41% of stocks on this exchange lost more than 1% of their value. Foreign investors offloaded a net sell of over VND1,000 billion for the second time this week.