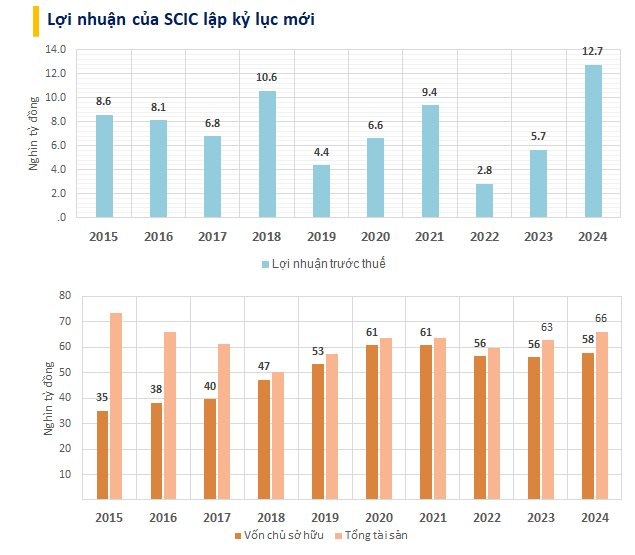

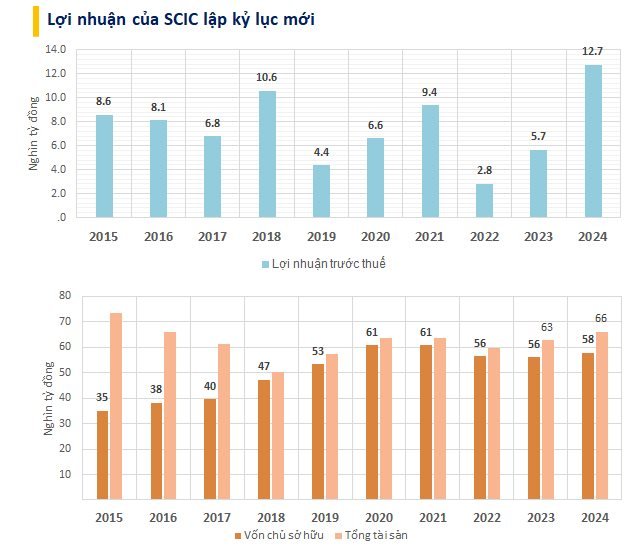

According to the consolidated financial statements of the State Capital Investment Corporation (SCIC), consolidated revenue from investment and capital business activities in 2024 surged by 40% to VND 10,015 billion.

Dividend and profit share contributed significantly to this growth, amounting to VND 8,397 billion, a 56% increase compared to 2023. Revenue from the sale of investments also witnessed a remarkable surge, climbing to VND 548 billion, reflecting a 373% increase from the previous year.

Operating expenses related to investment and capital business activities in 2024 resulted in a negative value of VND 542 billion, primarily due to the reversal of investment allowance provisions exceeding the incurred expenses. SCIC recorded a gross profit of over VND 10,557 billion.

Notably, the share of profits from associated companies underwent a positive transformation, shifting from a loss of VND 1,729 billion in 2023 to a profit of VND 2,432 billion in 2024. Within this, SCIC’s portion of profits in Vietnam Airlines amounted to VND 2,356 billion.

The Corporation’s pre-tax accounting profit reached VND 12,722 billion, reflecting a significant 125% increase compared to the previous year’s figure of VND 5,650 billion, marking the highest profit ever achieved by SCIC. After-tax profit for 2024 stood at VND 12,345 billion, a substantial 134% increase from 2023. As of the end of 2024, SCIC had accumulated losses totaling more than VND 3,173 billion.

