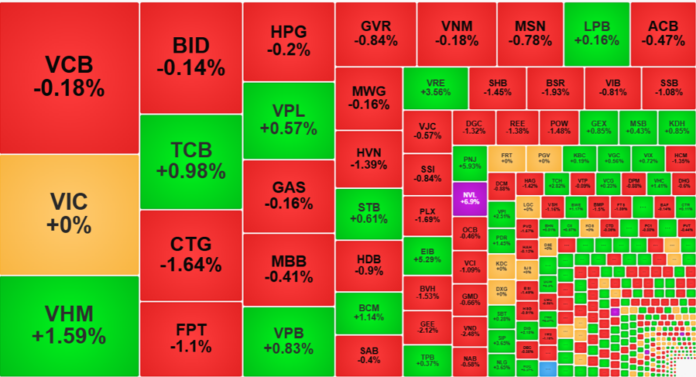

The VN-Index struggled to stay afloat today, ending the session slightly in the red. It was only due to a last-minute push for VHM that prevented a more significant drop; without this intervention, the loss would have been more substantial. The market is witnessing a clear divergence, with some stocks experiencing heavy selling pressure while others are being aggressively pushed higher.

The VN-Index found support from VHM, which gained 1.59% at the close, contributing approximately 1.1 points to the index. TCB, VPL, and VPB also provided some uplift, rising 0.98%, 0.57%, and 0.83%, respectively. However, these gains were partially offset by losses in CTG and FPT, which fell 1.64% and 1.1%, respectively, weighing on the index.

The tug-of-war between these heavyweights resulted in a relatively stable performance, with the index managing to stay above the 1340 mark. However, the lack of decisive momentum has led to a stagnant performance, unable to break through resistance levels.

VN30 basket witnessed a continuation of weak participation, with today’s volume dropping by 4% from yesterday’s levels and hitting the lowest point since the beginning of the week. Out of the 30 stocks in the basket, only 8 advanced while 21 declined, resulting in a 0.04% loss for the index. VHM and VRE were the key contributors, adding nearly 3 points, offsetting losses from FPT, MSN, SHB, and HDB. Despite the index holding steady, the breadth indicated a clear sign of fatigue among blue chips, coupled with robust selling pressure from foreign investors, who offloaded a net VND 580 billion worth of stocks in the basket today.

The broader market exhibited a mixed performance, with a slight bias towards decliners. The HoSE floor ended the day with 157 gainers and 161 losers, while 70 stocks rose over 1%, accounting for 23% of the floor’s liquidity. Meanwhile, 65 stocks fell by more than 1%, also representing 23% of the liquidity. The distinguishing factor was the presence of resilient stocks that continued to attract buying interest, even as others experienced sharp profit-taking.

It is challenging to identify stocks with sustained upward momentum given the rapid rotation of funds. VSC, for instance, suffered a severe correction today, plunging to its daily limit-down price after a 4.3% decline yesterday. This followed a remarkable 77% rally since April 2025, forming a double top pattern. VSC’s liquidity reached VND 507 billion, ranking 8th in the market and setting a new historical record. HVN followed a similar trajectory, posting losses for the second consecutive session with a 1.39% drop. This came on the heels of a more than 55.6% surge. HAG also underwent a correction, slipping by 1.42% after a nearly 44% ascent until yesterday…

In contrast, other stocks are witnessing robust trading interest and price momentum. NVL, for instance, soared to its daily limit-up price today, with liquidity nearly reaching a nine-month high of VND 863.5 billion, the second highest in the market. This rally has generated over 72% in profits, and NVL continues to be aggressively bid up. Stocks like HVH, NTL, PDR, EIB, NLG, HDC, TCH, and PNJ remain robust, with many regaining their upward trajectory after a brief period of volatility. These stocks continue to record triple-digit billion liquidity…

This market divergence is keeping investors engaged and active. When investors take profits, they often consider whether to re-enter immediately or wait for a better opportunity. If the overall market exhibits weakness, investors tend to focus on capital preservation. However, when multiple stocks demonstrate resilience and upward momentum, investors are enticed to seek new opportunities.

Today’s trading volume on the two exchanges remained robust, with a combined value of approximately VND 21.5 trillion. The HoSE floor witnessed a slight decline of over 3%, settling at VND 20.2 trillion. While the VN-Index’s stagnant performance amid high liquidity may seem concerning, the breadth indicates a more nuanced picture, suggesting that funds are actively rotating within the market rather than exiting.

The Stock Market Slump: VN-Index Stumbles at the Peak Once Again

Today, the market witnessed a potential breakthrough as the VN-Index surged past 1,348.31 points, marking an impressive intraday gain of approximately 6.4 points and briefly touching yesterday’s peak. However, the inability of blue-chip stocks to sustain their prices dampened the momentum, resulting in a prolonged downward slide for the index during the majority of the morning session.

Stock Market Blog: Hot Stocks Take a Tumble

A significant profit-taking event occurred in the mid and small-cap stock categories early today, intensifying as the day progressed. Although the VNI remained relatively stable, propped up by heavyweights like VIC, VHM, and GAS, limiting the decline, hundreds of stocks plummeted by over 1%, facing substantial selling pressure.