Today’s market saw significant volatility, but despite the frustrating VNI fluctuations, capital remained robust, actively seeking opportunities in mid- and small-cap stocks. It’s prudent to focus on specific stocks for strategic moves rather than fixating on the index.

The two consecutive sessions on HSX with matching orders exceeding 20 trillion VND failed to push the index higher. From the perspective of the VNI, the market faces challenges. However, the index doesn’t always accurately reflect market trends. Currently, the blue-chips are in a tug-of-war, unable to decisively drive the VNI up, resulting in a lack of explosive growth.

During the first three weeks of May, the VN30 witnessed a distinct influx of capital, with the average liquidity ratio of this basket consistently above 55% of the total floor, even reaching nearly 62% in some weeks. This was the phase when the VNI climbed to the old peak of March 2025. However, since the beginning of this week, capital has been gradually withdrawn, averaging around 44% in the last four sessions, including today’s 42.1%, compared to last week’s average of 55.4% per session.

Conversely, the capital flow into Midcap and Smallcap stocks has been relatively stable, coupled with significant gains in many stocks within this group. It’s not that capital is shifting entirely from blue-chips to mid- or small-cap stocks, but rather that the intensity of activity in these two groups is increasing. Most small individual investors are not fond of heavy blue-chip stocks, while the performance of “hot” stocks is highly appealing. This doesn’t account for the fact that many weeks ago, the VNI quietly climbed, and the midcap and penny portfolios benefited very little. Now is the time for the market to make amends, and it’s only natural for hot money to seize the opportunity.

Today’s strong differentiation among hot stocks indicates varying signals of entry and exit, but it doesn’t weaken the overall trend of capital flow. Many stocks that had been rising for an extended period have been continuously profit-taken and slowed down, while others continue to be aggressively speculated on. The phenomenon of capital rotation with substantial amounts makes it challenging to ascertain whether today’s strong stocks will remain robust tomorrow or whether a weak stock in this session will attract attention in the next. The only certainty is that everyone has their level of satisfaction, and when profits reach their target, it’s time to “harvest”; the rest is up to fate!

