The retail industry demonstrated its resilience in Q1 of 2025, ranking among the top four sectors in terms of profit plan fulfillment compared to the overall market.

The industry witnessed a remarkable profit growth, with a 73.8% year-on-year surge in the sector’s net profit. This impressive performance was primarily driven by a significant improvement in EBIT margins, while revenue saw only a slight increase due to the slow recovery of consumer purchasing power. The growth was mainly attributed to MWG’s 71% year-on-year increase and FRT’s astonishing 250.6% surge, both achieving outstanding results in their core business segments.

Notably, MWG has emerged stronger after a comprehensive restructuring phase, involving the closure of hundreds of underperforming stores, optimization of operating costs, and asset depreciation. As a result, their EBIT margin witnessed a remarkable improvement, climbing to 3.04% in 2024, a significant rise from 0.37% in 2023. However, it still falls short of the 4.8% average observed during the 2019-2022 period. Thus, there are high expectations for MWG’s EBIT margin to continue expanding in 2025 as their Bach Hoa Xanh chain reaches breakeven, and their ICT system (The Gioi Di Dong/Dien May Xanh) sustains stable growth, focusing on smart home appliances.

Similarly, DGW has been effectively managing costs, leading to an improved EBIT margin and contributing to profit growth. Nevertheless, it is important to note that the demand for laptops and smartphones has not yet shown a strong recovery.

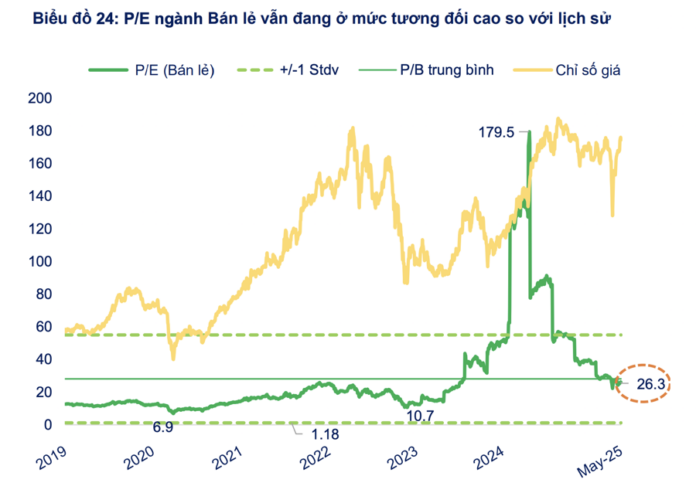

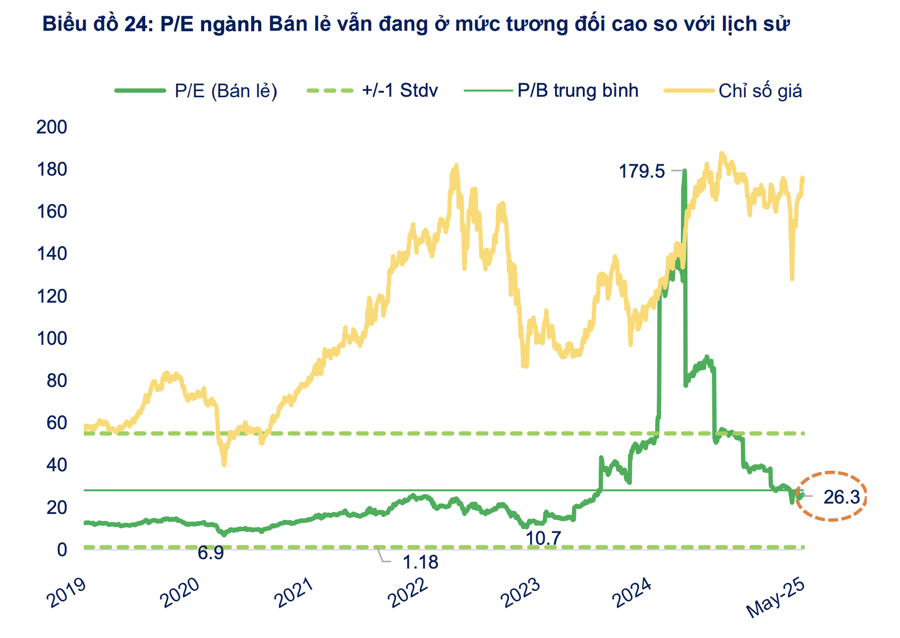

According to FiinGroup, the retail industry’s profit growth in 2025 is expected to be positive due to three key factors. First, consumer demand is on an upward trend, particularly for FMCG and smart home appliances, influenced by low-interest rates and stable disposable income. Second, the effective expansion strategies implemented by MWG (BHX, TGDĐ) and FRT (Long Chau) have contributed to continued improvements in EBIT margins. Lastly, the industry’s valuation multiples are lower than the five-year average but relatively high compared to historical levels (26x), and positive earnings are anticipated to bring valuations of some retail businesses to more reasonable levels.

However, it is crucial to acknowledge the risks associated with investing in retail stocks. The sector’s premium valuation compared to the overall market could lead to significant downward pressure if the industry’s outlook takes a negative turn. This is especially pertinent given the uneven recovery in consumer demand, primarily focused on non-essential goods. Additionally, trade measures imposed by the US could indirectly impact input costs and weaken purchasing power, adversely affecting the profit margins of retail businesses.

Is the Mid and Small-Cap Stock Group Undervalued?

The notable observation here is that the P/E ratio of the Non-Financial sector, excluding Real Estate, has plummeted by a staggering -35% from its peak a year ago, which also marked a historical high for this group. This represents a significantly deeper discount compared to the broader market, with the overall market’s P/E declining by -14%, Banks by -10%, and Real Estate by -28%.

Where would the Vietnamese stock market be without the Vingroup conglomerate?

The SSI Chief Economist offered insights into the surge of large-cap stocks and the factors influencing the stock market.

“A Bright Start: PJICO’s Impressive Performance in Q1”

In the recently released Q1 2025 financial report, Petrolimex Insurance Joint-Stock Corporation (PJICO, code: PGI) recorded a total revenue of VND 1,343 billion, a 3.3% increase, amounting to 26% of the yearly plan. The original insurance revenue reached VND 1,114 billion, a slight 1.3% uptick compared to the same period in 2024.

The Top 8 Undervalued Industries to Invest in Now: Uncovering Hidden Gems Amidst Uncertain Tariffs.

Investors may prioritize the recovery phase to restructure their portfolios, focusing on stocks that are less directly impacted and those with strong fundamentals and attractive valuations, given the uncertain outlook regarding tax negotiation prospects.