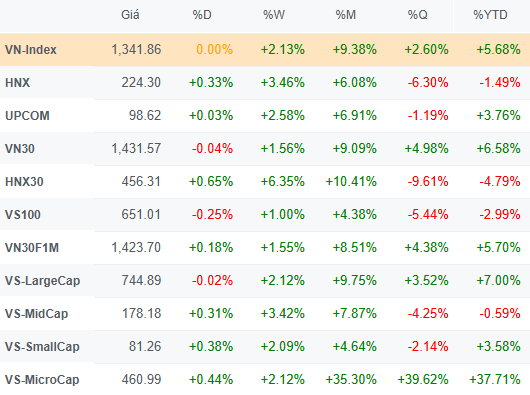

Despite facing pressure from the latter half of the morning session, the VN-Index slowly recovered in the afternoon session to close near the reference level. Looking at the market map, it is evident that the recovery momentum came from the real estate sector.

| VN-Index recovers in the afternoon session |

|

Source: VietstockFinance

|

Specifically, the real estate sector witnessed a strong surge with prominent names such as NVL and NTL hitting the ceiling price, VHM gaining 1.59%, VRE rising by 3.56%, CEO climbing by 5.41%, HDC increasing by 6.67%, TCH going up by 2.82%, DIG advancing by 2.18%, PDR appreciating by 1.45%, and NLG surging by 3.65%.

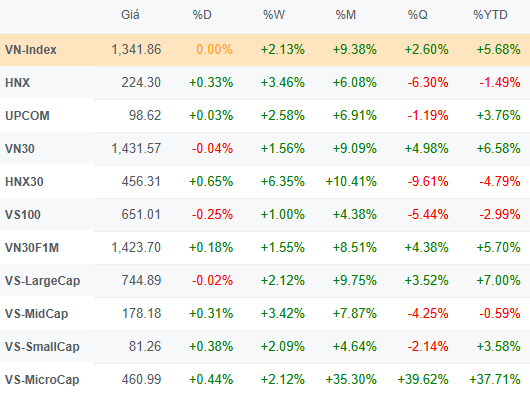

Another notable aspect was that the market recorded 425 stocks that posted gains, including 31 stocks that hit the ceiling price, outnumbering 362 declining stocks, of which 9 hit the floor price. From a capitalization perspective, this can be explained by the fact that the LargeCap group (which includes real estate stocks) dipped by 0.02%, thus impacting the overall market despite the higher number of advancing stocks.

Several large-cap stocks witnessed price declines today, spanning various sectors. Notable mentions include CTG, which fell by 1.64%; VCB, which dropped by 0.18%; BID, which slipped by 0.14%; MSN, which lost 0.78%; MWG, which declined by 0.16%; HPG, which decreased by 0.2%; and FPT, which went down by 1.1%.

Meanwhile, the Mid Cap group rose by 0.31%, the Small Cap group climbed by 0.38%, and the Micro Cap group advanced by 0.44%.

|

LargeCap group exerted pressure on the market during the May 29 session

Source: VietstockFinance

|

|

Real estate sector painted a green picture

Source: VietstockFinance

|

In terms of liquidity, the market recorded over 1 billion shares traded, with a value of nearly VND 22,917 billion, lower than the previous session and the recent average. However, foreign investors were quite active, with net selling of nearly VND 305 billion, including net buying of over VND 2,693 billion and net selling of nearly VND 2,998 billion.

CTG and GEX were the two stocks that witnessed net selling in the hundreds of billions today, with net selling values of over VND 136 billion and over VND 110 billion, respectively. On the opposite side, NVL led in terms of net buying value, with nearly VND 291 billion, which provided some support for its ceiling price increase today.

Morning session: Intensifying pressure caused the VN-Index to temporarily lose its gains

Amid multiple pressures, especially during the latter half of the morning session, the market failed to maintain its gains going into the lunch break.

At the morning session close, the VN-Index lost 2.9 points to 1,338.97, despite a strong start that saw it gain over 6 points at one point. Similarly, the UPCoM-Index dipped by 0.01 points to 98.58. In contrast, the HNX-Index managed to stay in positive territory, climbing by 0.58 points to 224.14.