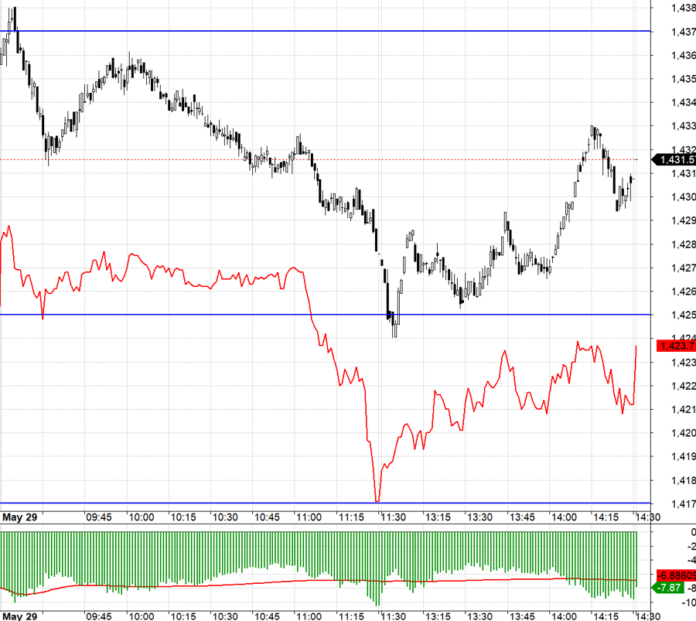

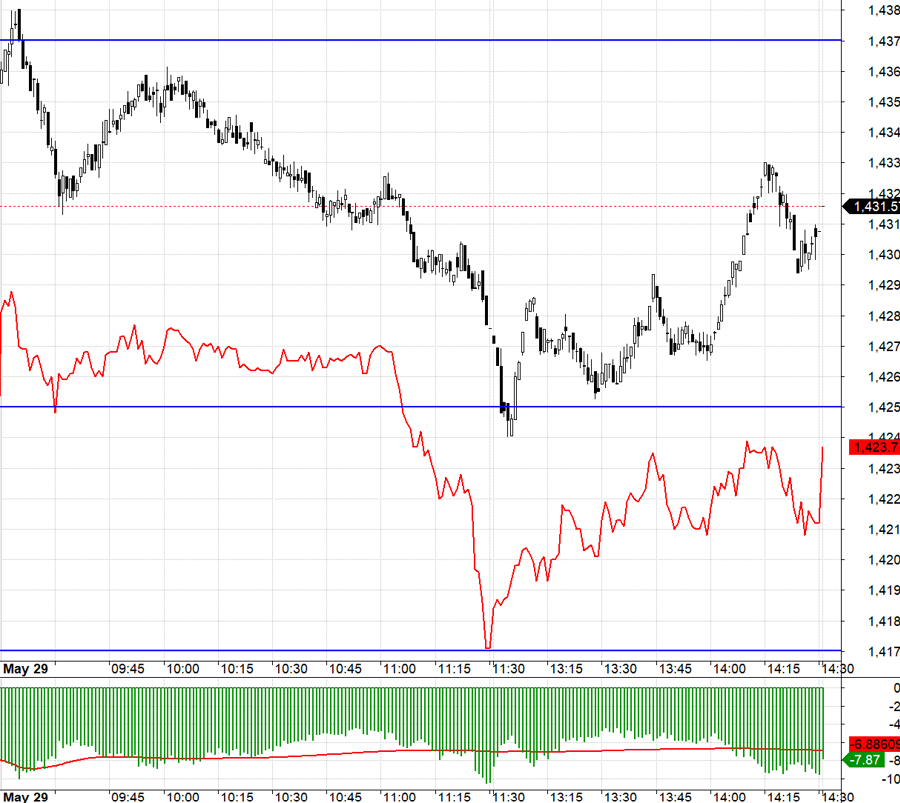

The derivatives market today witnessed a significant discount, a highly uncomfortable situation. VN30 touched 1437.xx at the opening but soon declined, with the F1 basis already accepting a discount of -10 points. In the subsequent rebound, VN30 rose again to near 1437.xx around 10 am, and although the basis improved, it still discounted more than 7 points. This 30-minute period was challenging to manage because if it couldn’t reach 1437.xx, the outlook was for VN30 to drop to 1425.xx, but F1 had already ironed out this level, so going Short would only bet on F1 maintaining the basis to make a profit. This scenario is precarious in terms of risk/opportunity, and if one is cautious, it’s best to refrain from participating. If one insists on engaging, it’s advisable to open a small position.

However, the session where VN30 fell to 1425.xx was the most significant decline for F1, with the contract dropping to 1417.xx, also the next support level for the index. If one couldn’t go Short at the higher level, this would be the opportunity to go Long due to the favorable basis. Nevertheless, the opposite scenario is equally uncomfortable, as F1 still accepts a wide discount, and the efficiency for Long isn’t high. Nonetheless, in terms of risk/opportunity, Long is the safer option.

With the blue-chips in a tug-of-war, it’s likely that the VNI and VN30 will continue to fluctuate. The capital flow into mid- and small-cap stocks will eventually come to an end. A large “harvest” in hot stocks could signal a market correction. The strategy is to take profits, and employ a flexible Long/Short approach with derivatives.

VN30 closed at 1431.57. Tomorrow’s nearest resistance is 1437; 1442; 1451; 1460; 1473. Support is at 1425; 1419; 1408; 1400; 1393; 1384; 1378.

“Blog chứng khoán” reflects the personal perspective of the investor and does not represent the views of VnEconomy. VnEconomy respects the author’s opinions and writing style and does not hold responsibility for issues related to the published content.

The Foreign Capital Exodus: Over VND 1,100 Billion in Outflows, Yet the Market Shines Brightly

The market experienced multiple shakes during the afternoon session, with blue-chip stocks being the primary drivers of volatility. Despite this, mid-cap and small-cap stocks shone brightly, with many witnessing impressive price gains and featuring among the market’s most liquid stocks.

The Cash Flow “Ditches” Blue-Chips: Small-Cap Stocks Surge Ahead

The lackluster performance of leading large-cap stocks is weighing heavily on the VN-Index, while the broader market continues to show resilience. This marks a reversal from previous weeks, when the index was propelled by these very same stalwarts, but investors saw limited gains as most stocks lagged.

Stock Market Blog: Flash Crash Stimulates Bottom-Fishing?

Today’s market movement was characterized by a swift crash that occurred within a 2-minute window around 9:30 am in the derivatives market. It took the underlying market a good 5 minutes to react strongly to this development. Over 11,200 contracts changed hands during this intense 2-minute period, marking a significant turning point in the day’s events.