Technical Signals for the VN-Index

During the morning trading session of May 29, 2025, the VN-Index witnessed a slight decline and formed a candle pattern resembling a Gravestone Doji. It retested the previous March 2025 high (1,330-1,345 points), indicating investors’ cautious sentiment.

Currently, the MACD indicator is narrowing its gap with the Signal line in recent sessions. If it triggers a sell signal, the risk of a short-term correction will increase.

Technical Signals for the HNX-Index

On May 29, 2025, the HNX-Index posted a modest gain, while trading volume declined during the morning session, reflecting investors’ uncertainty.

Additionally, the index is retesting the 100-day SMA, and the Stochastic Oscillator is forming a bearish divergence in the overbought territory. If the indicator triggers a sell signal and falls below this level in the upcoming sessions, the downside risk will heighten.

EIB – Vietnam Export Import Commercial Joint Stock Bank

An extremely important breakout signal emerged during the morning trading session of May 29, 2025. The price surpassed the October 2024 and March 2025 highs (21,500-22,500) with a White Marubozu candle pattern.

The price is also approaching the Upper Band of the Bollinger Bands, which are expanding, indicating a highly positive short-term outlook. The sharp increase in trading volume and the upward trajectory of the MACD confirm the short-term upward trend. The short-term target is the 25,000-27,000 range.

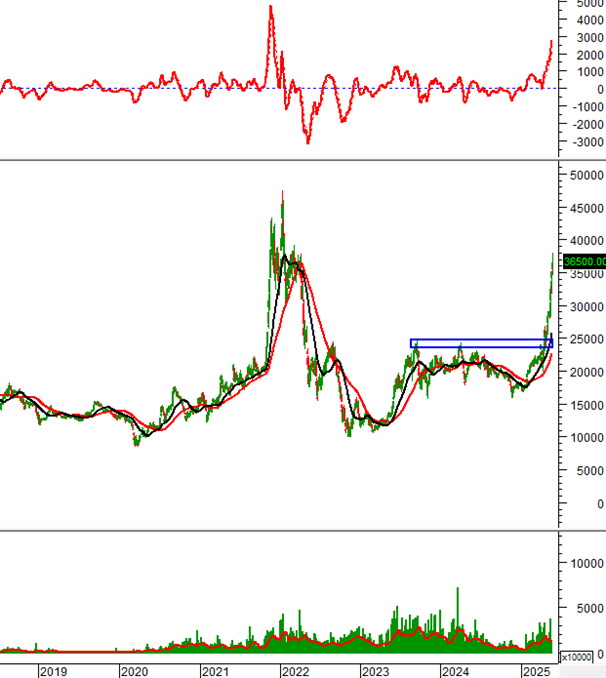

GEX – GELEX Group Joint Stock Company

During the morning trading session of May 29, 2025, GEX stock experienced intense fluctuations and formed an Inverted Hammer candle pattern, suggesting significant selling pressure.

The March 2022 and April 2022 highs (36,000-39,000) are considered robust and unlikely to be breached in the near term. However, the trading volume consistently remains above the 20-day average, indicating that a severe correction is improbable.

Technical Analysis Department, Vietstock Consulting

– 12:11, May 29, 2025

Technical Analysis for May 30: Short-Term Outlook Dims

The VN-Index and HNX-Index witnessed a synchronous decline, accompanied by rather negative technical signals, indicating a heightened risk of downward adjustment.

“Market Watch: Uncertainty Creeps In?”

The VN-Index narrowed its losses after a prolonged tug-of-war session, featuring a Doji candlestick pattern. This indicates investor indecision in the market. Currently, the index remains resilient above the old peak of March 2025 (around 1,320-1,340 points), offering a glimmer of optimism. However, the Stochastic Oscillator is venturing deep into overbought territory. Investors are advised to exercise caution in the coming days if the indicator retreats from these elevated levels.

Market Beat: VN-Index Retreats, Real Estate Stages a Slight Uptick

The market closed with declines for the major indices; the VN-Index fell by 9.26 points (-0.69%), settling at 1,332.6, while the HNX-Index dropped 1.08 points (-0.48%) to 223.22. The market breadth tilted towards decliners, with 497 stocks closing in the red compared to 285 gainers. This bearish sentiment was echoed in the VN30 basket, where 25 stocks declined, four advanced, and one remained unchanged.

Stock Market Wrap-up for Week of May 26-30, 2025: A Pause in the Rally

The VN-Index stalled its upward trajectory following a significant dip last week. The index retreated to test the old peak from March 2025 (1,320-1,340 points). Meanwhile, persistent net selling by foreign investors continues to weigh on the market. If this trend persists, the short-term outlook may face challenges, indicating potential hurdles for a smooth correction.