Source: VietstockFinance

|

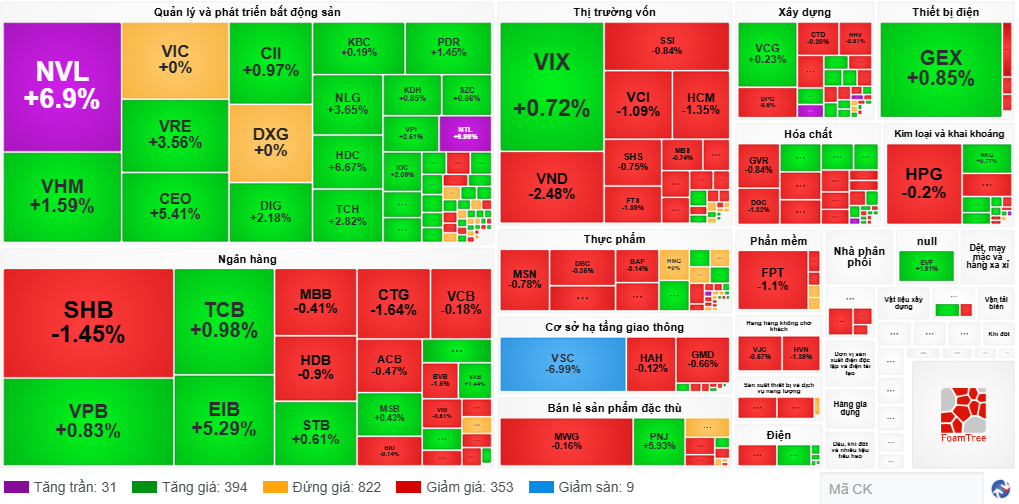

The number of declining stocks increased rapidly, reaching 330, matching the number of advancing stocks. Additionally, there were 949 stocks that remained unchanged.

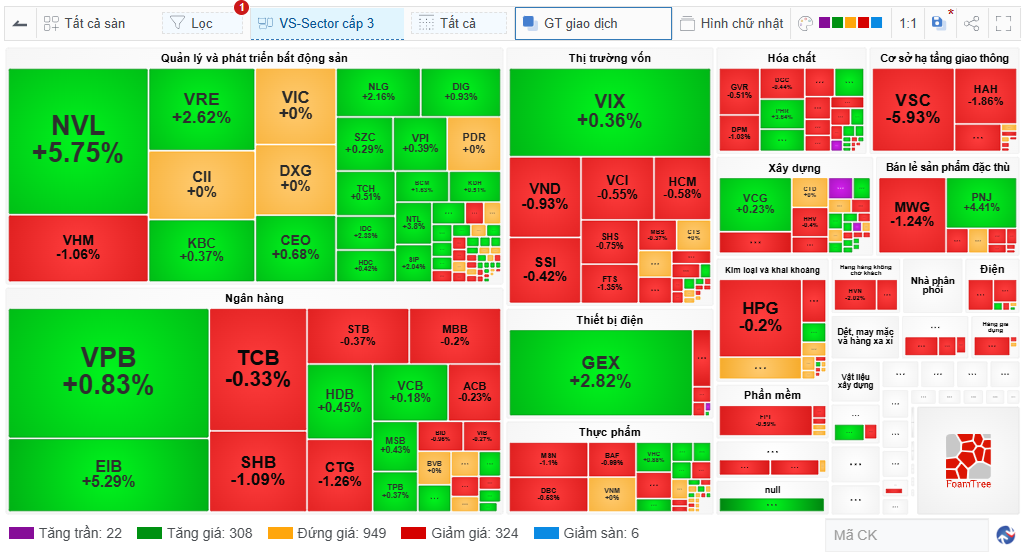

Looking at the market map, red dominated and covered large areas. In the banking sector, a series of stocks such as TCB, SHB, STB, MBB, CTG, ACB, and BID declined, presenting a clear contrast within the industry compared to VPB, HDB, VCB, TPB, and MSB, which posted slight gains, and EIB, which surged by 5.29%.

Red even dominated in other large-cap sectors, including securities, with VND, SSI, VCI, HCM, SHS, and FTS all declining; food & beverage, with MSN, DBC, and BAF falling; chemicals, with GVR, DPM, and DGC slipping; infrastructure, with VSC and HAH decreasing; retail, with MWG dropping; and aviation, with HVN and VJC dipping.

Source: VietstockFinance

|

The momentum that prevented the index from falling further came from the real estate sector, led by NVL, which rose by 5.75%; VRE, which climbed by 2.62%; and NLG, which gained 2.16%…

The market’s trading value reached nearly VND 11,287 billion, slightly higher than the previous session. In this context, foreign investors net sold over VND 429 billion, including net buying of over VND 1,292 billion and net selling of nearly VND 1,721 billion.

Foreign investors’ selling pressure focused on VHM, with a net selling value of over VND 97 billion; CTG, with net selling of over VND 71 billion; STB, with net selling of VND 61 billion; and GEX, with net selling of nearly VND 51 billion. On the buying side, NVL was the stock with the highest net buying value, at nearly VND 156 billion, partly explaining its strong increase this morning.

While Vietnam’s market status changed, major Asian markets continued to witness positive sentiment, with All Ordinaries, Hang Seng, Nikkei 225, and Shanghai Composite all maintaining their gains.