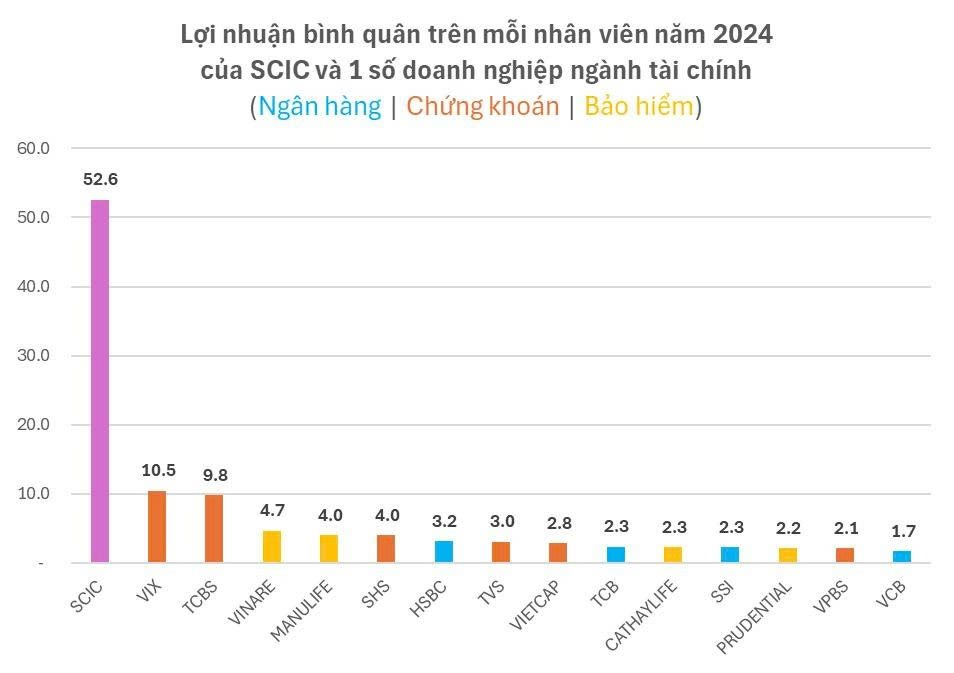

The total number of employees in the Corporation and its subsidiaries as of December 31, 2024, was 242, a decrease of 1 person compared to the end of 2023. This translates to an impressive pre-tax profit per employee of VND 52.6 billion for SCIC in 2024, making it the enterprise with the highest profit per employee in Vietnam.

Even enterprises in the financial sector, renowned for their high profit per capita, pale in comparison to this remarkable figure achieved by SCIC.

As of the end of 2024, SCIC’s total assets amounted to VND 65,959 billion, representing a 5% increase compared to the previous year. The Corporation’s term deposits at the end of the year stood at VND 28,982 billion, a decrease of 5%.

SCIC’s payables as of 2024 totaled VND 8,215 billion, a 21% increase from 2023. Short-term debt accounted for the majority of this amount, totaling VND 7,607 billion, with the largest item being taxes and other payments to the State (VND 7,429 billion).

Owners’ equity reached VND 57,745 billion. Invested capital from owners stood at VND 50,332 billion.

“Vietnamese Billionaire Nguyen Thi Phuong Thao: Vietjet’s Commitment to Being a Growth Connector Between Vietnam and the World.”

On May 30, Vietjet Aviation Joint Stock Company (HOSE: VJC) held its 2025 Annual General Meeting, setting its sights on the continued expansion of domestic services and investment in its aircraft fleet for long-term growth.

The Insiders’ Rush to Scoop up TDM Shares Amidst High Prices

“In a show of strong confidence, key stakeholders and insiders associated with the TDM leadership collectively snapped up over 2 million shares in May and June. This move comes amidst a backdrop of a remarkable recovery for the stock, which has more than doubled in value since hitting rock bottom in late 2022.”

The Capital’s Success: 30 Land Plots Auctioned Off in Phu Xuyen District

All 30 land lots were successfully auctioned, generating a impressive total of over 8.2 billion VND. The most expensive plot fetched a staggering 42.9 million VND per square meter, while the lowest winning bid was 19.4 million VND per square meter.

The Automotive Industry Stalls in Q1 Following the End of Registration Fee Incentives

The automotive industry witnessed a boost in the last quarter of 2024 due to a 50% reduction in registration fees. However, this momentum was short-lived as the first quarter of 2025 saw a decline in both vehicle sales and profits. While revenues increased year-over-year, profits took a hit, with only a select few businesses experiencing a turnaround through strategic restructuring.