Vietnamese Stock Market Review: VN-Index’s Volatile Session

The VN-Index opened in the green but quickly turned red due to widespread selling pressure. As the session progressed, profit-taking intensified, leading to a substantial correction in Vietnam’s stock market. At the close of the May 30 session, the VN-Index fell 9.26 points to 1,332.6 points. The matching value on HoSE slightly improved from the previous session, reaching VND 20,792 billion.

Against this backdrop, foreign investors continued their strong selling streak, net selling VND 1,171 billion in the market, extending the net selling streak to six consecutive sessions.

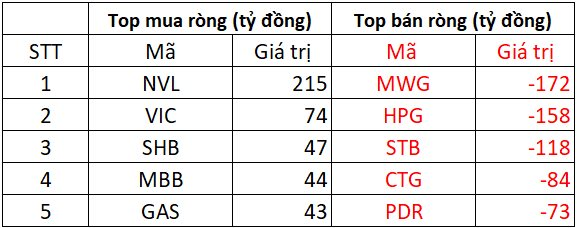

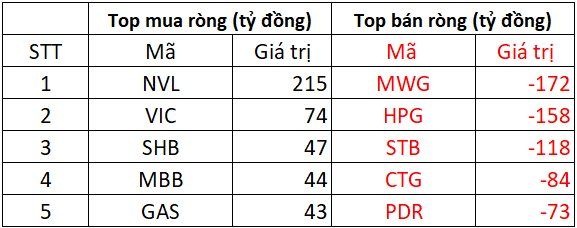

Foreign investors net sold approximately VND 1,161 billion on HoSE

In the selling session, MWG experienced the largest net sell-off in the market, with a value of VND 172 billion. This was followed by HPG and STB, which were also heavily sold, with respective net sell-offs of VND 158 billion and VND 118 billion. Other stocks that witnessed net sell-offs in the tens of billions of VND included CTG (-VND 84 billion) and PDR (-VND 73 billion).

Conversely, NVL attracted strong net buying, leading the market with a value of VND 215 billion. VIC also received net buying of about VND 74 billion. Additionally, SHB, MBB, and GAS experienced net buying, with values ranging from VND 43 billion to VND 47 billion for each stock.

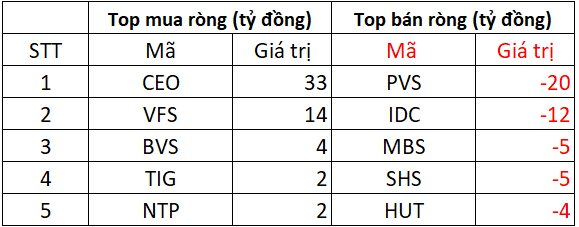

Foreign investors net bought nearly VND 8 billion on the HNX

In the buying session, CEO stock witnessed strong net buying by foreign investors, with a value of VND 33 billion. VFS also experienced net buying of VND 14 billion. Additionally, BVS, TIG, and NTP were among the top net bought stocks in today’s session.

On the opposite side, PVS experienced the largest net sell-off, with a value of VND 20 billion. IDC followed with a net sell-off of VND 12 billion. Other stocks that faced net selling of around VND 4-5 billion included MBS, SHS, and HUT.

Foreign investors net sold approximately VND 17 billion on UPCOM

In the buying session, MCH experienced net buying of VND 4 billion, followed by ABI, DRI, HPD, and VHG, which also witnessed net buying in the range of a few hundred million to VND 1 billion each.

Conversely, ACV faced a net sell-off of VND 18 billion. QNS, BOT, VEA, and OIL also experienced net selling of around VND 1-3 billion each.

Technical Analysis for May 29: Short-Term Risks Begin to Emerge

The VN-Index and HNX-Index displayed a contrasting performance, with the Stochastic Oscillator indicating a potential bearish divergence in the overbought territory. This divergence suggests a heightened risk of a short-term correction if sell signals emerge and the indicator drops out of this zone.

A Brilliant May for Vietnam’s Stock Market: VN-Index Hits 3-Year High, Foreign Investors Return with a Bang, and a Mega IPO Takes Center Stage.

The Vietnamese stock market has just witnessed its strongest May performance in years, bolstered by a plethora of positive news and supportive factors.

“Market Watch: Uncertainty Creeps In?”

The VN-Index narrowed its losses after a prolonged tug-of-war session, featuring a Doji candlestick pattern. This indicates investor indecision in the market. Currently, the index remains resilient above the old peak of March 2025 (around 1,320-1,340 points), offering a glimmer of optimism. However, the Stochastic Oscillator is venturing deep into overbought territory. Investors are advised to exercise caution in the coming days if the indicator retreats from these elevated levels.

Market Beat: VN-Index Retreats, Real Estate Stages a Slight Uptick

The market closed with declines for the major indices; the VN-Index fell by 9.26 points (-0.69%), settling at 1,332.6, while the HNX-Index dropped 1.08 points (-0.48%) to 223.22. The market breadth tilted towards decliners, with 497 stocks closing in the red compared to 285 gainers. This bearish sentiment was echoed in the VN30 basket, where 25 stocks declined, four advanced, and one remained unchanged.