10:30 am: The real estate sector took on a leading role

After adjusting towards the reference level, the VN-Index quickly rebounded, driven by the notable green spread within the real estate sector.

As of 10:30 am, the VN-Index climbed by 3.26 points to 1,345.13, while the HNX-Index and UPCoM-Index rose by 1.73 points and 0.02 points to 225.29 and 98.61, respectively. The trading value on the HOSE was boosted to nearly VND 6,935 billion, slightly higher than the same period in the previous session.

In the real estate sector, numerous stocks continued to demonstrate their strength by extending their gains. Notably, NVL surged by 6.51%, VRE climbed by 3.37%, CEO rose by 3.38%, NLG advanced by 3.51%, and KDH increased by 2.33%. Notably, NVL hit the ceiling price at one point and was also the stock with the highest net buying value by foreign investors, reaching nearly VND 100 billion.

Additionally, the industrial park group recorded good gains, with notable mentions including KBC, SZC, IDC, and BCM…

The banking sector also showed optimism, with prominent names such as EIB hitting the ceiling price and VPB climbing by 1.67%. Meanwhile, securities stocks were also positive, with VIX rising by 2.54% after recently announcing dividend payments and leadership changes.

Overall, green dominated with 347 stocks posting gains, including 18 stocks that hit the ceiling price. However, the market also faced certain pressures as the number of declining stocks increased to 233, including 5 stocks that hit the floor price. Many notable declining stocks as of 10:30 am included VHM, SHB, CTG, VND, MSN, MWG, VSC, and HAH… However, most of these stocks experienced only minor losses.

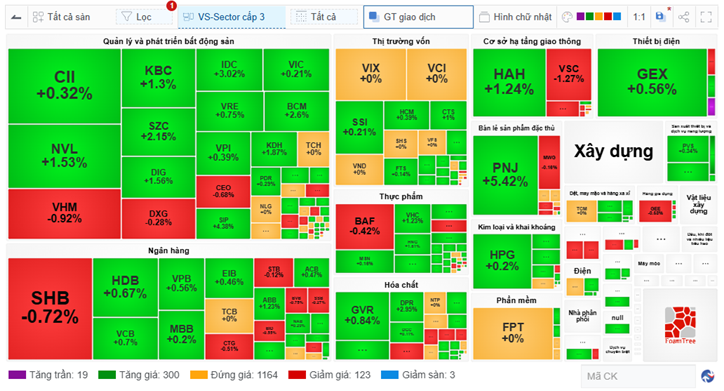

Opening: Green dominated the early session

On May 29, Vietnam’s stock market welcomed positive signals, reflected in the green across all three exchanges. As of 9:30 am, the VN-Index climbed by 2.55 points to 1,344.42, even surpassing 6 points at one point; the HNX-Index rose by 1.43 points to 224.99; and the UPCoM-Index gained 0.18 points to 98.77.

The market recorded 319 advancing stocks, overwhelmingly outnumbering 126 declining stocks. Additionally, 1,164 stocks remained unchanged. Looking at the market map, green dominated with many stocks posting strong gains, including IDC, BCM, KBC, SIP, and SZC from the real estate and industrial park sectors; NVL, KDH, and DIG from the residential real estate sector; HAH from the maritime transportation sector; and PNJ from the retail sector, which surged by 5.42%.

|

Green dominated the early session

Source: VietstockFinance

|

In terms of liquidity, nearly 65 million shares were traded, corresponding to a value of nearly VND 1,505 billion. This liquidity level was not significantly different from the recent average during the same period.

The developments in Vietnam’s market partly reflected the positive sentiment in international markets.

Specifically, major Asian markets opened in positive territory, with All Ordinaries, Hang Seng, Nikkei 225, and Shanghai Composite all starting the day with gains.

In the US, stock futures rose sharply after a federal court blocked President Donald Trump’s tariff retaliation, while chip giant Nvidia announced earnings that far exceeded expectations.

– 15:45 29/05/2025

The Stock Market Slump: VN-Index Stumbles at the Peak Once Again

Today, the market witnessed a potential breakthrough as the VN-Index surged past 1,348.31 points, marking an impressive intraday gain of approximately 6.4 points and briefly touching yesterday’s peak. However, the inability of blue-chip stocks to sustain their prices dampened the momentum, resulting in a prolonged downward slide for the index during the majority of the morning session.

Stock Market Blog: Hot Stocks Take a Tumble

A significant profit-taking event occurred in the mid and small-cap stock categories early today, intensifying as the day progressed. Although the VNI remained relatively stable, propped up by heavyweights like VIC, VHM, and GAS, limiting the decline, hundreds of stocks plummeted by over 1%, facing substantial selling pressure.