After a series of consecutive breakthrough sessions, the market officially witnessed a deep correction during the final trading session of the week. The VN-index closed 9.26 points lower, retreating to 1,332.60, with a significant deterioration in breadth, as 236 declining stocks outnumbered 99 advancing ones. Most sectors underwent sharp corrections, with the exception of real estate, which was propelled by VIC and VHM.

Consequently, VIC extended its gains today by 1.44%, while VHM rose by 0.91%. These two stocks alone contributed 1.3 points to the overall market. Other real estate stocks with improving financial health, such as NVL, also witnessed an increase of 1.43%, while SZC, NLG, and CEO surged by 5.77%. Conversely, the majority of real estate stocks, including KDH, PDR, DIG, and HDG, witnessed a downturn, especially those like BCM, KBC, and SIP.

The banking sector faced the most significant pressure, as a plethora of large, medium, and small capitalization stocks witnessed declines. Securities stocks, which had been buoyant in the morning session, also witnessed a sell-off in the afternoon, with SSI, VCI, VND, VIX, MBS, and SHS succumbing to selling pressure. Overall, the market’s correction was reasonable, and a wait-and-see approach is warranted until more positive news regarding tariffs emerges.

Stocks that had been positively impacted by tariff-related news in the previous phase also reversed course and declined. Regardless of the level of retaliatory tariffs, the business operations of enterprises will inevitably be adversely affected. A positive note is that cash flow continually rotates between sectors and across different capitalization segments.

Deeply discounted stocks with solid fundamentals continue to attract cash flow. Today’s liquidity across the three exchanges remained high, with matched orders reaching VND 24,500 billion, including net foreign selling of VND 1,123.6 billion, of which VND 1,085.9 billion was from matched orders. Foreign investors’ net buying on the matched order side focused on real estate, electricity, water, and oil and gas sectors. The top net bought stocks by foreigners on the matched order side included NVL, VIC, GMD, GAS, VHM, MBB, SHB, DXG, NLG, and GEX.

