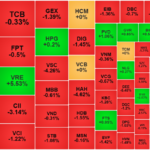

A significant profit-taking move in mid and small-cap stocks appeared quite early today and intensified towards the end of the trading day. While the VNI index was propped up by large-cap stocks such as VIC, VHM, and GAS, limiting the decline, hundreds of other stocks fell more than 1% under intense selling pressure.

This sell-off was inevitable, and many stocks had already been facing selling pressure earlier. The positive market sentiment from yesterday’s session kept several stocks on an upward trajectory, but this situation will become increasingly rare, and the likelihood of portfolios being impacted will rise. A strongly performing stock cannot offset the decline in the rest of the portfolio.

Apart from some speculative stocks that tend to witness extended rallies, many others are typically traded for only a few T+ rounds with limited upside potential. It is common for speculative stocks to experience a sharp outflow of funds once the rally ends, making it challenging to recover quickly. Hot money tends to exit decisively, leading to daily price fluctuations.

Among large-cap stocks, the weakness persists, and today’s market performance would have been more severe if it weren’t for VIC, VHM, and GAS supporting the index. Within the VN30 basket, 15 stocks declined by more than 1%, with 5 of them falling over 2%. This highlights that the recent rally to new highs was not broadly supported, and today’s retreat below the 1340 level is not surprising.

Average weekly liquidity across the two exchanges reached nearly VND22.9 trillion per session, excluding negotiated trades, which is relatively high. While there weren’t any sessions with explosive liquidity, the consecutive large trading sessions without a corresponding price impact suggest that the market may be undergoing hidden distribution. The question remains whether this selling pressure is a result of normal risk reduction or actual distribution.

As we enter a crucial month for trade negotiations and the 90-day deadline approaches, a resolution is likely to emerge. However, it is challenging to predict whether the market will be satisfied with the outcome. A favorable result would be ideal, but if the situation turns unfavorable or falls short of expectations, the market will undoubtedly react, even if temporarily. Given this uncertainty, reducing equity exposure is prudent, especially since the recent rally has provided decent returns for many stocks. If a positive scenario unfolds, it will mark a fresh start. In the event of an adverse scenario, there will still be multiple options to consider. Preserving resources will enable effective deployment regardless of the outcome.

