I. VIETNAMESE STOCK MARKET WEEK 26-30/05/2025

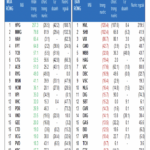

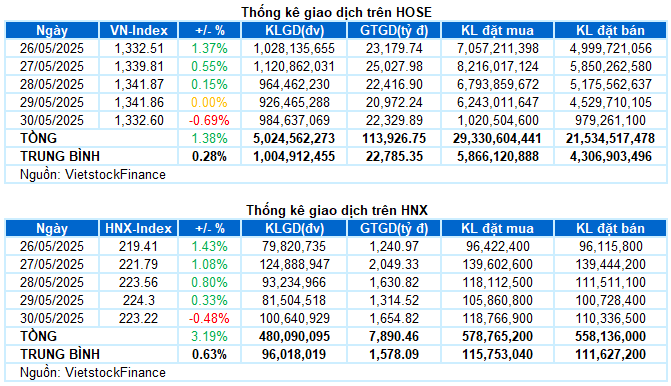

Trading: The main indices turned lower in the final trading session of the week. The VN-Index fell by 0.69% from the previous session to close at 1,332.6 points. The HNX-Index also declined by 0.48%, ending at 223.22 points. However, for the week, the VN-Index still gained a total of 18.14 points (+1.38%), while the HNX-Index added 6.9 points (+3.19%).

The Vietnamese stock market closed out the final trading week of May with volatile movements. After continuing to rise impressively and setting the highest closing level since the beginning of the year in the mid-week session, the VN-Index reversed course and adjusted in the last two sessions with a clear divergence. Active money continued to be present and took turns seeking out stock groups, but profit-taking pressure also quickly increased as the index approached strong resistance, creating strong fluctuations within the session. The VN-Index ended the week at the 1,332.6-point mark, also concluding May with an impressive 8.67% gain, marking the strongest monthly increase since the beginning of the year.

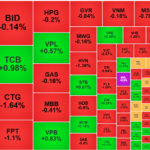

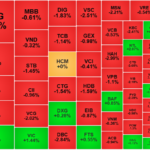

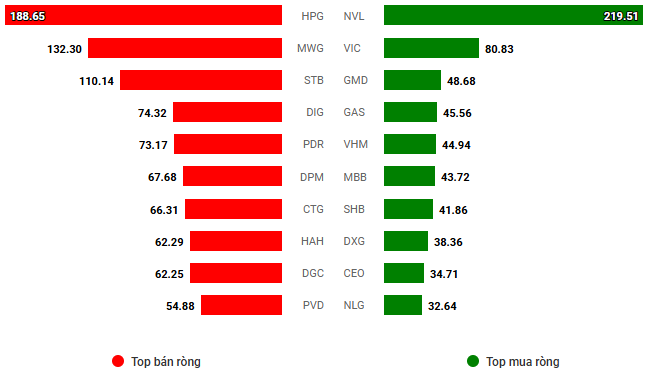

In terms of impact, CTG, MWG, and BID exerted the most significant pressure in the final session, taking away a total of more than 2 points from the VN-Index. In contrast, VIC remained a solid pillar, contributing 1.3 points to the overall index’s advance. This was followed by VHM and GAS, which also helped the VN-Index retain more than 1 point, curbing the decline as selling pressure increased broadly.

The broad-based correction caused red to dominate in most sectors. The energy sector ranked at the bottom, losing nearly 3%, with notable names such as BSR (-2.81%), PVS (-3.51%), PVD (-2.39%), PVC (-2.04%), and PVB (-2.09%).

The telecommunications, industrials, and non-essential consumer sectors also faced heavy selling pressure, losing more than 1% in the final session. A series of stocks witnessed sharp sell-offs with notable volume, including CTR (-3.53%), YEG (-2.05%), VGI (-1.45%); VCG (-2.02%), VSC (-2.51%), HAH (-2.99%), CTD (-3.65%), HVN (-3.46%); MWG (-3.42%), GEE (-4.03%), TCM (-2.75%), DGW (-2.69%), and PET (-2.93%).

Real estate and utilities were the only two sectors to remain in positive territory, although the gains were also very fragile as divergent movements dominated. Notable outperformers in these sectors included CEO (+5.77%), NVL (+1.43%), VIC (+1.44%), NTL (+2.07%); GAS (+1.56%) and DNW (+2.47%).

