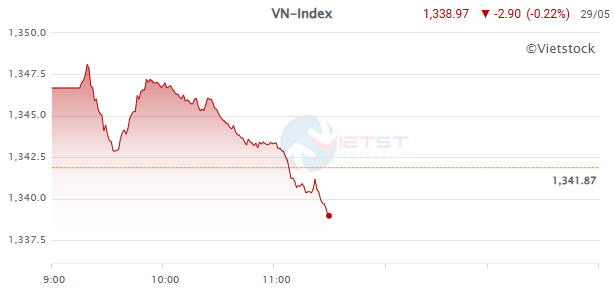

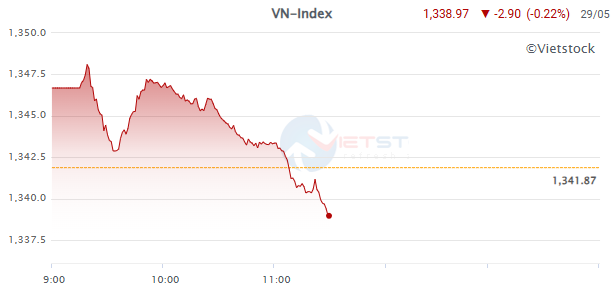

The morning session ended with the VN-Index down 2.9 points to 1,338.97, despite a strong first half where it gained over 6 points at one point. Similarly, the UPCoM-Index fell 0.01 points to 98.58. However, the HNX-Index managed to stay in the green, rising 0.58 points to 224.14.

Source: VietstockFinance

|

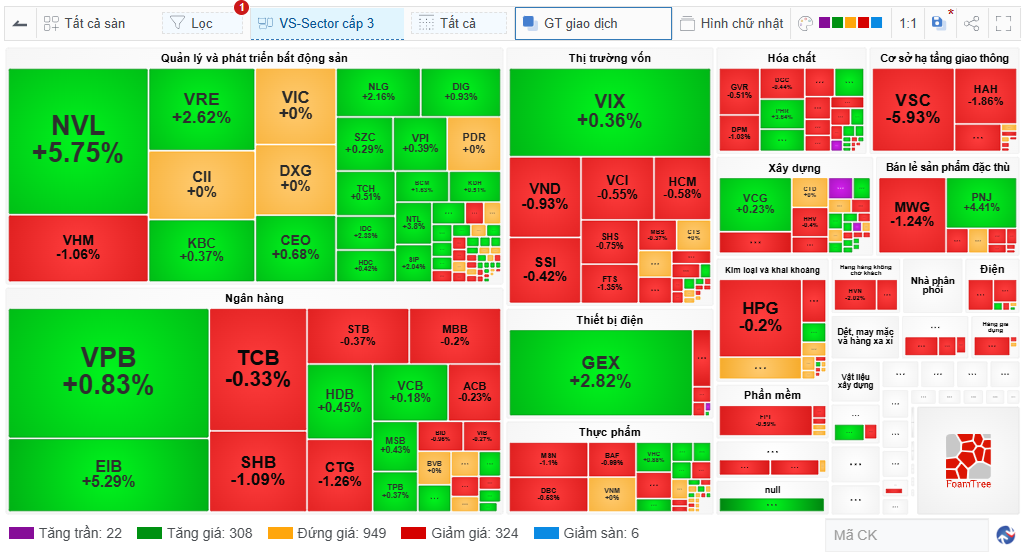

The number of declining stocks quickly rose to 330, matching the number of advancing stocks. Meanwhile, 949 stocks remained unchanged.

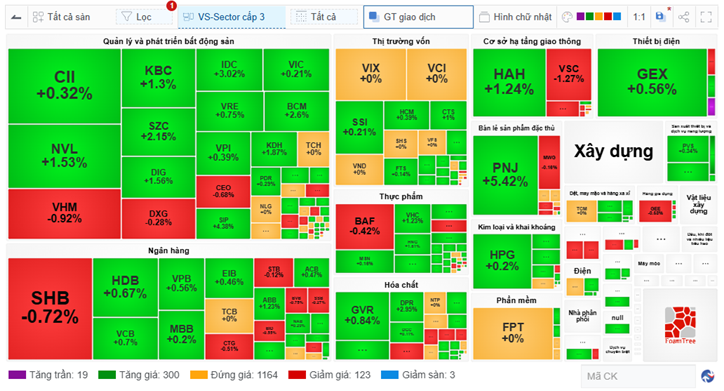

Looking at the market map, red dominated with large areas painted in this color. In the banking group, a series of stocks such as TCB, SHB, STB, MBB, CTG, ACB, and BID fell, creating a clear contrast within the industry, opposite to the gains seen in VPB, HDB, VCB, TPB, and MSB. Notably, EIB surged by 5.29%.

The color red also prevailed in another large-cap industry, securities, with VND, SSI, VCI, HCM, SHS, and FTS all declining. A similar scenario played out in the food industry with MSN, DBC, and BAF; chemicals with GVR, DPM, and DGC; infrastructure with VSC and HAH; retail with MWG; and aviation with HVN and VJC.