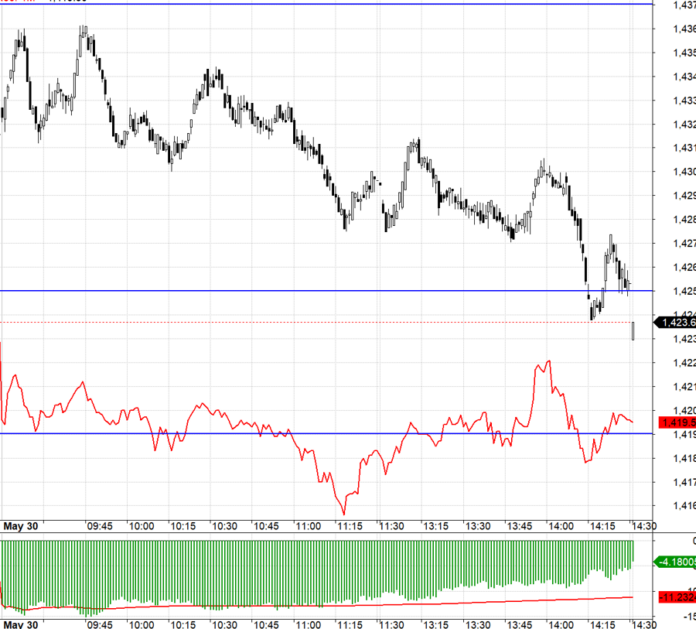

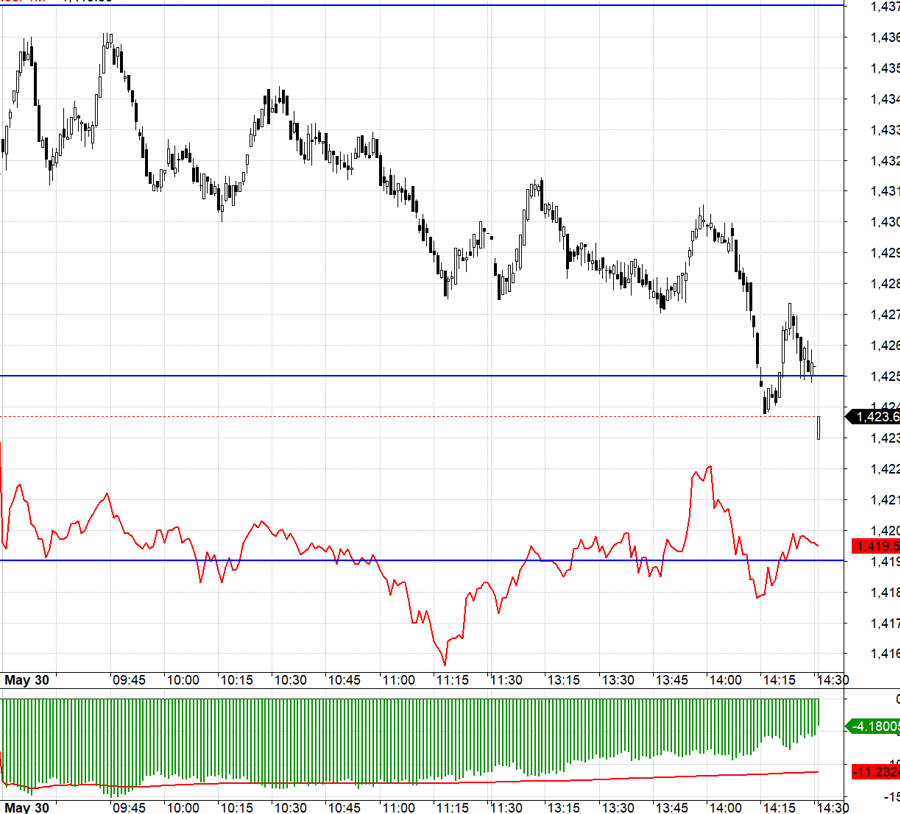

Today, the futures market witnessed an extremely wide discount of over 15 points, despite VN30’s early gains. With such a significant basis, short positions carried extreme risk, especially with VIC and VHM holding steady. Throughout VN30’s decline from near 1437.xx to 1425.xx, F1 exhibited minimal movement and even trended upwards during the first half of the afternoon session. In such a scenario, the best course of action is to remain on the sidelines.

The risk of a correction is increasing, although it will likely be a brief one. Many stocks will experience significant declines as fund flows change. Short-term opportunities have dried up, and the time to buy is not yet here. The strategy is to take a break, and for those inclined, to engage in long/short trading in the derivatives market if the basis becomes more favorable.

VN30 closed today at 1423.68. Near-term resistance levels to watch are 1425, 1440, 1450, 1457, 1461, and 1466. Support levels are 1419, 1408, 1401, 1391, 1384, and 1378.

“Blog Chứng Khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The insights and opinions expressed are solely those of the author, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the published opinions and views.

The Red Dominance: Stocks Surge to New Heights

The VN-Index reached new heights today (May 28th), surpassing 1340 points. However, the market is highly polarized, and the benchmark’s upward trajectory is dependent on the Vingroup conglomerate’s performance.

Profits Pressure Mounts, Blue-Chip Stocks Keep Index in the Green

The market took a significant turn for the worse in the afternoon session as bottom-fishing stocks from the volatile May 26 session flowed into accounts. It wasn’t just the weakness in blue-chips that pushed the VN-Index below reference levels; the contraction in breadth also indicated a widespread decline in stock prices.

The Powerhouse Stocks Push VN-Index to New Heights, but Trading Volume Takes a Surprising Dip

The HoSE saw three of its top 10 large-cap stocks surge by over 1% this morning, providing a significant boost to the VN-Index, which climbed to 1345.86, a 0.45% increase. With this rise, the index has surpassed its 36-month peak witnessed in mid-March. However, the market enthusiasm was muted, with HoSE’s matching liquidity dropping by 18% compared to yesterday’s morning session.

The VN-Index Surges to a 3-Year High, but Many Investors’ Accounts are Yet to Reap the Benefits: Insights from VPBankS Experts

“There are still investment opportunities in various sectors and stock groups that were affected during the previous period, offering relatively safe valuation entry points,” the expert emphasized.

Market Beat: Stocks End Higher, Energy Sector Soars

The market ended the session on a positive note, with the VN-Index climbing 2.06 points (+0.15%) to reach 1,341.87, while the HNX-Index gained 1.77 points (+0.8%), closing at 223.56. The market breadth tilted in favor of gainers, with 388 advancing stocks against 360 declining ones. However, the large-cap VN30 index painted a mixed picture, as 15 stocks declined, 10 advanced, and 5 remained unchanged.