Oil prices dip on expected OPEC+ output hike

Oil Slides as OPEC+ Expected to Raise Output

U.S. crude oil futures declined on Friday as traders anticipated that OPEC+ would decide to boost oil output for July beyond earlier forecasts during their Saturday meeting.

Brent crude futures settled down 25 cents, or 0.39%, at $63.90 a barrel. U.S. West Texas Intermediate (WTI) crude futures fell 15 cents, or 0.25%, to $60.79.

For the week, both crude benchmarks posted losses of over 1%.

Natural Gas Flat as Asian Demand Weakens

Asian spot liquefied natural gas (LNG) prices held steady this week after three weeks of gains, as weak demand from Asian buyers and rising supply in Europe weighed on the market.

The average LNG price for July delivery into Northeast Asia was estimated at $12.40 per million British thermal units (mmBtu).

Despite extremely weak production from Malaysia’s Bintulu export plant, which is undergoing maintenance and shipment delays, Argus’ LNG pricing director Martin Young noted that Asian demand remained soft with limited buying interest this week.

Gold Softens as Dollar Strengthens

Gold prices slipped on Friday as the U.S. dollar firmed slightly and markets continued to monitor the latest tariff developments, while softer-than-expected U.S. inflation data kept hopes alive for an interest rate cut.

Spot gold fell 0.7% to $3,293.59 per ounce, registering a weekly loss of 1.9%.

U.S. gold futures for June delivery settled down 0.9% at $3,315.40.

The dollar index rose 0.1%, making gold more expensive for holders of other currencies.

On Thursday, a federal appeals court temporarily reinstated President Donald Trump’s most sweeping tariffs, a day after a trade judge ruled that Trump had overstepped his authority by imposing tariffs on steel imports and ordered a refund of billions collected.

Data-wise, the U.S. core personal consumption expenditures (PCE) price index rose 2.1% year-over-year in April, below expectations of a 2.2% increase.

Copper Weakens on Dollar Strength

Copper prices softened on Friday, pressured by a stronger dollar. Three-month copper on the London Metal Exchange (LME) slipped 0.6% to $9,510 a tonne.

Supporting prices, however, were falling inventories in LME-registered warehouses, which dropped 45% since mid-February to 149,875 tonnes, the lowest in nearly a year. Copper stocks in warehouses monitored by the Shanghai Futures Exchange rose 7.2% this week.

Coffee Slips as Brazil Harvest Progresses

Robusta coffee beans fell $67, or 1.5%, to $4,463 per tonne after touching a six-and-a-half-month low of $4,390. Industry experts attribute this decline to the progressing harvest of the 2025 Robusta crop in Brazil, the world’s second-largest producer after Vietnam.

Arabica coffee beans fell 1.7% to $3.4245 per lb.

Rubber Prices Ease on Seasonal Harvests

Rubber prices on the Tokyo Commodity Exchange (TOCOM) softened on Friday as seasonal harvests in producing countries eased supply concerns, while uncertainty loomed over U.S. tariffs and their impact on global trade.

The most active rubber contract on the Osaka Exchange (OSE) for November delivery fell 19.6 yen, or 6.23%, to end the day at 295 yen ($2.05) per kg.

September rubber on the Shanghai Futures Exchange (SHFE) dropped 435 yuan to 13,405 yuan ($1,864.68) per tonne.

July butadiene rubber, the most active contract on the SHFE, fell 200 yuan to 11,145 yuan ($1,550.31) per tonne.

Wheat, Soybean, and Corn Markets Mixed

Chicago wheat futures were unchanged on Friday, supported by a weaker dollar and favorable weather in growing regions. Soybean and corn prices dipped slightly amid expectations of ample supplies, favorable weather, and uncertainty surrounding biofuel demand as the U.S. government considers small refinery exemptions from biofuel laws.

The most active wheat contract on the Chicago Board of Trade (CBOT) was steady at $5.34 per bushel. Corn fell 3 cents to $4.44 a bushel, while soybeans dropped 10-3/4 cents to $10.41-3/4 a bushel.

Raw Sugar Climbs for Second Straight Session

Raw sugar prices on ICE rose for the second consecutive session, although they remained not far off their lowest level in nearly four years.

Raw sugar futures on ICE ended up 0.05 cent, or 0.3%, at 17.05 cents per lb. Prices fell 2.3% in May, touching a near four-year low of 16.81 cents on Thursday.

White sugar futures on ICE rose 0.5% to $476.10 per tonne.

Cocoa Prices Surge

Cocoa futures on ICE surged £340, or 5.5%, to £6,541 per tonne, although they posted only a 1% gain for the month. Cocoa futures on NYSE rose 7.5% to $9,791 per tonne, climbing 7% in May.

Brokers attributed the surge to an end to a protracted speculative sell-off, with prices falling about 22% from a peak of £7,862 on May 16 to lows of £6,168 on Thursday and Friday this week.