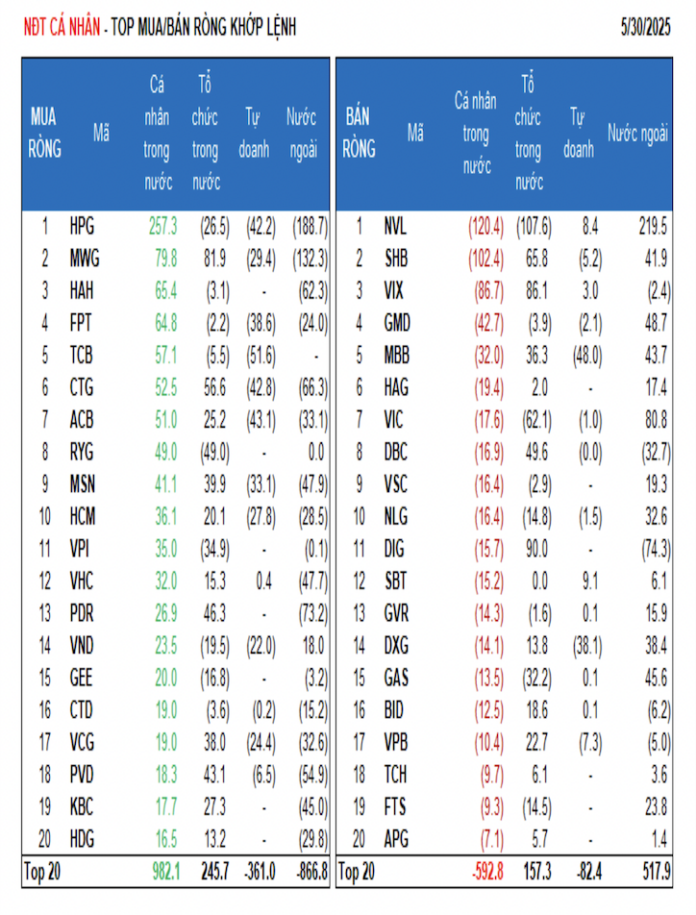

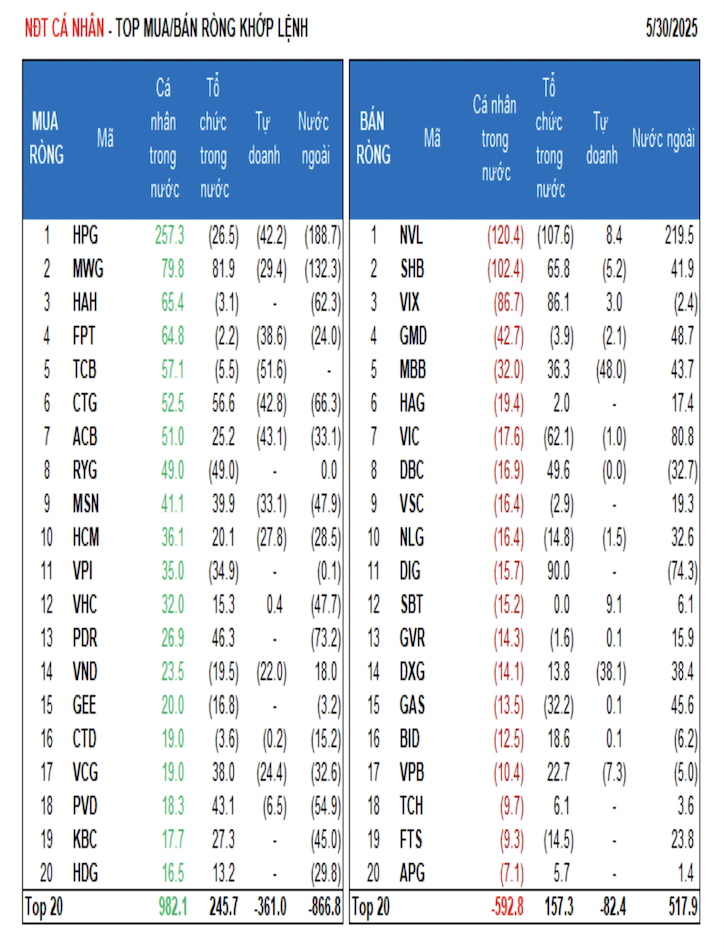

On the selling side, foreigners net sold banking stocks, with HPG, MWG, STB, DIG, PDR, CTG, HAH, DGC, and PVD being among the top sold stocks. Individual investors net bought VND 981.1 billion, of which VND 573.3 billion was from matched orders. In terms of matched orders, they net bought 11 out of 18 sectors, mainly focusing on Basic Materials. The top bought stocks by individual investors included HPG, MWG, HAH, FPT, TCB, CTG, ACB, RYG, MSN, and HCM.

On the net selling side, they sold 7 out of 18 sectors, mainly focusing on Real Estate and Financial Services. The top net sold stocks by individual investors included NVL, SHB, VIX, GMD, MBB, HAG, DBC, VSC, and NLG.

Proprietary trading accounted for net selling of VND 802.2 billion, of which VND 508.8 billion was from matched orders. In terms of matched orders, proprietary trading net bought 5 out of 18 sectors, with the strongest purchases in Chemicals, Automobiles & Components. The top net bought stocks by proprietary trading today included E1VFVN30, SBT, NVL, STB, FUEVFVND, DGC, PVT, VIX, DRC, and NT2. On the net selling side, banking stocks dominated. The top stocks net sold by proprietary trading included TCB, MBB, ACB, CTG, HPG, SS1, FPT, DXG, MSN, and MWG.

Domestic institutional investors net bought VND 907.1 billion, of which VND 1,021.4 billion was from matched orders. In terms of matched orders, domestic institutions net sold 5 out of 18 sectors, with the largest net selling in Industrial Goods & Services. The top net sold stocks included NVL, VIC, RYG, VHM, VPI, GAS, CTS, HPG, GEX, and BAF.

The largest net buying was in the banking sector, with STB, DIG, VIX, MWG, SHB, DPM, CTG, DGC, DBC, and PDR being among the top net bought stocks.

Today’s matched order trading value reached VND 1,630.9 billion, up 77.5% compared to the previous session, contributing 6.6% of the total trading value.

Notable transactions today included a purchase of 15 million HDB shares by an individual investor from a domestic institution, valued at VND 322.5 billion. Additionally, there was a transaction where domestic proprietary trading sold 15 million VPB shares (valued at VND 291 billion) to a domestic institution.

Cash flow allocation increased in Securities, Steel, Chemicals, Agricultural & Seafood, Food & Beverage, Retail, Oil & Gas, and Software sectors, while decreasing in Real Estate, Banking, Electrical Equipment, Warehousing & Logistics, Plastics & Rubber, and Personal Items sectors.

In terms of matched orders, cash flow allocation increased in the large-cap VN30 and small-cap VNSML segments, while decreasing in the mid-cap VNMID segment.

The Stock Market Slump: VN-Index Stumbles at the Peak Once Again

Today, the market witnessed a potential breakthrough as the VN-Index surged past 1,348.31 points, marking an impressive intraday gain of approximately 6.4 points and briefly touching yesterday’s peak. However, the inability of blue-chip stocks to sustain their prices dampened the momentum, resulting in a prolonged downward slide for the index during the majority of the morning session.

Stock Market Blog: Hot Stocks Take a Tumble

A significant profit-taking event occurred in the mid and small-cap stock categories early today, intensifying as the day progressed. Although the VNI remained relatively stable, propped up by heavyweights like VIC, VHM, and GAS, limiting the decline, hundreds of stocks plummeted by over 1%, facing substantial selling pressure.

The Stock Market is ‘Riding High’ in its Strongest Performance of the Year

As of the market close on May 27th, the VN-Index soared to a year-to-date high, hovering just below the 1340-point mark. The real estate sector continued to be a magnet for investment, attracting a substantial influx of capital.