“

Tan Thanh JSC, an entity related to Ms. Nguyen Thi Ngoc Thanh – Chief Controller of Nước Thủ Dầu Một JSC (HOSE: TDM), has just registered to purchase an additional 1 million TDM shares from June 2-27, aiming to increase its ownership from 3% to 3.9%, equivalent to 4.3 million shares. Ms. Thanh currently does not directly hold any TDM shares but is the Director of Tan Thanh JSC.

Previously, Ms. Nguyen Do Ngoc Bao, the wife of Mr. Nguyen Thanh Phong, a member of the Board of Directors of TDM, also registered to buy 1 million TDM shares from July 7-05/06 to restructure her investment portfolio. If the transaction is completed, Ms. Bao will increase her ownership from 0% to 0.91% of the charter capital.

Mr. Phong currently holds 1 million TDM shares, and the related entity, N.T.P Trading Co., Ltd., owns 4.6 million TDM shares. In total, Mr. Phong’s group holds approximately 5.6 million shares, equivalent to 5.09% of the capital.

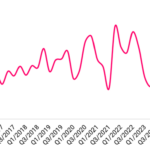

These transactions take place against the backdrop of a steady rise in TDM share prices. The code has recovered by more than 17% in one year and increased by 134% from below 24,000 VND/share in early November 2022 to the current level of 55,700 VND/share. At this market price, the two buying deals are expected to cost nearly VND 56 billion.

Price movement of TDM shares on the stock exchange – Source: VietstockFinance

|

Profit for the first four months increased sharply by 272%

According to the preliminary business results for the first four months of 2025, TDM recorded revenue of over VND 243 billion, up 59% over the same period last year and reaching 46% of the yearly plan. Of this, core revenue from water production activities decreased by 10%, to VND 134 billion. In contrast, financial revenue surged from VND 2.5 billion to VND 108.5 billion (more than 43 times) thanks to a 13% cash dividend from Biwase – a company in which TDM is a strategic shareholder, holding 37.42% of capital. Last year, Biwase paid dividends in shares, so TDM did not receive the equivalent amount.

Finally, TDM‘s after-tax profit for the first four months reached VND 155.5 billion, up 272% over the same period and fulfilling 79% of the 2025 plan.

– 10:28 30/05/2025

“

The Automotive Industry Stalls in Q1 Following the End of Registration Fee Incentives

The automotive industry witnessed a boost in the last quarter of 2024 due to a 50% reduction in registration fees. However, this momentum was short-lived as the first quarter of 2025 saw a decline in both vehicle sales and profits. While revenues increased year-over-year, profits took a hit, with only a select few businesses experiencing a turnaround through strategic restructuring.

A New Era for VIX Stock: Welcoming the Chairman and Unveiling a 73-Million-Share Dividend Plan

On May 28, VIX Shares Joint Stock Company (HOSE: VIX) announced several leadership changes, notably the appointment of Nguyen Tuan Dung as the new Chairman. On the same day, the VIX Board of Directors passed a resolution to issue over 72.9 million shares as a dividend payout for the year 2024, amounting to a 5% ratio and a scale of over VND 729 billion.

“Binh Dien Fertilizer to Dish Out Nearly VND 143 Billion in Dividends to Shareholders”

“Binh Dien Fertilizer plans to spend over VND 142.9 billion on dividends for its shareholders for the fiscal year 2024, with a generous payout ratio of 25%. The record date for shareholders to be eligible for this dividend is set for June 12, 2025.”