The performance gap from the beginning of the year to date and the performance of the four months of 2025 show that most equity funds have narrowed their losses significantly, with closed-end funds being the most notable.

In addition, many open-end funds and ETFs have even regained their losses after a sharp drop in April 2025 – when the market reacted negatively to the news of the US imposing up to 46% retaliatory tariffs on imports from Vietnam, according to FiinGroup.

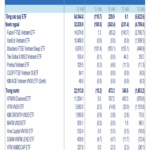

This demonstrates the ability of open-end funds and ETFs to respond quicker and more flexibly compared to closed-end funds. Notably, the Fubon FTSE Vietnam, ETF DCVFMVN30, and DCDS funds with a focus on large-cap stocks such as the Vin Group (VIC, VHM, VRE), and GEX performed well.

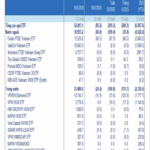

Capital inflows into the Vietnamese market through funds continued to be in a net withdrawal state in April 2025, and this trend is continuing into May 2025. Estimated data up to mid-May 2025 showed a net withdrawal value of nearly VND 800 billion, relatively low compared to the scale of withdrawals in March-April 2025 (averaging more than VND 3,300 billion per month).

The pressure to withdraw capital is showing signs of easing in the stock group, falling from VND 3,400 billion in March 2025 to VND 2,400 billion in April 2025 and an estimated VND 646 billion in the first half of May 2025. In contrast, the pressure to withdraw capital increased in the bond fund group, with a net withdrawal value in April 2025 of nearly VND 850 billion, about eight times the scale of net withdrawals in the previous month.

In April 2025, the net withdrawal pressure continued in the ETF group, with a net withdrawal value of up to VND 2,500 billion, mainly in foreign funds such as Fubon FTSE Vietnam and VanEck Vietnam ETF.

However, this trend reversed in the first three weeks of May 2025 when the ETF funds recorded a slight net inflow (over VND 145 billion) with the main contribution (over VND 403 billion) from the DCVFMVN Diamond (FUEVFVND) fund of Dragon Capital. Meanwhile, the Global X MSCI Vietnam ETF, which tracks the MSCI Vietnam index, recorded a net inflow of nearly VND 45 billion.

In the open-end fund group, the inflows in April 2025 were concentrated in large-scale funds (NAV > VND 1,000 billion), notably the Dynamic Securities DC (DCDS) fund and the VinaCapital Modern Economy (VMEEF) fund.

However, in the first three weeks of May 2025, the capital flow reversed to a slight net outflow in the DCDS fund (-VND 70 billion) while maintaining a positive net inflow in the VMEEF fund. The top holdings of the VMEEF fund are banks (MBB, TCB, VCB, ACB), followed by utilities (GAS, REE, BWE) and telecommunications (FOX). The fund’s portfolio currently focuses on banks (MBB, TCB, VCB, ACB), followed by utilities (GAS, REE, BWE), and telecommunications (FOX). The weight of the information technology industry in the portfolio is only 4.11%, reflecting the fund’s reduction in the proportion of FPT to 3.71%, compared to 9.17% a year ago.

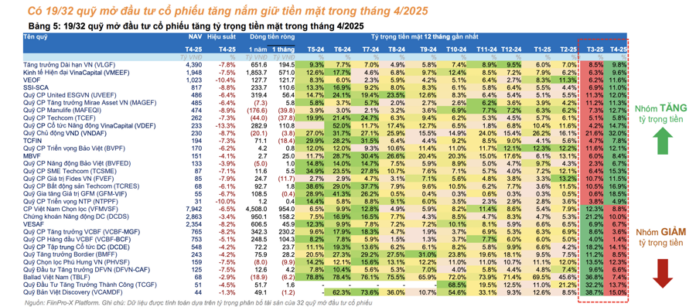

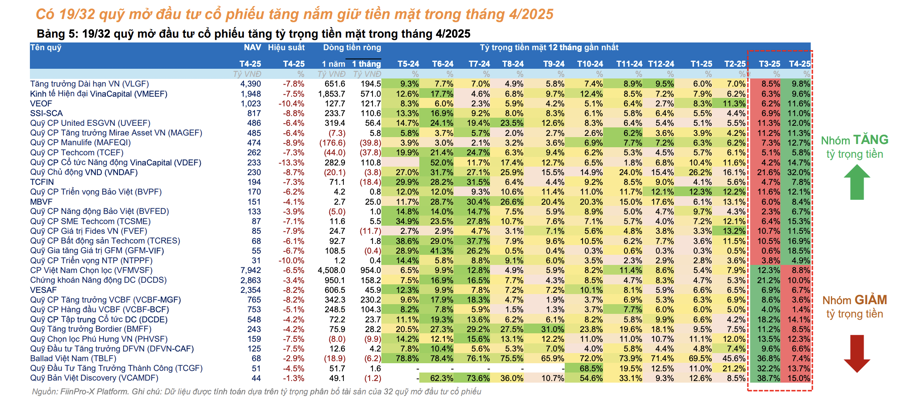

In April 2025, 19 out of 32 open-end equity funds increased their cash holdings (compared to 19 out of 31 funds in March). This reflects a persistent defensive psychology in the context of a volatile market.

However, some funds showed a more positive dynamic, typically the Dynamic Securities DC (DCDS) fund with a NAV of over VND 2,800 billion, which significantly reduced its cash holdings after increasing them in March. This move indicates that the fund has reinvested in the market as stock valuations became more attractive.

In April 2025, VIX was the most net bought stock by volume, mainly due to strong buying from the PYN Elite fund with more than 13 million shares.

Notably, HPG turned positive, ranking third in net buying volume and was the most bought stock by 29 funds. This trend is completely opposite to the strong net selling in March 2025. The buying pressure mainly came from VN30-referenced ETFs such as ETF DCVFMVN30, KIM Growth VN30, and ETF MAFM VN30 after HPG’s weight was increased in the second-quarter portfolio restructuring. In addition, some open-end funds such as VFMVSF, VEOF, and VMEEF also actively invested in this stock.

On the other hand, the top 10 stocks that were net sold the most in April 2025 (by volume) were all in the banking group, mainly due to portfolio restructuring by domestic VN30-referenced ETFs after the weight of the financial group was limited to 40% in the second-quarter restructuring.

ACB topped the net selling list, with the participation of 31 funds, including both ETFs and actively managed funds such as VFMVSF, VESAF, and VMEEF. VPB ranked second, facing strong selling pressure from the VEIL fund. Notably, this stock was also net sold by foreign investors for the sixth consecutive month.

Which Stocks Will the VNM ETF and FTSE ETF Hunt in the 2nd Quarter of 2025?

“Yuanta Securities forecasts the constituent stocks and the quantity of shares to be bought/sold for ETFs tracking benchmark indices. “

“Capital Outflow from Vietnam ETFs Persists”

During the week of May 12-16, 2025, Vietnam-focused equity ETFs experienced net outflows of over VND 210 billion.