Source: VietstockFinance

|

The real estate group provided support and prevented the indices from falling further, led by NVL, which rose 5.75%, VRE up 2.62%, and NLG gaining 2.16%…

The market’s total trading value reached nearly VND 11,287 billion, slightly higher than the previous session. Foreign investors bought VND 1,292 billion worth of shares and sold VND 1,721 billion, resulting in a net sell-off of over VND 429 billion.

The foreign sell-off focused on VHM with a net sell value of more than VND 97 billion, CTG with VND 71 billion, STB with VND 61 billion, and GEX with nearly VND 51 billion. On the buying side, NVL was the most net bought stock, with a value of nearly VND 156 billion, contributing to its strong performance this morning.

While Vietnam’s market turned red, major Asian markets remained positive, with All Ordinaries, Hang Seng, Nikkei 225, and Shanghai Composite all trading in the green.

10:30 am: Real Estate Group Takes the Lead

After a brief dip towards the reference price, the VN-Index quickly rebounded thanks to the notable spread of green in the real estate sector.

As of 10:30 am, the VN-Index rose 3.26 points to 1,345.13, while the HNX-Index and UPCoM-Index climbed 1.73 points and 0.02 points, respectively. Trading value on the HOSE reached nearly VND 6,935 billion, slightly higher than the same period yesterday.

In the real estate sector, a series of stocks continued to show strength by widening their gains, notably NVL surging 6.51%, VRE up 3.37%, CEO rising 3.38%, NLG gaining 3.51%, and KDH climbing 2.33%. Notably, NVL hit its daily limit and was also the most net bought stock by foreign investors, with a net buy value of nearly VND 100 billion.

Industrial park stocks also recorded good gains, such as KBC, SZC, IDC, and BCM…

The banking group also showed optimism, with EIB hitting its daily limit and VPB climbing 1.67%. Additionally, securities stocks were positive, with VIX rising 2.54% after recently announcing dividend payments and leadership changes.

Overall, green dominated with 347 advancing stocks, including 18 stocks hitting their daily limit. However, the market also faced some pressure as the number of declining stocks increased to 233, including 5 stocks hitting their daily limit. Notable decliners as of 10:30 am included VHM, SHB, CTG, VND, MSN, MWG, VSC, and HAH… However, most of these stocks experienced only minor losses.

Market Open: Green Dominates

On May 29, Vietnam’s stock market welcomed positive signals, with all three indices opening in the green. By 9:30 am, the VN-Index had gained 2.55 points to 1,344.42, even surpassing 6 points at one point; the HNX-Index rose 1.43 points to 224.99, and the UPCoM-Index climbed 0.18 points to 98.77.

The market witnessed 319 advancing stocks, overwhelmingly outpacing 126 declining stocks. Additionally, 1,164 stocks remained unchanged. Looking at the market map, green dominated with many stocks performing well, including IDC, BCM, KBC, SIP, and SZC from the real estate and industrial park sectors; NVL, KDH, and DIG from the residential real estate sector; HAH from the maritime transportation sector; and PNJ from the retail sector, which surged by 5.42%.

|

Green dominated the market at the opening

Source: VietstockFinance

|

In terms of liquidity, nearly 65 million shares were traded, equivalent to a value of nearly VND 1,505 billion. This liquidity level was not significantly different from the average of recent sessions at the same time.

The performance of Vietnam’s market echoed the positive sentiment in international markets.

Specifically, Asian markets opened higher, with All Ordinaries, Hang Seng, Nikkei 225, and Shanghai Composite all trading in positive territory.

In the US, futures rose sharply after a federal court blocked President Donald Trump’s retaliatory tariffs, and Nvidia, a tech giant, reported earnings that far exceeded expectations.

– 12:00 29/05/2025

Profits Pressure Mounts, Blue-Chip Stocks Keep Index in the Green

The market took a significant turn for the worse in the afternoon session as bottom-fishing stocks from the volatile May 26 session flowed into accounts. It wasn’t just the weakness in blue-chips that pushed the VN-Index below reference levels; the contraction in breadth also indicated a widespread decline in stock prices.

The Powerhouse Stocks Push VN-Index to New Heights, but Trading Volume Takes a Surprising Dip

The HoSE saw three of its top 10 large-cap stocks surge by over 1% this morning, providing a significant boost to the VN-Index, which climbed to 1345.86, a 0.45% increase. With this rise, the index has surpassed its 36-month peak witnessed in mid-March. However, the market enthusiasm was muted, with HoSE’s matching liquidity dropping by 18% compared to yesterday’s morning session.

The Ultimate Guide to Crafting Compelling Copy: “Novaland Postpones Repayment of Nearly VND 906 Billion in Principal and Interest on Bonds”

Novaland has only managed to pay a meager 221 million VND out of the whopping 906 billion VND in principal and interest due on its NVLH2123011 bond series, leaving a staggering 905.8 billion VND still outstanding.