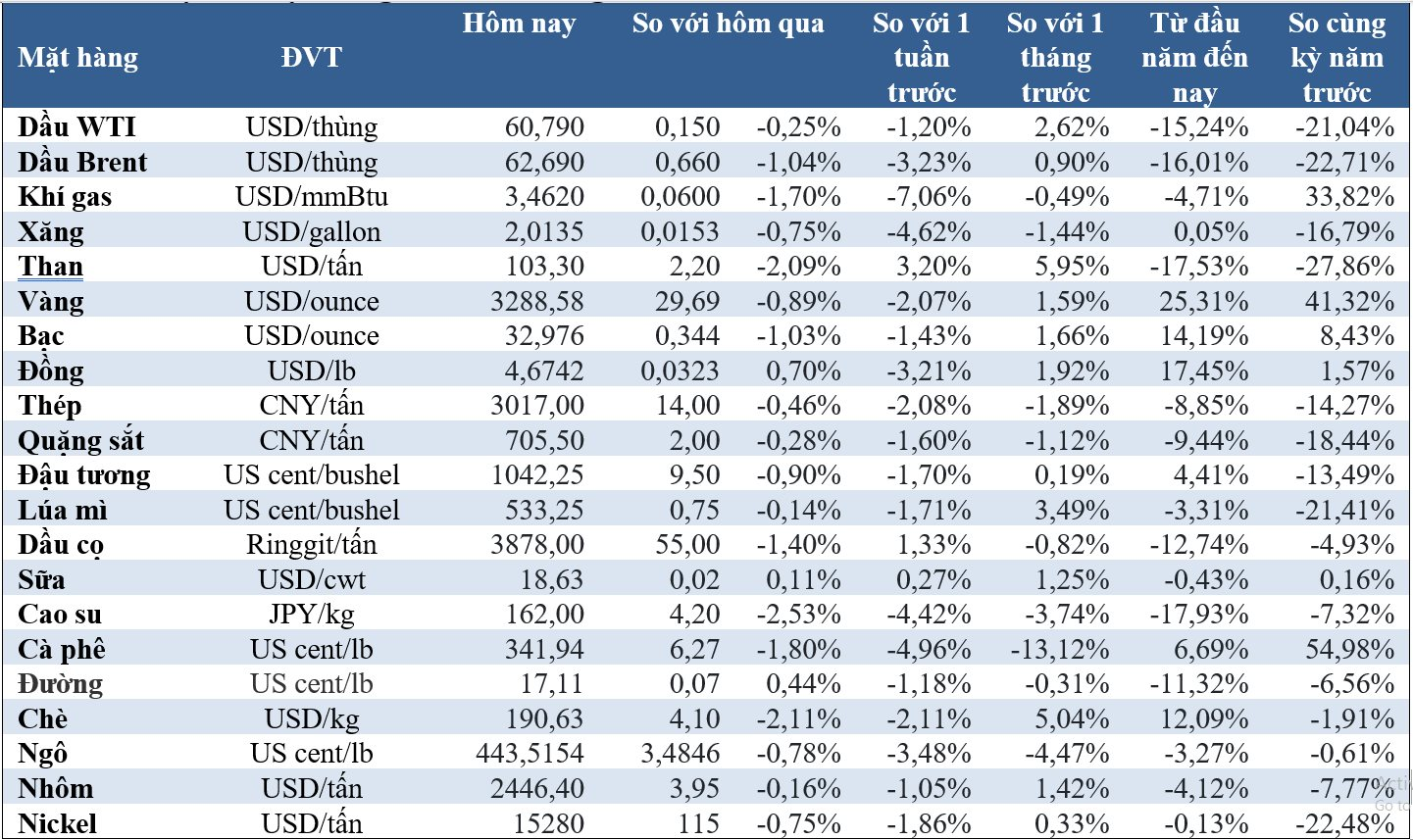

Key Commodity Prices as of May 31

The Price of Gold Drops Despite Lowest US Inflation Figures in Four Years

This week, gold prices dipped, ending a month of sideways movement despite ongoing support from the uncertainty surrounding President Donald Trump’s tariff policies.

Gold, Oil, Rubber, and Iron Ore Markets: A Day of Declines

The commodities market witnessed a broad-based decline with gold prices dipping for the second straight session, iron ore and wheat slipping for the third consecutive session, and cacao falling for the fifth session in a row. This downward trend comes on the back of the US tariff reprieve for EU goods and a stronger US dollar.

“Market Update: Oil Prices Hold Steady, Gold Drops Nearly 1%”

The commodities market was subdued as the US and UK observed public holidays. On the close of trading for May 26, oil prices held firm, metals gained, while gold fell nearly 1%, and iron ore on the Dalian exchange hit a two-week low.