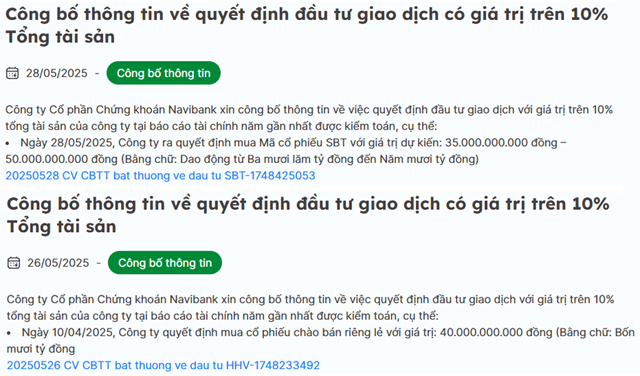

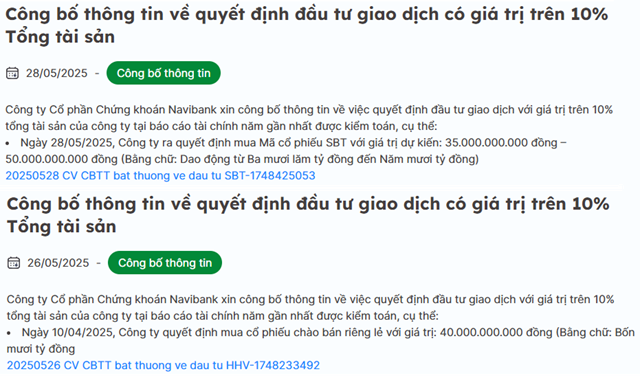

On May 28, Navibank Securities Joint Stock Company (NVS) decided to purchase shares of Thanh Thanh Cong – Bien Hoa Joint Stock Company (SBT) with an expected price range of VND 35-50 billion. NVS‘s move comes as SBT has been consistently rising in price, currently trading around VND 18,000 per share, a 50% increase from the beginning of the year.

Earlier, on May 26, NVS also made another notable decision regarding the purchase of privately placed shares worth VND 40 billion.

Source: Compiled from NVS website

|

Thus, within a few days, NVS has finalized plans to invest up to VND 90 billion in two separate stock deals.

As of March 31, 2025, NVS recorded financial assets of over VND 136 billion in FVTPL, a 35% increase from the beginning of the year, accounting for 40% of total assets. This includes investments in listed stocks of over VND 93 billion, unlisted bonds of nearly VND 27 billion, and unlisted shares of over VND 16 billion.

Notably, the company has to make provisions for impairment of financial assets and mortgaged assets of nearly VND 23 billion.

NVS‘s asset structure also includes a significant amount of cash, totaling over VND 98 billion, a slight decrease from the beginning of the year, equivalent to 29% of total assets. Most of this is bank deposits for the company’s operations and cash equivalents.

| NVS‘s asset structure consists mainly of cash and FVTPL financial assets |

In terms of business results, in the first quarter of 2025, NVS‘s proprietary trading segment made a profit of over VND 15 billion, a slight increase from the previous year. The company also recorded lending revenue of nearly VND 1.4 billion, almost seven times higher, and turned a profit in brokerage activities instead of a loss compared to the same period last year. Finally, NVS reported a net profit of nearly VND 12 billion, an 18% increase.

| NVS earned a net profit of nearly VND 12 billion in Q1/2025 |

– 10:06 30/05/2025

“Thaigroup and LPBS Nominate Members for HAGL’s Board of Directors”

The Hoang Anh Gia Lai Joint Stock Company (HOSE: HAG) has unveiled its slate of nominees for the Board of Directors and Supervisory Board for the upcoming term (2025-2030), to be elected at the forthcoming 2025 Annual General Meeting of Shareholders. Notably, alongside current members, the nomination list features several candidates from the large shareholder group holding 121 million HAG shares.

The Automotive Industry Stalls in Q1 Following the End of Registration Fee Incentives

The automotive industry witnessed a boost in the last quarter of 2024 due to a 50% reduction in registration fees. However, this momentum was short-lived as the first quarter of 2025 saw a decline in both vehicle sales and profits. While revenues increased year-over-year, profits took a hit, with only a select few businesses experiencing a turnaround through strategic restructuring.

“Novaland’s Receivables and Going Concern: SMC’s Response to the Audit Emphasis”

“Following the independent auditor’s report from Moore AISC, which included emphasis-of-matter paragraphs regarding trade receivables from the Novaland Group and going concern in the 2024 audited financial statements, CTCP Trade and Investment SMC (HOSE: SMC) submitted an explanatory letter to the Ho Chi Minh Stock Exchange (HOSE) on May 20, 2025. In the letter, the company also addressed its plan to rectify consecutive years of losses.”