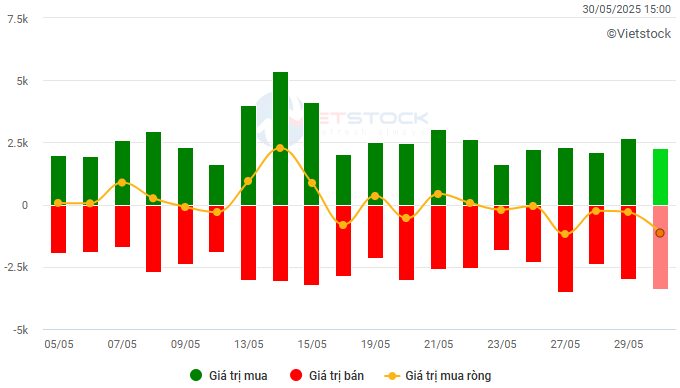

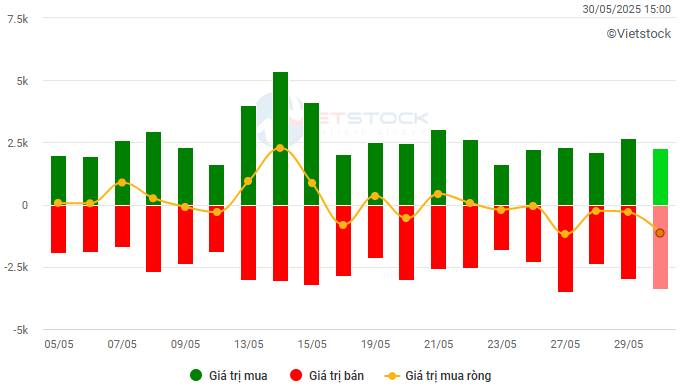

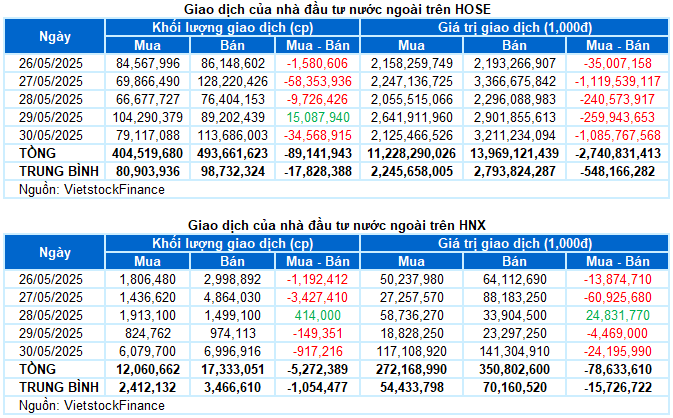

Foreign investors increased their net selling with a value of more than VND 2,800 billion on both exchanges during the week. Specifically, foreign investors net sold more than VND 2,700 billion on the HOSE and nearly VND 79 billion on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: VND billion

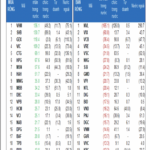

Net trading value by stock ticker. Unit: VND billion

Stocks that increased significantly during the week: NTL

NTL rose by 19.38%: NTL recorded a vibrant trading week with a gain of 19.38%. However, the stock just formed a High Wave Candle pattern accompanied by trading volume surging strongly above the 20-day average, indicating investors’ uncertain psychology. Currently, the Stochastic Oscillator indicator is diving deep into the overbought zone. Investors should exercise caution in the coming period if this indicator flashes a sell signal again.

Stocks that declined sharply during the week: VNE

VNE fell by 22.4%: VNE experienced a rather negative trading week with five consecutive declining sessions. Moreover, the trading volume remained above the 20-day average, indicating strong selling pressure. If, in the coming sessions, the VNE stock price cuts down below the Middle line of the Bollinger Bands, the situation will become even more pessimistic. At present, the Stochastic Oscillator indicator continues to fall after flashing a sell signal. Additionally, MACD also gives a similar signal. This suggests that the risk of short-term adjustments persists.

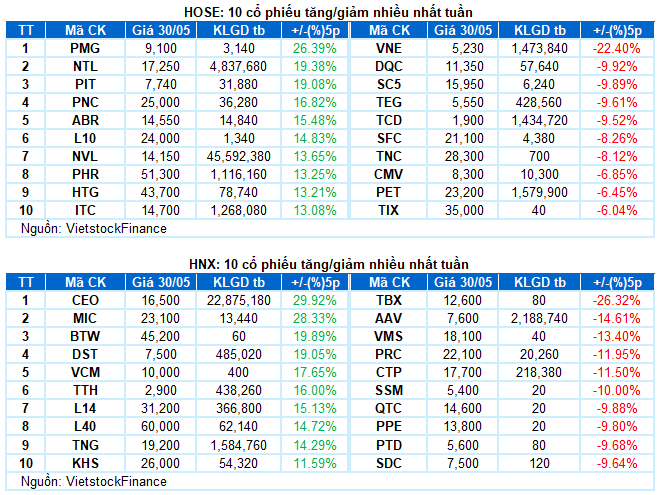

II. STOCK MARKET STATISTICS FOR THE PAST WEEK

Economics & Market Strategy Division, Vietstock Research

The Overseas and Proprietary Desks Liquidate Together, While Retail Investors Keep the Race Going.

Today’s trading liquidity across the three exchanges reached nearly 23 trillion dong. Foreign investors sold a net 304.6 billion dong, with a net sell of 341.4 billion dong in matched orders alone.

The Hot Stock Divide: VN-Index’s “Quirky” Rise

The mounting pressure on blue-chip stocks dragged the VN-Index down for most of today’s afternoon session. It would have dipped further than 0.01 points if it weren’t for the sudden boost to VHM in the final trading phase. A divergence is emerging, with sell-offs in previously hot stocks while others are being aggressively pushed up.

The Red Sea of Stocks: Foreign Investors Sell-Off Billions

The selling pressure soared on the last trading day of the week, with most stocks, blue-chips, and speculative plays, ending in the red. Although VIC and VHM attempted to prop up the VN-Index, which closed down only 0.69%, over 41% of stocks on this exchange lost more than 1% of their value. Foreign investors offloaded a net sell of over VND1,000 billion for the second time this week.