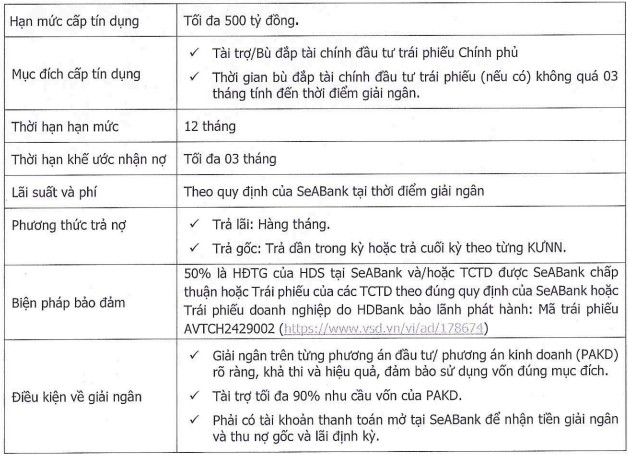

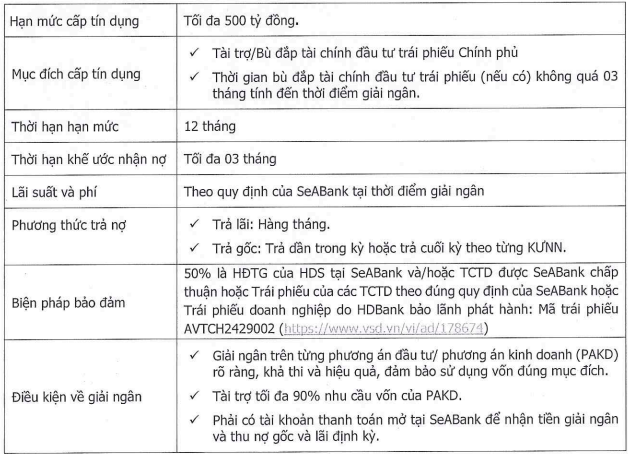

According to HDS, the purpose of the loan is to finance/offset the investment in government bonds. The offset period for the bond investment (if any) shall not exceed 3 months from the disbursement date.

Interest rates and fees will be applied as per SeABank’s regulations at the time of disbursement, with interest paid monthly and principal repaid in installments or in full at maturity, as per each loan agreement.

The loan will be secured by a 50% guarantee in the form of HDS‘s deposit contract with SeABank and/or another credit institution approved by SeABank, or bonds issued by credit institutions in accordance with SeABank’s regulations, or corporate bonds guaranteed and issued by HDBank with the code AVTCH2429002.

Information about HDS’s loan limit – Source: HDS

|

According to HNX, AVTCH2429002 is a bond with a scale of VND 535 billion, issued by Allgreen – Vuong Thanh – Trung Duong JSC on 25/12/2024. The bond has a 5-year term, maturing on 25/12/2029, and is underwritten by HDS. It offers an interest rate of 12% per annum, paid semi-annually, and is non-convertible, without warrants, and asset-backed.

Additionally, Allgreen – Vuong Thanh – Trung Duong JSC has another bond issue with the code AVTCH2429001, amounting to VND 1,735 billion. This bond was issued earlier, on 02/12/2024, with a 5-year term maturing on 02/12/2029. The remaining information regarding the interest rate, payment periods, and underwriter is similar to that of AVTCH2429002.

Allgreen – Vuong Thanh – Trung Duong JSC was established on 03/07/2008 and primarily operates in the short-stay accommodation services industry. With a charter capital of VND 860 billion, the company is owned by Truong Phu Trading Construction Production Co., Ltd. Its current Director and Legal Representative is Mr. Bui Ngoc Tuan.

Turning back to HDS, as of 31/03/2025, the company’s total assets exceeded VND 6,214 billion, a decrease of 19% compared to the beginning of the year. HDS reduced its short-term borrowings by 47%, to VND 1,680 billion, indicating the settlement of significant loan amounts. Previously, in late 2024, HDS had short-term borrowings of VND 3,190 billion, including a VND 3,000 billion loan from HDBank with an interest rate of 6-7.5% per annum, secured by the ownership rights of bonds from multiple enterprises.

Regarding bond activities, on May 20, the company announced that it had received decisions from the Vietnam Securities Depository and Clearing Corporation (VSDC) and the Vietnam Stock Exchange (VNX) to suspend trading and settlement activities in the private corporate bond market from May 20 to 26.

Specifically, on May 19, VSDC decided to suspend settlement activities for private corporate bonds of HDS from May 20 to 26, as the company had been reprimanded by VSDC for two consecutive months (April and May 2025) for removing settlement of private corporate bond transactions.

Based on this decision, on the same day, HDS was also suspended by VNX from all trading activities in the private corporate bond market at the Hanoi Stock Exchange (HNX) for the period from May 20 to 26.

– 19:02 30/05/2025

“A Securities Firm Suspended from Making Payments and Trading Private Bonds for One Week”

On May 20th, HD Securities JSC (HDS) announced that it had received a decision from the Vietnam Securities Depository and Settlement Corporation (VSDC) and the Vietnam Stock Exchange (VNX) to suspend the company’s settlement operations and activities in the private corporate bond market from May 20th to May 26th.

Get a $3M Funding from a Foreign Fund, F88 Aims to Establish a New Position Before UPCoM Listing.

F88 Business Joint Stock Company (F88) is proud to announce that it has secured a significant investment of 30 million USD (approximately 780 billion VND) from Lendable, a leading international financial institution based in London, UK. With a 3-year term, this investment marks the largest of its kind by Lendable to a financial enterprise in Vietnam, showcasing F88’s strong potential and promising future prospects.

The Stock Market Conundrum: Experts Advise Caution as VN-Index Surges in Banking and Real Estate Sectors.

The Vietnamese market has demonstrated remarkable resilience, bouncing back from the challenges posed by the US government’s tariff policies. This recovery can be largely attributed to the strong performance of the VN30, particularly the real estate and banking sectors, which have played a pivotal role in driving the market’s resurgence.

The Perennial Borrower: Nhựa Việt Thành’s Spiraling Debt Saga

The Board of Directors of Vietnam Plastics Production and Trading Joint Stock Company (HNX: VTZ) has approved a resolution to secure a VND 100 billion working capital loan, including issuing guarantees and opening L/Cs for its business operations with SeABank – Thu Duc Branch.

“Amending the Law on Credit Institutions: Empowering Bad Debt Handling and Revising Zero-Interest Special Lending Regulations”

“The proposed amendments to the Law on Credit Institutions in 2024 are a necessary step forward, according to Mr. Tran Van Phuoc, Acting Director of the State Bank’s Branch Office in Region 15. These amendments aim to legalize several provisions of Resolution No. 42/2017/QH14, which piloted the handling of bad debts by credit institutions. This resolution has proven to be a pivotal tool in addressing the issue of non-performing loans and strengthening the financial stability of credit institutions across the region.”